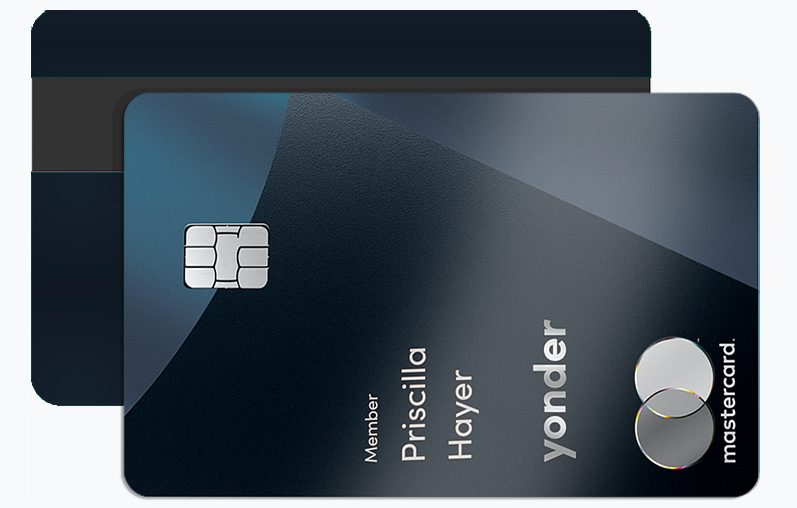

YONDER

EXPERIENCE-FIRST REWARDS EXCLUSIVE "MEMBER EVENTS" ACESSYonder positions itself as a lifestyle-first credit card in the UK, aimed at diners, travellers and experience seekers. Unlike ordinary cashback or airline cards, Yonder converts everyday spending into flexible points redeemable at curated restaurants, events and travel partners. Its mobile-first app, membership tiers and Open Banking affordability checks make it accessible to younger applicants and people with thin credit histories. Representative APRs have been advertised in public comparisons, so it’s important to plan to clear balances monthly to avoid interest diluting reward value. New-member promotions — such as bonus points after meeting an initial spend target — can jump-start your reward balance, but always check the small print.

Top 3 Advantages of the Yonder Credit Card

1. Experience-first rewards

Yonder’s point system prioritises curated experiences — earning points on everyday spend and receiving higher multipliers at partner venues such as restaurants, theatres and wellness brands. Monthly rotating perks and the ability to redeem points at checkout for hands-on lifestyle rewards increase the practical utility of the card.

2. Travel-ready features

This card advertises worldwide travel insurance and no foreign transaction fees, making it a practical travel credit card for city breaks and short trips abroad. The absence of hidden currency-exchange mark-ups means you can spend overseas more confidently, which enhances value for cardholders who travel or spend internationally.

3. Open Banking eligibility & credit-building potential

Yonder uses Open Banking for affordability checks rather than relying solely on traditional credit-bureau history. That means faster decisions and potentially wider access for younger applicants or those looking to rebuild. In addition, regular timely payments may help your credit profile over time, making the card a twin opportunity: lifestyle rewards plus credit-building.

Two Disadvantages to Consider

1. Subscription cost for full perks

While Yonder offers a free tier, unlocking the top earning rates and premium benefits requires a monthly fee (commonly reported around £15/month) for full membership. If your average monthly spend is low, the subscription may wipe out any net benefit. You’ll need to actively use the premium perks to justify the cost.

2. Partner-dependent value

Redemption value depends heavily on Yonder’s partner network and curated offers. If your local market lacks strong partner venues, the effective “cashback-like” value may fall short compared with mainstream cashback cards. Also, availability of partner experiences can vary month-to-month, which may affect long-term predictability of value.

Continue on Our Site to Discover Exclusive Yonder Details and Learn How to Apply Today

If you’re intrigued by the idea of earning flexible lifestyle rewards and enjoying zero foreign transaction fees, you’ll want to explore further. On our website, you can find in-depth comparisons, hidden benefits, and the complete application walkthrough for the Yonder Credit Card UK.

Discover exactly how Yonder’s membership tiers work, learn insider strategies to maximize your point value, and see step-by-step instructions to apply safely through the official app.

👉 Follow our detailed guide to uncover every Yonder advantage and start your application today — turning everyday spending into extraordinary experiences.

HSBC Credit Card: Unlock Premium Rewards and Exclusive Banking Power <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Experience Financial Freedom with the HSBC Credit Card </p>

HSBC Credit Card: Unlock Premium Rewards and Exclusive Banking Power <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Experience Financial Freedom with the HSBC Credit Card </p>  How to Apply for the HSBC Credit Card – Eligibility & Approval Tips <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Maximise Your Financial Potential with the HSBC Credit Card </p>

How to Apply for the HSBC Credit Card – Eligibility & Approval Tips <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Maximise Your Financial Potential with the HSBC Credit Card </p>  How to Apply for the Yonder Credit Card UK: Complete Insider Guide <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Unlock lifestyle rewards, hidden benefits, and faster approval using Open Banking insights </p>

How to Apply for the Yonder Credit Card UK: Complete Insider Guide <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Unlock lifestyle rewards, hidden benefits, and faster approval using Open Banking insights </p>