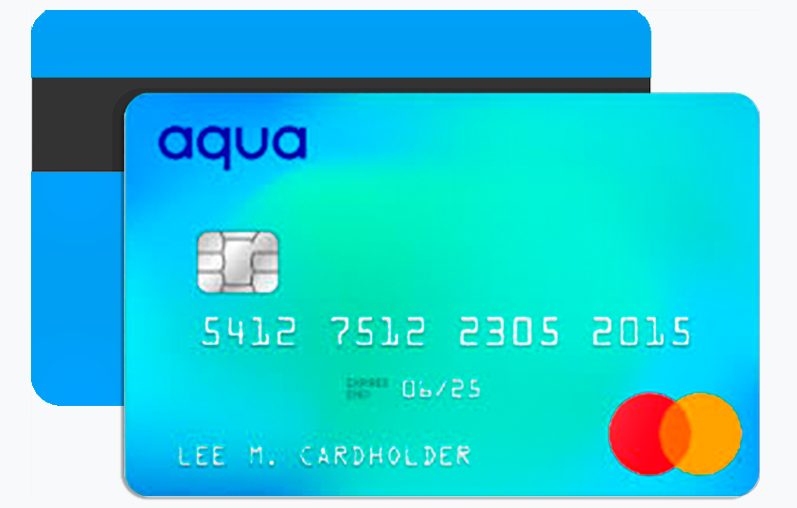

AQUA

NO ANNUAL FEES FLEXIBLE CREDIT LIMITSThe Aqua Credit Card is designed for individuals who need to build or rebuild their credit score. Whether you’ve had credit issues in the past or are just starting your credit journey, the Aqua Credit Card offers an accessible path to improving your financial standing. With manageable credit limits and a focus on responsible borrowing, this card can be a stepping stone to a brighter financial future.

Top 3 Advantages of the Aqua Credit Card

Credit Building Potential

One of the most significant benefits of the Aqua Credit Card is its potential to help you build or rebuild your credit score. Aqua reports your payment history to major credit bureaus, meaning every timely payment you make positively impacts your credit profile. Over time, responsible use of this card can lead to a better credit score, opening doors to more financial opportunities.

No Annual Fees

Unlike many other credit cards aimed at those with low or no credit, the Aqua Credit Card does not charge an annual fee. This makes it an affordable option for those looking to build credit without incurring extra costs. By avoiding annual fees, you can focus on managing your expenses and making timely payments, which are crucial steps in improving your credit score.

Manageable Credit Limits

Aqua Credit Card provides manageable credit limits that are ideal for those new to credit or looking to regain control of their finances. The limits are designed to encourage responsible spending, reducing the risk of accumulating unmanageable debt. This feature is particularly beneficial for individuals who need to keep their credit usage low while they work on improving their credit score.

Disadvantages of the Aqua Credit Card

Higher Interest Rates

One of the drawbacks of the Aqua Credit Card is its relatively high-interest rates. While this is common among credit cards for individuals with low credit scores, it does mean that carrying a balance from month to month can become expensive. To avoid high-interest charges, it’s essential to pay off your balance in full each month.

Limited Rewards Program

The Aqua Credit Card does not offer a rewards program, which can be a downside for those who are used to earning points or cashback on their purchases. If you’re seeking a card that provides incentives for spending, you may want to consider other options once your credit score has improved.

Continue Reading for More Details and How to Apply

Ready to take the next step in building your credit? The Aqua Credit Card offers a straightforward and effective way to improve your financial health. Continue reading to explore more details about this card, including the application process and tips on how to get approved. Apply today and start your journey towards a stronger credit profile!

Zopa Credit Card: Financial Management Upgrade <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Learn How the Zopa Credit Card Can Improve Your Financial Management and Provide Exclusive Benefits in Your Daily Life. </p>

Zopa Credit Card: Financial Management Upgrade <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Learn How the Zopa Credit Card Can Improve Your Financial Management and Provide Exclusive Benefits in Your Daily Life. </p>  Zopa Credit Card: Key Benefits & Features <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits and Features of the Zopa Credit Card to Improve Your Financial Management and Maximize Your Purchases. </p>

Zopa Credit Card: Key Benefits & Features <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits and Features of the Zopa Credit Card to Improve Your Financial Management and Maximize Your Purchases. </p>  Zilch Credit Card: Main Features, Tips, and How to Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how the Zilch Credit Card can transform your financial life with interest-free payments and exclusive benefits. </p>

Zilch Credit Card: Main Features, Tips, and How to Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how the Zilch Credit Card can transform your financial life with interest-free payments and exclusive benefits. </p>