Why Empower is More Than Just a Budget App

In a saturated market of personal finance tools, the Empower Personal Dashboard Budget App emerges as a sophisticated and investor-focused platform. Formerly known as Personal Capital, Empower has expanded its offerings beyond mere budgeting — blending wealth tracking, investment analysis, and retirement planning into one seamless dashboard.

If you’re looking for a personal finance app that combines high-level insights with user-friendly navigation, this in-depth 2025 review will uncover whether Empower truly stands out — or if it’s simply coasting on its brand legacy.

What Sets Empower Apart?

Hybrid Between a Budget App and Wealth Management Platform

Unlike most budgeting tools (like Mint or YNAB), Empower was built with high-net-worth individuals and long-term investors in mind. Yes, it tracks spending, but where it shines is its investment analytics engine.

Key Features:

- Retirement Fee Analyzer: Empower uses advanced algorithms to project how hidden fees from your 401(k) and mutual funds can impact your portfolio over 20+ years. This is a rare feature among budget apps.

- Net Worth Forecasting: While many apps show your current net worth, Empower uses projected growth rates and savings patterns to forecast net worth trajectories, a feature ideal for FIRE (Financial Independence, Retire Early) enthusiasts.

- Crypto Tracking (Beta): As of Q2 2025, Empower has begun rolling out limited crypto wallet integration, which includes portfolio weighting and volatility analysis for Bitcoin, Ethereum, and select altcoins.

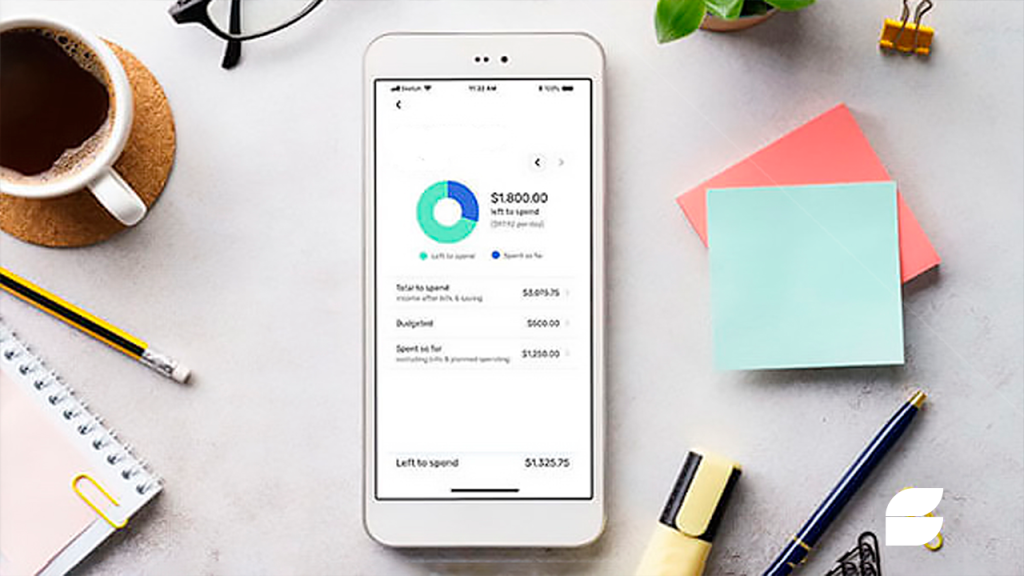

Budgeting That Doesn’t Feel Like Budgeting

While Empower’s strength lies in investment analytics, its budgeting features shouldn’t be underestimated.

- Cash Flow Visualization: Monthly cash flow is displayed in an intuitive graph, helping users identify spending leaks quickly.

- Category Alerts: AI-powered alerts notify users when they deviate from past spending trends — without needing to set a rigid monthly budget.

This approach appeals to users who want to optimize financial health without micromanaging every dollar.

Pricing: Is Empower Free?

Here’s where it gets interesting.

- The Empower Personal Dashboard (budgeting + investment tools) is 100% free to use.

- However, once your investable assets exceed $100,000, you’ll be pitched their Wealth Management Services — a premium advisory service with an AUM fee starting at 0.89% annually.

This dual-model (free and advisory) has drawn both praise and criticism. For savvy users, the free dashboard is a powerful no-cost asset. But if you engage their wealth managers, you should compare costs with a Robo-advisor like Betterment or Wealthfront.

Who Should (and Shouldn’t) Use Empower?

| Ideal User Profile | Who Might Look Elsewhere |

| High-income professionals | Daily cash envelope budgeters |

| Investors tracking multiple portfolios | Users with no investment assets |

| FIRE community members | College students with minimal income |

| Crypto-curious individuals | People who prefer gamified budgeting |

Pro Tip: Empower syncs well with institutions like Fidelity, Vanguard, and even niche platforms like M1 Finance, which adds value for self-directed investors.

Pros and Cons

✅ Pros:

- Robust investment analysis tools

- Accurate net worth and cash flow tracking

- Retirement planning and fee analysis

- Free to use core features

- Easy setup with 2FA security

❌ Cons:

- Wealth advisory sales calls can be persistent

- No envelope or zero-based budgeting

- Limited manual transaction editing

- Crypto support still in beta phase

Insider Tip: Empower’s “Financial Roadmap” Feature

One underrated feature that doesn’t often get coverage is the “Financial Roadmap” — a personalized plan based on your financial goals, age, risk tolerance, and income streams.

It helps you set smart financial milestones like:

- Paying off high-interest debt

- Saving for a down payment

- Optimizing tax-advantaged accounts

It’s like having a mini financial advisor on your phone.

Empower vs. Competitors

| Feature | Empower | Mint | YNAB | Monarch |

| Free Plan | ✅ | ✅ | ❌ | ❌ |

| Investment Tracking | ✅ | ❌ | ❌ | ✅ |

| Retirement Planning | ✅ | ❌ | ❌ | ❌ |

| Crypto Integration | ✅ (Beta) | ❌ | ❌ | ✅ |

| AI Spending Alerts | ✅ | ❌ | ✅ | ✅ |

If your priority is comprehensive financial visibility, Empower wins. But if you prefer strict budget control, tools like YNAB might serve you better.

Frequently Asked Questions (FAQ)

1. Is Empower really free?

Yes. The budgeting and investment tracking dashboard is completely free. You’ll only pay if you opt into their Wealth Management advisory service.

2. Can I use Empower for retirement planning?

Absolutely. Empower includes tools like the Retirement Planner and Fee Analyzer, which provide high-level insights into your retirement readiness.

3. Does Empower support crypto wallets?

As of mid-2025, yes — though support is in beta and currently limited to major coins.

Final Verdict: Is Empower Worth It in 2025?

If you’re serious about growing your net worth, understanding your investment fees, and having a clear financial picture — all in one sleek dashboard — then Empower is arguably the best free personal finance app available.

It’s not designed for minimalists or those who need constant budgeting reminders. Instead, it’s for strategic users looking to manage both their daily spending and long-term financial growth.

Revvi Visa: Tarjeta para Recuperar Crédito con Aceptación Global <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Inclusión financiera para consumidores con crédito limitado, aceptación Visa, tarifas más altas y gestión digital </p>

Revvi Visa: Tarjeta para Recuperar Crédito con Aceptación Global <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Inclusión financiera para consumidores con crédito limitado, aceptación Visa, tarifas más altas y gestión digital </p>  Credit Card Revvi Visa — Visión general, aceptación y características principales <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Tarjeta accesible para la reconstrucción del crédito, amplia aceptación Visa, funcionalidades digitales y control financiero básico. </p>

Credit Card Revvi Visa — Visión general, aceptación y características principales <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Tarjeta accesible para la reconstrucción del crédito, amplia aceptación Visa, funcionalidades digitales y control financiero básico. </p>  Discover Card: <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover Card: </p>

Discover Card: <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover Card: </p>