Navigating the financial aspects of higher education can be daunting, but finding the right student loan can make all the difference. CommonBond offers a student loan solution that combines competitive rates, flexible repayment options, and a commitment to social impact. This guide provides a detailed look at CommonBond Student Loans, including their key benefits, eligibility requirements, frequently asked questions, and a step-by-step application process. Whether you’re a current student or planning for future education, understanding these aspects will help you make an informed decision about financing your academic journey.

More Details and Key Benefits

Forbearance and Hardship Protection

Life can be unpredictable, and CommonBond offers forbearance and hardship protection to help you navigate challenging times. If you encounter financial difficulties, CommonBond allows you to temporarily pause your payments for up to 24 months over the life of your loan. This feature provides peace of mind, knowing you have support during unexpected financial setbacks.

No Origination or Prepayment Fees

CommonBond doesn’t charge origination fees or prepayment penalties, ensuring that you can borrow money without worrying about unnecessary costs. This feature is particularly beneficial for those who plan to pay off their loans early, as it allows you to save on interest without incurring any additional fees.

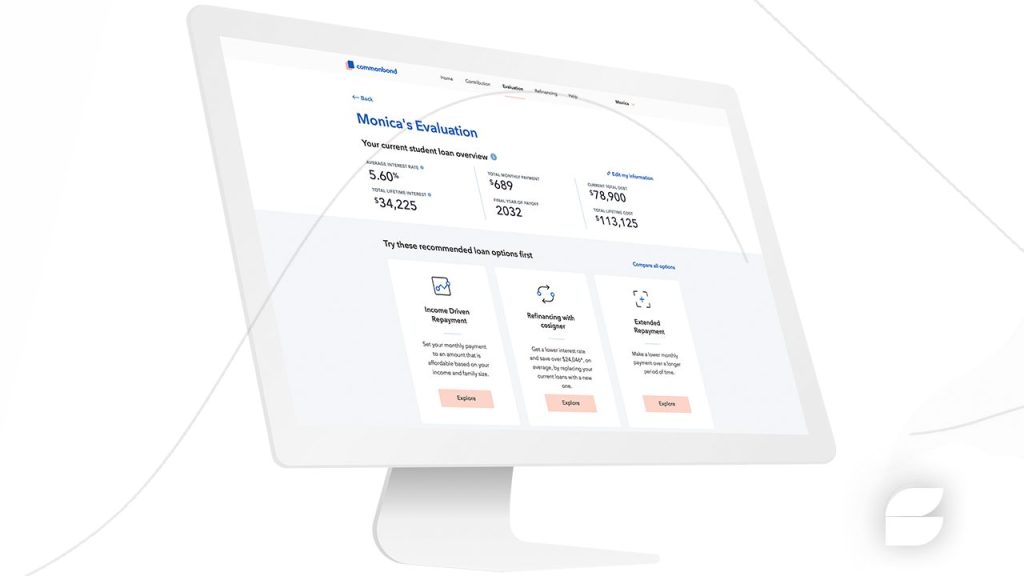

Loan Refinancing Option

In addition to student loans, CommonBond offers refinancing options for existing student loans. If you have outstanding loans from other lenders, refinancing with CommonBond could help you secure a lower interest rate or better repayment terms. This can be a valuable way to manage your existing debt more effectively and potentially save money over time.

Prerequisites for Applying for a CommonBond Student Loan

- Enrollment Status

To qualify for a CommonBond Student Loan, you must be enrolled in an eligible degree-granting institution. CommonBond provides loans for undergraduate, graduate, and MBA programs, but not all programs or institutions may be covered. It’s essential to verify that your school and program are eligible before applying. - Credit Score and Co-Signer Requirements

CommonBond requires a good credit score to qualify for their loans. Generally, a score of 660 or higher is needed to secure favorable rates. If your credit score is below this threshold, you may still be eligible with a creditworthy co-signer. A co-signer can help you qualify for the loan and potentially lower your interest rate. - Citizenship and Residency

Applicants must be U.S. citizens or permanent residents to apply for a CommonBond Student Loan. Additionally, you must be at least 18 years old to enter into a legal contract. - Income and Employment Verification

CommonBond may require proof of income or employment to assess your ability to repay the loan. This can include recent pay stubs, tax returns, or other financial documents that demonstrate your earning capacity.

Frequently Asked Questions (FAQ)

What Are the Loan Amounts Available?

CommonBond offers student loans ranging from $2,000 to $250,000, depending on your educational needs and the degree program you’re enrolled in. The loan amount you can borrow will be based on your specific circumstances and the cost of attendance at your institution.

How Long Does It Take to Get Approved?

The approval process for CommonBond Student Loans is typically quick. Many applicants receive a decision within a few business days. Once approved, the funds are usually disbursed to your school within 10-15 business days.

Can I Use a CommonBond Loan for Study Abroad Programs?

Yes, CommonBond loans can be used for study abroad programs if your institution recognizes the program and provides academic credit. Ensure that your study abroad program and institution meet CommonBond’s eligibility criteria.

What Happens If I Can’t Make a Payment?

CommonBond provides options to manage financial difficulties, including forbearance and deferment. If you encounter financial challenges, contact CommonBond’s customer service to discuss your options and find a solution that works for you.

Is There a Penalty for Early Repayment?

No, CommonBond does not charge prepayment penalties. You can pay off your loan early without incurring additional fees, which can help you save on interest.

Step-by-Step Application Process

- Check Eligibility

Before applying, verify that your institution and degree program are eligible for CommonBond loans. Additionally, ensure you meet the credit score requirements or have a qualified co-signer if needed. - Gather Required Documents

Prepare the necessary documentation, including proof of enrollment, identification, income verification, and any other financial documents required by CommonBond. - Complete the Online Application

Apply for a CommonBond Student Loan by filling out the online application form on their website. Provide all required information, including personal, financial, and academic details. - Review Loan Offer

Once your application is reviewed, CommonBond will present you with a loan offer outlining the terms, interest rate, and repayment options. Carefully review this offer to ensure it meets your needs. - Accept the Loan and Sign Documents

If you agree to the terms of the loan offer, accept it and sign the necessary documents electronically. CommonBond will then process your loan and arrange for the funds to be disbursed to your school. - Manage Your Loan

After receiving the funds, manage your loan according to the repayment plan you selected. Monitor your account, make timely payments, and reach out to CommonBond if you need assistance or wish to explore refinancing options.

Conclusion

CommonBond Student Loans provide a valuable solution for financing your education with competitive rates, flexible repayment options, and a commitment to social impact. By understanding the benefits, prerequisites, and application process, you can make an informed decision about how to finance your academic goals. Start your application process today and take the next step toward achieving your educational dreams with CommonBond.

Top Home improvement loan options

Top Home improvement loan options  Discover Personal Loans: A Flexible Financial Solution <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits, Requirements, and Application Process </p>

Discover Personal Loans: A Flexible Financial Solution <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits, Requirements, and Application Process </p>  SeedFi Borrow and Grow Loan <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Your Pathway to Financial Growth and Credit Improvement </p>

SeedFi Borrow and Grow Loan <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Your Pathway to Financial Growth and Credit Improvement </p>