Choosing the right student loan is crucial for managing your educational expenses and ensuring financial stability as you pursue your academic goals. Earnest offers a tailored approach to student loans, providing flexible terms and competitive rates to support your education. This comprehensive guide will delve deeper into the benefits of Earnest Student Loans, outline the prerequisites for application, answer frequently asked questions, and provide a step-by-step guide on how to apply. With this information, you can make an informed decision and successfully secure the financing you need.

More Details and Key Benefits

Grace Period Flexibility

Earnest offers a nine-month grace period after graduation, which is longer than the industry standard of six months. This extended grace period gives borrowers more time to find employment and get their finances in order before they start making loan payments. This additional breathing room can be especially helpful for new graduates who need time to transition from school to the workforce.

In-School Deferment Options

For students who decide to pursue further education after taking out a loan, Earnest provides in-school deferment options. This allows borrowers to temporarily pause their payments while they are enrolled in school at least half-time. The deferment option ensures that you can focus on your studies without the added stress of immediate loan payments, making it easier to manage your finances during school.

Unemployment Protection

Earnest offers unemployment protection, which allows borrowers to pause their payments if they lose their job. During this period, Earnest will not only suspend your payments but also provide support in finding new employment. This safety net gives borrowers peace of mind, knowing that they have a safeguard in place in case of unexpected financial challenges.

Prerequisites for Applying

- Credit History and Financial Stability

To qualify for an Earnest Student Loan, you generally need to have a strong credit history and stable financial situation. Earnest assesses your credit profile to determine eligibility and loan terms. If you have a limited credit history or are still building your credit, you may need a co-signer to improve your chances of approval. - Enrollment Status

You must be enrolled at least half-time in an accredited college or university to apply for an Earnest Student Loan. Proof of enrollment may be required as part of the application process. If you’re a recent graduate, you can also apply for refinancing your existing student loans with Earnest. - Income and Employment

A stable income and employment history are important factors in qualifying for an Earnest loan. Earnest looks at your current income to assess your ability to repay the loan. If you’re a student with limited income, a co-signer with a stable income can strengthen your application. - D. U.S. Citizenship or Permanent Residency

Earnest Student Loans are available to U.S. citizens or permanent residents. If you’re an international student, you may need a co-signer who meets these residency requirements to qualify for a loan.

Frequently Asked Questions (FAQ)

What Are the Interest Rate Options for Earnest Student Loans?

Earnest offers both fixed and variable interest rate options. Fixed rates remain the same throughout the life of the loan, while variable rates can fluctuate based on market conditions. Choose the option that best aligns with your financial situation and risk tolerance.

Can I Refinance My Existing Student Loans with Earnest?

Yes, Earnest offers refinancing options for existing student loans. If you have federal or private student loans, you can apply to refinance and potentially secure a lower interest rate or better terms.

How Long Does the Application Process Take?

The application process with Earnest is typically quick, with many borrowers receiving approval within a few business days. The exact timeline may vary depending on your application details and documentation.

Are There Any Fees for Late Payments?

Earnest does not charge late fees. However, it’s important to make your payments on time to avoid any potential impacts on your credit score and to stay in good standing with your loan.

Can I Make Extra Payments Without Penalty?

Yes, Earnest allows you to make extra payments or pay off your loan early without incurring prepayment penalties. This can help you reduce the total interest paid and pay off your loan more quickly.

Step-by-Step Application Process

- Determine Your Loan Needs

Assess the amount you need to borrow and the purpose of the loan. This will help you determine the loan terms and repayment plan that best suit your financial situation. - Gather Necessary Documentation

Prepare the required documentation, including proof of enrollment, income statements, and credit history. Having these documents ready will streamline the application process. - Complete the Online Application

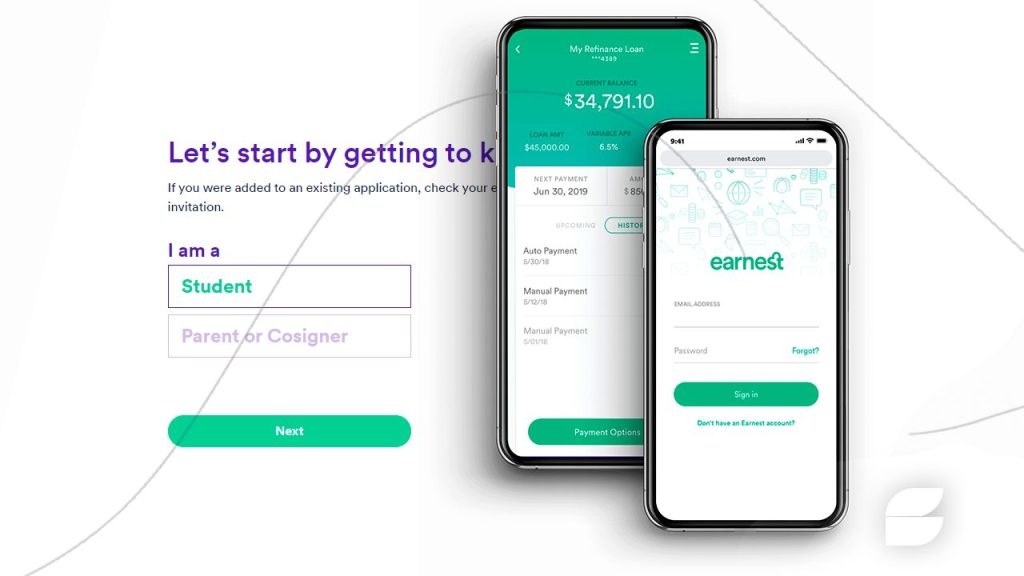

Visit the Earnest website and complete the online application form. Provide accurate information about your financial situation, loan needs, and personal details. - Review Loan Offer

Once your application is processed, review the loan offer carefully. Pay attention to the interest rate, repayment terms, and any other conditions associated with the loan. - Accept the Loan

If you agree with the loan terms, accept the offer electronically. Earnest will finalize the loan and prepare the funds for disbursement. - Manage Your Loan

After receiving the funds, use them according to your needs and manage your loan payments according to the agreed-upon schedule. Take advantage of Earnest’s flexible repayment options if your financial situation changes.

Conclusion

Earnest Student Loans provide a range of benefits, including customizable repayment plans, competitive interest rates, and no hidden fees. By understanding the key features, requirements, and application process, you can make an informed decision and secure the financing needed for your education. Apply for an Earnest Student Loan today and take the first step toward achieving your academic and career goals.

Top Home improvement loan options

Top Home improvement loan options  Discover Personal Loans: A Flexible Financial Solution <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits, Requirements, and Application Process </p>

Discover Personal Loans: A Flexible Financial Solution <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits, Requirements, and Application Process </p>  SeedFi Borrow and Grow Loan <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Your Pathway to Financial Growth and Credit Improvement </p>

SeedFi Borrow and Grow Loan <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Your Pathway to Financial Growth and Credit Improvement </p>