Even without a good credit score requirement, the Tomo credit card is not pre-approved for everyone. You need to complete an application process, providing all your personal information to request it.

After the company verifies all of your details, you will be pre-approved and receive an invitation to apply for your credit card. Although it is a simple process, it is still possible to have your card denied, as a second check of your personal data, income and bank details is done.

Is Tomo the best option in the market?

The Tomo credit card is intended for a specific type of audience. When compared to other premium credit cards, it will naturally be a little more limited.

But not all people have a good enough credit score to get a premium credit card, which makes Tomo an excellent choice for these people.

It is worth emphasizing that you always need to pay your bills in full, because if you leave it to pay later, some interest may be added.

If you fall into the group of people who want to build a good financial history and boost their credit score, don’t worry! The Tomo credit card will fit right in.

Learn how to apply to Discover Personal Loan

Learn how to apply to Discover Personal Loan  Happy Money Personal Loan

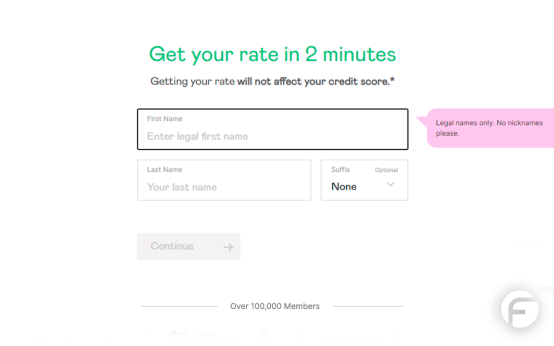

Happy Money Personal Loan  Apply of the Advantage Education Loan

Apply of the Advantage Education Loan