Securing the right financing for your education is crucial to achieving academic and career goals. College Ave Student Loans offer a range of options to help cover educational expenses with flexibility and competitive terms. This guide delves into the detailed benefits of College Ave Student Loans, outlines the prerequisites for applying, answers frequently asked questions, and provides a step-by-step process for submitting your application. Whether you’re an undergraduate, graduate, or professional student, understanding these aspects will help you make an informed decision about your financing options.

More Details and Positive Points

Customizable Loan Terms

College Ave provides a range of loan term lengths, allowing you to tailor your loan repayment to your financial situation. With terms ranging from 5 to 15 years, you can select a repayment period that fits your budget and future earnings. Shorter terms generally result in higher monthly payments but lower overall interest costs, while longer terms offer lower monthly payments but a higher total interest expense.

Interest Rate Flexibility

College Ave offers both fixed and variable interest rate options. Fixed rates provide predictable monthly payments throughout the loan term, while variable rates can offer lower initial rates that may decrease over time. This flexibility allows you to choose the interest rate type that best suits your financial strategy and risk tolerance.

Interest Rate Discounts

College Ave provides opportunities for interest rate discounts, such as automatic payment discounts. Enrolling in automatic payments can lower your interest rate, reducing the overall cost of your loan. This feature can make managing your loan more affordable and convenient.

Support for a Wide Range of Students

College Ave Student Loans are available for undergraduate, graduate, and professional students. This broad coverage ensures that various educational levels and programs are supported, making it easier for students at different stages of their academic journey to find appropriate funding.

No Prepayment Penalties

There are no penalties for paying off your loan early with College Ave. If you have the means to make additional payments or pay off the loan before the term ends, you can do so without facing extra charges. This flexibility helps you reduce your debt faster and save on interest costs.

Prerequisites for Applying

- Enrollment Status

You must be enrolled in an eligible degree program at a qualified school to apply for College Ave Student Loans. The school and program should be accredited and recognized by the Department of Education. - Credit History

While College Ave considers applicants with varying credit profiles, having a good credit history can improve your chances of securing favorable terms. If your credit is less than stellar, you may need a co-signer to enhance your application and qualify for better rates. - Income and Financial Information

Be prepared to provide information about your income and financial situation. This helps College Ave assess your ability to repay the loan. For students with limited income, having a co-signer with a strong financial profile can strengthen your application. - U.S. Citizenship or Legal Residency

Applicants must be U.S. citizens or legal residents to qualify for College Ave Student Loans. Ensure you meet this requirement before starting the application process. - Minimum Enrollment Requirements

To qualify for a loan, you generally need to be enrolled at least half-time in your program. Full-time enrollment may be required for certain loan types or terms.

Frequently Asked Questions (FAQ)

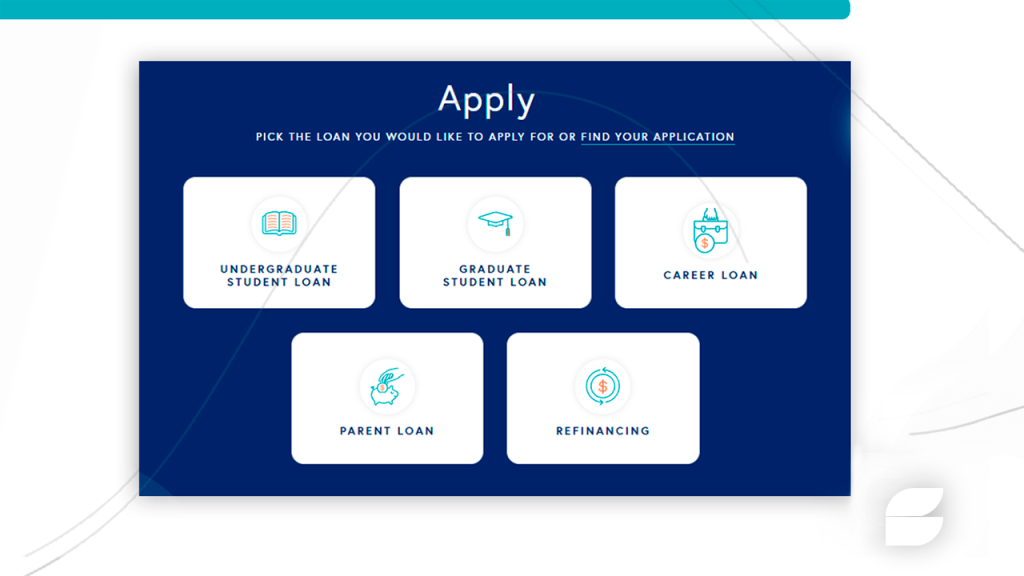

What types of loans does College Ave offer?

College Ave provides undergraduate, graduate, and professional student loans. Each loan type is designed to meet the specific needs of students at various stages of their education.

How do I apply for a College Ave Student Loan?

The application process is straightforward and can be completed online through the College Ave website. You will need to provide personal and financial information to complete your application.

Can I change my repayment plan after my loan is disbursed?

Yes, College Ave allows you to change your repayment plan after your loan is disbursed. Contact customer service to discuss your options for adjusting your repayment plan based on your financial situation.

Are there any fees associated with College Ave Student Loans?

College Ave does not charge origination fees, application fees, or prepayment penalties. However, late fees may apply if payments are missed, so it’s important to stay current on your payments.

How can I lower my interest rate with College Ave?

You can lower your interest rate by enrolling in automatic payments. College Ave offers a discount for borrowers who set up automatic monthly payments from a bank account.

Step-by-Step Application Process

- Research Loan Options

Start by researching the different loan options offered by College Ave. Determine whether an undergraduate, graduate, or professional loan best suits your needs and review the terms and conditions associated with each. - Check Eligibility Requirements

Ensure you meet the eligibility criteria, including enrollment status, credit history, and citizenship requirements. If needed, secure a co-signer to strengthen your application. - Gather Necessary Documentation

Collect all required documentation, including proof of income, financial statements, and information about your educational institution. Having these documents ready will expedite the application process. - Complete the Online Application

Visit the College Ave website and complete the online loan application. Provide accurate information about your personal, academic, and financial details to facilitate the approval process. - Review and Submit Your Application

Carefully review your application for accuracy and completeness. Submit the application online once you are satisfied with the information provided. - Await Loan Decision

After submission, College Ave will review your application and provide a decision. This process typically takes a few business days. You will receive an offer detailing the loan terms and interest rates. - Accept the Loan Offer

If you agree to the loan terms, accept the offer. You may need to electronically sign the loan agreement to finalize the process. - Disbursement of Funds

Once your loan is approved and accepted, College Ave will disburse the funds directly to your school or to you, depending on the loan type and your school’s disbursement process. - Manage Repayments

Set up a repayment plan that suits your financial situation and stay on top of your payments. Consider enrolling in automatic payments to ensure timely repayment and potentially lower your interest rate.

Conclusion

College Ave Student Loans offer a flexible and efficient solution for financing your education. By understanding the detailed benefits, meeting the prerequisites, and following the application process, you can secure the funding needed to support your academic goals. Ready to take the next step? Explore College Ave Student Loans further and apply today to set yourself on the path to educational success.

Apply for a personal loan with Eagle Financial: step-by-step <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how to have the necessary funds to buy an asset you've always dreamed of </p>

Apply for a personal loan with Eagle Financial: step-by-step <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how to have the necessary funds to buy an asset you've always dreamed of </p>  Top Home improvement loan options

Top Home improvement loan options  Discover Personal Loans: A Flexible Financial Solution <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits, Requirements, and Application Process </p>

Discover Personal Loans: A Flexible Financial Solution <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits, Requirements, and Application Process </p>