YONDER

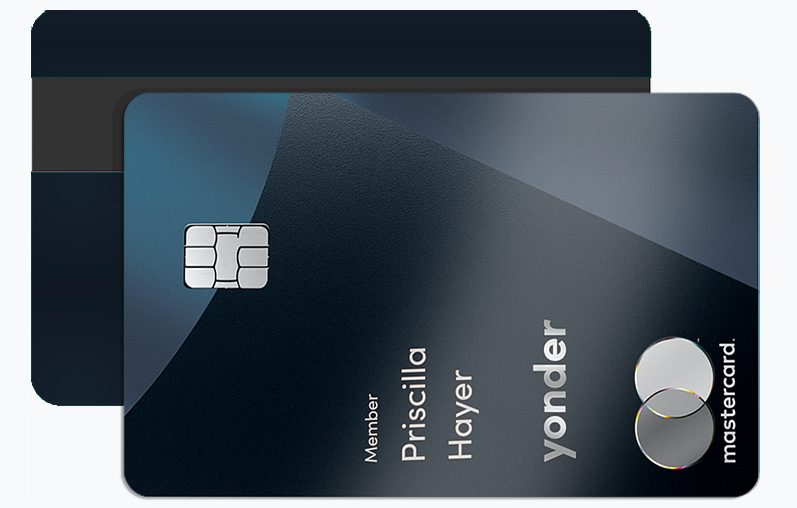

EXPERIENCE-FIRST REWARDS EXCLUSIVE "MEMBER EVENTS" ACESSThe Yonder Credit Card UK is changing how British consumers experience credit. Designed for young professionals, digital nomads, and food lovers, Yonder combines premium lifestyle benefits with transparent financial control — offering an experience that goes far beyond traditional cashback.

Unlike typical UK credit cards that reward spending with points you’ll rarely use, Yonder focuses on real-world perks. Members earn rewards at London’s best restaurants, access curated experiences, and enjoy zero foreign transaction fees — all powered by Mastercard’s global acceptance.

But what truly makes Yonder different is its subscription-based model and credit-building focus, making it ideal for people who want to enjoy their city while improving their financial reputation.

Top 3 Advantages of the Yonder Credit Card

1. Exceptional Dining and Lifestyle Rewards

Yonder partners directly with top-tier restaurants, cafés, and cultural venues across London and other major UK cities. Instead of traditional points, you earn Yonder Points redeemable for meals, experiences, and even curated events — delivering genuine, tangible value for everyday spending.

Users can earn up to 3x points on dining and 1x points on all other purchases, creating a seamless rewards ecosystem that encourages real experiences instead of complicated redemption systems.

2. Zero Foreign Transaction Fees

Unlike many UK credit cards that charge extra when you spend abroad, Yonder allows fee-free global transactions. This makes it a perfect companion for digital nomads and frequent travelers who want the freedom to spend internationally without hidden costs.

Combined with Mastercard’s global reach, you can use Yonder in over 200 countries without worrying about additional fees or fluctuating exchange rates.

3. Credit-Building Made Simple

Yonder isn’t just about luxury perks — it’s also about building and improving your credit score responsibly. The card reports to major UK credit agencies and provides spending insights through its intuitive mobile app.

Users can easily monitor transactions, automate repayments, and set personal spending limits — ensuring responsible credit usage that translates into long-term financial growth.

Two Disadvantages of the Yonder Credit Card

1. Monthly Membership Fee

Yonder operates on a subscription model, which includes a monthly fee for access to its premium rewards ecosystem. While the perks easily outweigh the cost for active users, occasional spenders may find the membership less justifiable.

2. Limited Availability Outside Major Cities

Currently, the best Yonder partner experiences are concentrated in London and other metropolitan areas. Users in smaller towns may not fully enjoy the rewards potential, although the company continues to expand nationwide.

Continue Reading to Learn How to Apply for the Yonder Credit Card Today

The Yonder Credit Card UK is not just another financial product — it’s a lifestyle companion that redefines what modern credit means. Whether you want to enjoy Michelin-star dining, travel abroad with no hidden fees, or build your credit score effortlessly, Yonder delivers value that feels personal and immediate.

In the next section, you’ll discover:

- The exclusive Yonder benefits most people overlook.

- The application process and eligibility requirements.

- Proven strategies to increase your approval chances.

💳 Continue reading and find out how to get approved for your Yonder Credit Card today — and start living your best financial life with rewards that truly matter.

Zopa Credit Card: Financial Management Upgrade <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Learn How the Zopa Credit Card Can Improve Your Financial Management and Provide Exclusive Benefits in Your Daily Life. </p>

Zopa Credit Card: Financial Management Upgrade <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Learn How the Zopa Credit Card Can Improve Your Financial Management and Provide Exclusive Benefits in Your Daily Life. </p>  Zopa Credit Card: Key Benefits & Features <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits and Features of the Zopa Credit Card to Improve Your Financial Management and Maximize Your Purchases. </p>

Zopa Credit Card: Key Benefits & Features <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits and Features of the Zopa Credit Card to Improve Your Financial Management and Maximize Your Purchases. </p>  Zilch Credit Card: Main Features, Tips, and How to Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how the Zilch Credit Card can transform your financial life with interest-free payments and exclusive benefits. </p>

Zilch Credit Card: Main Features, Tips, and How to Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how the Zilch Credit Card can transform your financial life with interest-free payments and exclusive benefits. </p>