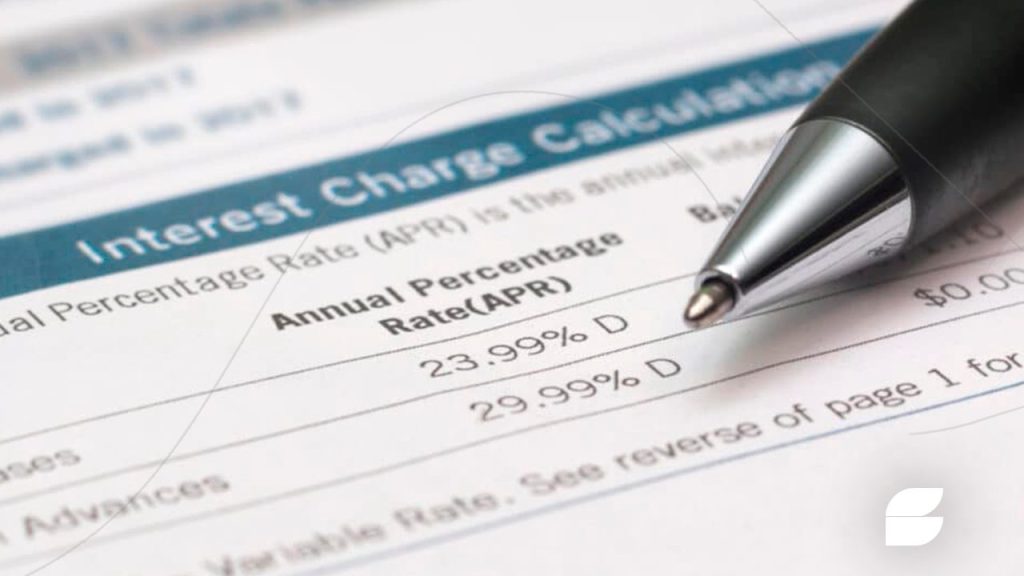

When exploring credit card options, you’ve likely come across the term “APR.” Short for Annual Percentage Rate, APR is a crucial factor in understanding how much you’ll pay to borrow money on your card. However, APR often leaves people confused, especially since it can vary based on several factors. Whether you’re new to credit cards or looking to improve your financial knowledge, understanding APR can save you money and help you manage your credit more effectively.

What is APR on Credit Cards?

APR, or Annual Percentage Rate, represents the interest rate applied annually on the balance of your credit card. In simple terms, it’s the cost of borrowing money, expressed as a yearly rate. For credit cards, APR only applies when you carry a balance beyond your due date, meaning you pay interest on the remaining amount each billing cycle. Most credit cards come with variable APRs, which can fluctuate over time based on economic conditions and your credit score.

Why APR Matters in Credit Card Choices

When choosing a credit card, the APR determines how expensive it can be to maintain a balance. If you tend to carry a balance month-to-month, a lower APR can significantly reduce your interest expenses. By understanding the different types of APR and when they apply, you’ll be better prepared to make a financially sound choice.

Types of APRs on Credit Cards

Credit card APRs are not one-size-fits-all; there are several types, each with its specific applications. Here are the most common types of APR you’ll encounter:

Purchase APR

This is the interest rate applied to new purchases if you carry a balance. For many people, the Purchase APR is the most frequently encountered, as it impacts how much interest you’ll pay on everyday spending. If you don’t pay your balance in full each month, the Purchase APR will apply to your remaining balance.

Introductory APR

Many credit cards offer a temporary, lower APR as a promotional rate for new customers. Often, this is a 0% APR for a specified period, typically ranging from six to 18 months. During this time, no interest accrues on new purchases or balance transfers, allowing cardholders to save on interest. However, after the introductory period ends, the standard APR kicks in, and any unpaid balance begins accruing interest.

Balance Transfer APR

For those with existing debt on other credit cards, the Balance Transfer APR is important to understand. Balance transfer credit cards often offer a low or 0% APR for transferring balances from other cards. This rate typically applies for a limited period, helping cardholders save on interest while paying down their balances more effectively.

Cash Advance APR

The Cash Advance APR is the interest rate applied when you withdraw cash from your credit card. It’s usually significantly higher than the Purchase APR and starts accruing immediately without a grace period, making it a costly option. Cash advances often also come with additional fees, so it’s generally advisable to avoid using a credit card for cash withdrawals.

Penalty APR

Penalty APR, also known as default APR, applies when you fail to make timely payments on your credit card. If you miss a payment or make a late payment, your credit card issuer may increase your APR to the penalty rate, which can be significantly higher than your standard rate. Penalty APRs serve as a deterrent to late payments and can remain in effect for months or even indefinitely if the issuer permits.

Factors That Influence Your Credit Card APR

Understanding what influences APR can empower you to secure a better rate. Here are the main factors credit card issuers consider:

- Credit Score: Your credit score is one of the biggest determinants of your APR. A higher credit score typically means a lower APR since lenders view you as less risky.

- Prime Rate: Many credit cards have variable APRs tied to the prime rate, which reflects the federal interest rate. When the prime rate rises, so does your credit card’s APR, and vice versa.

- Type of Card: Different types of cards, such as secured credit cards, rewards cards, or premium cards, come with varying APRs. Premium cards with rewards tend to have higher APRs, while secured cards designed for credit-building may have more favorable rates.

- Promotional Offers: Some cards offer introductory APR promotions to attract new users. After the promotional period, the APR will reset to the card’s standard rate.

How to Minimize the Impact of APR

While APR directly impacts interest costs, there are ways to manage and minimize its effects:

- Pay in Full Each Month: If you pay your full balance every month, you can avoid interest charges altogether since the APR only applies to balances carried beyond the grace period.

- Look for Introductory APR Offers: If you need to make a large purchase or transfer a balance, consider a card with a 0% introductory APR offer. This can help you save on interest for a limited time.

- Negotiate a Lower APR: If you’ve demonstrated good financial behavior, such as making timely payments, you may be able to negotiate a lower APR with your credit card issuer.

- Avoid Cash Advances: Cash advances come with high APRs and fees, making them a costly option. Consider alternative borrowing methods if you need quick cash.

Conclusion

APR is a central element in credit card costs, directly affecting how much you’ll pay to carry a balance. From understanding different types of APR to managing your payment strategies, knowing how APR works is essential for any cardholder aiming to make informed financial decisions. By being mindful of your spending habits and credit card terms, you can minimize the impact of APR, potentially saving hundreds of dollars in interest each year.