For many businesses, access to timely and flexible financing can be a game-changer. Reliant Funding offers business loans designed to support a wide range of needs, from managing day-to-day expenses to funding major growth initiatives. Understanding the full scope of what Reliant Funding provides, including the advantages, prerequisites, and application process, is essential for making the best decision for your business. This guide will delve into the details of Reliant Funding Business Loans, outline the prerequisites for applying, answer common questions, and provide a step-by-step guide to securing your loan.

Positive Points of Reliant Funding Business Loans

Reliant Funding Business Loans offer several compelling benefits that can significantly enhance your business operations:

Diverse Loan Products

Reliant Funding provides a variety of loan products tailored to different business needs. Whether you require a short-term loan to cover immediate expenses or a longer-term loan for significant investments, Reliant Funding has options to meet your specific requirements. This diversity allows businesses to choose a loan product that best aligns with their financial goals and operational needs.

No Collateral Required

Many Reliant Funding loans do not require collateral, which can be a significant advantage for businesses that lack valuable assets to pledge. This unsecured loan option makes it easier to access funding without putting your business assets at risk.

Support for Various Business Types

Reliant Funding serves a broad range of business types and industries. Whether you run a small retail shop, a service-based business, or a larger enterprise, Reliant Funding has solutions designed to fit different business models and needs.

Prerequisites to Apply

Before applying for a Reliant Funding Business Loan, ensure you meet the following prerequisites:

- Business Operations

Your business must be operational and generating revenue. Reliant Funding typically works with established businesses rather than startups that do not yet have a track record of income. - Credit History

While Reliant Funding is more flexible than traditional lenders, having a solid credit history can improve your chances of securing favorable loan terms. Businesses with stronger credit profiles may receive better rates and terms. - Business Documentation

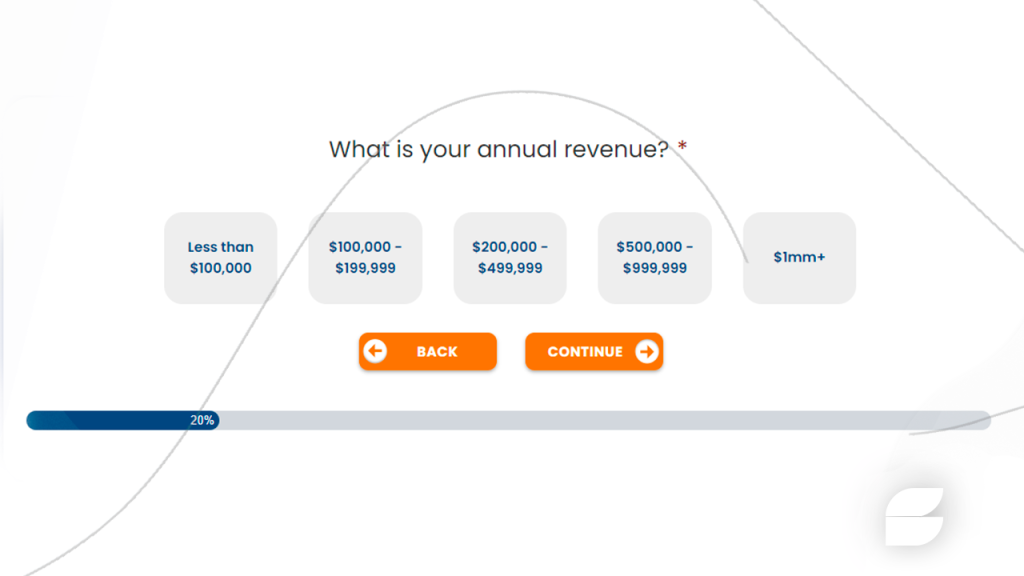

You will need to provide certain documentation to support your application, including financial statements, tax returns, and details about your business operations. This documentation helps Reliant Funding assess your business’s financial health and determine your eligibility for a loan. - Revenue Requirements

Reliant Funding may have minimum revenue requirements for loan eligibility. Ensure your business meets these requirements by reviewing the specific criteria outlined by Reliant Funding. - Business Age

While Reliant Funding serves a variety of business types, having a minimum operational period may be required. Typically, businesses should be at least 6 to 12 months old to apply for a loan.

Frequently Asked Questions (FAQ)

What types of businesses are eligible for Reliant Funding loans?

Reliant Funding serves a wide range of businesses, including retail, service-based, and larger enterprises. Businesses must be operational and generating revenue to qualify.

How quickly can I receive funding from Reliant Funding?

The application process is fast, with a funding decision often available within 24 hours. Once approved, funds can be disbursed quickly, allowing you to address immediate financial needs.

Are there any fees associated with Reliant Funding loans?

Reliant Funding may charge fees such as origination fees or prepayment penalties depending on the loan product. It’s important to review the loan terms carefully to understand any associated costs.

Can I apply for a loan if I have existing debt?

Yes, you can apply for a Reliant Funding loan even if you have existing debt. The key is to demonstrate that your business can manage additional debt and service the new loan effectively.

Step-by-Step Application Process

- Assess Your Needs

Determine the amount of funding you need and the purpose of the loan. This will help you choose the right loan product and prepare the necessary documentation. - Check Eligibility

Ensure your business meets the eligibility requirements, including operational status, revenue, and credit history. Verify that you have all required documentation. - Prepare Documentation

Gather the necessary documents, such as financial statements, tax returns, and business details. Having these documents ready will streamline the application process. - Complete the Online Application

Visit the Reliant Funding website and complete the online application form. Provide accurate information about your business and the loan amount you are requesting. - Submit Your Application

Review your application for completeness and accuracy before submitting it. Reliant Funding will process your application and provide a decision within 24 hours. - Review Loan Offer

If approved, you will receive a loan offer outlining the terms, including the interest rate, repayment schedule, and any fees. Review the offer carefully to ensure it meets your needs. - Accept the Offer

If you agree to the terms, accept the loan offer. You may need to sign a loan agreement electronically or in person, depending on the process outlined by Reliant Funding. - Receive Funds

Once the loan agreement is finalized, Reliant Funding will disburse the funds to your business. Ensure that you apply the funds according to your business needs and keep track of the disbursement. - Manage Repayments

Follow the repayment schedule and make timely payments according to your chosen plan. Stay in contact with Reliant Funding if you have any questions or need assistance managing your loan.

Conclusion

Reliant Funding Business Loans offer a valuable solution for businesses seeking flexible and timely financial support. By understanding the benefits, prerequisites, and application process, you can make an informed decision and secure the funding you need to advance your business goals. Ready to get started? Follow the steps outlined above to apply for your Reliant Funding Business Loan and take the next step in growing your business.

Top Home improvement loan options

Top Home improvement loan options  Discover Personal Loans: A Flexible Financial Solution <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits, Requirements, and Application Process </p>

Discover Personal Loans: A Flexible Financial Solution <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits, Requirements, and Application Process </p>  SeedFi Borrow and Grow Loan <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Your Pathway to Financial Growth and Credit Improvement </p>

SeedFi Borrow and Grow Loan <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Your Pathway to Financial Growth and Credit Improvement </p>