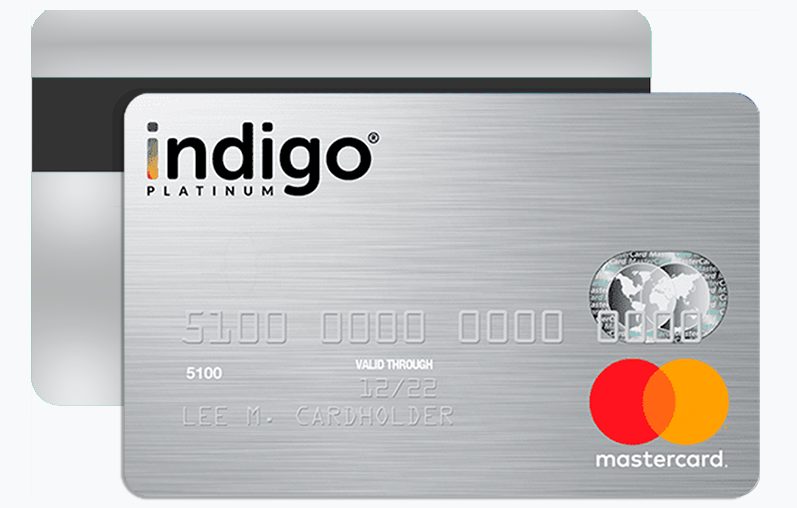

In today’s fast-paced world, having access to credit is essential for many aspects of life. Whether it’s booking a flight, paying for unexpected medical expenses, or making everyday purchases, a credit card can be a valuable financial tool. However, not all credit cards are created equal, so how can we define the Indigo Platinum Mastercard?

The Indigo Platinum Mastercard stands out as a unique and accessible option for individuals seeking to build or rebuild their credit history. In this review, we will explore the features, benefits, and advantages of this card.

Understanding Indigo Platinum Mastercard

The Indigo Platinum Mastercard stands out as a unique and accessible option for individuals seeking to build or rebuild their credit history. In this review, we will explore the features, benefits, and advantages of this card.

The Indigo Platinum Mastercard is specifically designed for individuals with less-than-perfect credit histories. It is an unsecured credit card, meaning that no security deposit is required to open an account.

This sets it apart from many other credit cards in the market, as secured credit cards often necessitate a deposit that serves as collateral. The absence of a security deposit makes the Indigo Platinum Mastercard a more accessible option for those working to improve their credit scores.

Application process

One of the key attractions of the Indigo Platinum Mastercard is its straightforward application process. Prospective cardholders can easily apply online, and the response is typically quick.

This user-friendly approach makes it an excellent choice for individuals who want to rebuild their credit but don’t want to endure the hassle of extensive paperwork or a lengthy approval process.

Credit building features

For those on the journey to rebuild their credit, the Indigo Platinum Mastercard offers several features to support this goal:

- Credit reporting: the card reports to all three major credit bureaus – Equifax, Experian, and TransUnion. This means that responsible use of the card can positively impact your credit history over time;

- Credit limit increases: responsible card usage may result in credit limit increases, providing more financial flexibility and potentially improving your credit score further;

- Fraud protection: like other major credit cards, the Indigo Platinum Mastercard offers robust fraud protection to safeguard your finances;

- Account management: the online account management system is user-friendly, allowing cardholders to monitor transactions, pay bills, and track their credit progress.

Fees and rates

While the Indigo Platinum Mastercard offers many advantages, it is essential to be aware of its fees and rates. Like most credit cards tailored to individuals with lower credit scores, it may have higher interest rates and fees.

Understanding these terms is crucial to making informed financial decisions. Learning more with our list bellow.

- Annual fee: the card has an annual fee, which varies depending on the specific offer extended to the applicant. It is important to review the terms and conditions carefully to understand the annual fee associated with your card.

- APR (Annual Percentage Rate): the APR for purchases and cash advances can be higher than what you might find with other credit cards. It’s essential to pay your balance in full each month to avoid accruing interest charges.

- Late fees and penalties: late payments can result in late fees and potential penalty APR increases. Responsible card usage is key to avoiding these additional costs.

Is the Indigo Platinum Mastercard right for you?

The Indigo Platinum Mastercard is an excellent option for individuals who:

- Have less-than-perfect credit and are looking to rebuild their credit history;

- Prefer an unsecured credit card without the need for a security deposit;

- Are willing to manage their card responsibly and pay bills on time to avoid additional fees and interest charges.

However, it may not be the best choice for those who:

- Already have a good credit score and can qualify for cards with lower interest rates and better rewards;

- Do not want to pay an annual fee;

- Do not intend to use a credit card frequently.

Application process

To apply for the Indigo Platinum Mastercard, visit the official website or follow an invitation link if you received one. The application process typically involves the following steps:

- Pre-Qualification: you may have the option to go through a pre-qualification process to check your eligibility without affecting your credit score;

- Application Form: fill out the application form with your personal information, including your name, address, SSN, and income details;

- Submit and Await Decision: once you submit your application, you’ll typically receive a decision within a few moments.

In conclusion, the Indigo Platinum Mastercard is accessible to many, making it a suitable choice for individuals looking to improve their credit.

By understanding the basic eligibility criteria, credit requirements, and the application process, you can navigate the application with confidence and increase your chances of approval. Keep in mind that responsible credit use can help you on your journey to financial stability.

FIT Mastercard <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the Power of FIT Mastercard </p>

FIT Mastercard <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the Power of FIT Mastercard </p>  Apply for a personal loan with Eagle Financial: step-by-step <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how to have the necessary funds to buy an asset you've always dreamed of </p>

Apply for a personal loan with Eagle Financial: step-by-step <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how to have the necessary funds to buy an asset you've always dreamed of </p>  How to get a loan with Capital One? <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> This guide is for you who wants a car with a loan </p>

How to get a loan with Capital One? <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> This guide is for you who wants a car with a loan </p>