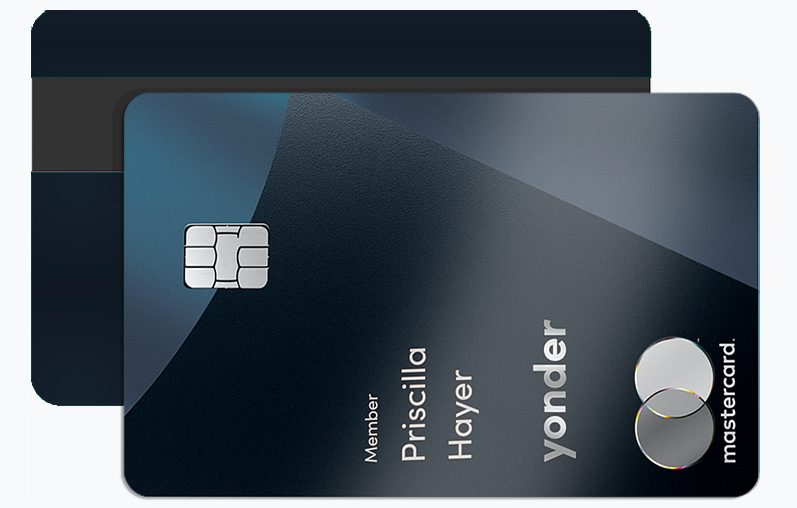

If you’ve ever wished for a credit card that fits your lifestyle — not the other way around — the Yonder Credit Card UK might be the perfect match. Unlike traditional cards that focus solely on cashback or travel miles, Yonder offers a membership-based rewards ecosystem designed for those who live, work, and dine in urban Britain.

With exclusive restaurant partnerships, zero foreign transaction fees, and a clear focus on responsible credit-building, Yonder is quickly becoming one of the most desirable financial products in the UK market. But to truly understand what makes this card so valuable — and how to increase your chances of approval — you need details that most websites overlook.

Let’s explore everything you need to know about the Yonder Credit Card.

More Benefits That Make Yonder Stand Out

1. Real-Time Reward Redemption

Most credit cards make you wait to accumulate enough points before you can redeem them. Yonder is different. You can redeem Yonder Points instantly via the mobile app at partner venues — from luxury dining to cultural events. This real-time flexibility makes your rewards immediately meaningful.

2. Transparent, Flexible Spending Limits

Yonder uses advanced technology to assign dynamic credit limits based on your real financial behavior, not just static data. This makes it more inclusive for professionals with irregular income streams, such as freelancers or digital entrepreneurs.

3. Cutting-Edge Security and App Control

Yonder’s mobile app gives users complete control over their credit card. You can freeze or unfreeze your card in seconds, receive instant notifications for every transaction, and use biometric login for extra security. Unlike older banks, Yonder was built mobile-first, meaning every tool is available at your fingertips — 24/7.

4. Sustainable and Transparent Banking

Yonder positions itself as a socially responsible fintech. The company invests in sustainable initiatives and ensures that all card materials are eco-friendly. Its transparency extends to fees and data protection, offering peace of mind for users who care about ethics as much as efficiency.

Eligibility Criteria: Who Can Apply for the Yonder Credit Card?

Before you apply, it’s essential to understand the Yonder eligibility requirements. This card is accessible yet selective, ensuring that users can manage their credit responsibly.

To apply for the Yonder Credit Card, you must:

- Be at least 18 years old and a UK resident.

- Have a UK bank account for repayments.

- Provide proof of income (employment, self-employment, or regular earnings).

- Pass a soft credit check during the initial application stage.

- Own a smartphone compatible with the Yonder app (iOS or Android).

While a perfect credit score isn’t required, having a stable financial profile significantly improves your approval odds.

Frequently Asked Questions (FAQ)

1. What is the monthly fee for the Yonder Credit Card?

Yonder operates on a subscription model, with a standard monthly membership fee that grants access to exclusive partner rewards and zero foreign transaction charges.

2. Does Yonder offer balance transfers?

No, Yonder is designed as a lifestyle and rewards card, not for balance transfers. It focuses on credit-building and daily rewards, not debt management.

3. Can I use Yonder abroad?

Absolutely. With zero foreign transaction fees, Yonder is ideal for travel and international spending. You can use it anywhere Mastercard is accepted.

4. How does Yonder help build my credit score?

Each month, your payment history is reported to major UK credit reference agencies. Timely payments and responsible usage will steadily increase your credit rating.

5. Can I cancel my membership anytime?

Yes. The Yonder subscription model allows you to pause or cancel your plan via the app, giving you full control without hidden penalties.

Step-by-Step Guide: How to Apply for the Yonder Credit Card

Here’s a clear, actionable guide to help you apply quickly and effectively:

Step 1: Visit the Official Yonder Website or Download the App

The Yonder application process is entirely digital. Download the app or visit the official site to begin.

Step 2: Complete the Online Form

Fill out the short online form with your personal details, employment status, and income level.

Step 3: Undergo a Soft Credit Check

Yonder performs a soft search to assess eligibility without affecting your credit score.

Step 4: Verify Your Identity

Upload valid identification (passport or UK driving licence) and proof of address (such as a utility bill or bank statement).

Step 5: Receive Your Decision

In most cases, you’ll receive a response within minutes. If approved, you can start using your virtual Yonder card instantly through the app.

Step 6: Activate Your Physical Card

Your physical card will arrive within 3–5 business days, ready for in-person purchases.

Pro Tips to Increase Your Chances of Approval

To improve your odds of getting approved for the Yonder Credit Card UK, follow these expert strategies:

1. Maintain a Healthy Credit Utilisation Ratio

Keep your credit usage below 30% of your total available credit. This shows lenders that you manage debt responsibly.

2. Ensure Stable Income Documentation

Yonder values financial consistency. Upload accurate, verifiable income proof — even if you’re self-employed or a freelancer.

3. Avoid Multiple Credit Applications at Once

Too many recent applications can lower your credit score temporarily. Wait at least three months between credit card applications.

4. Pay Off Outstanding Balances First

Clearing old debts or credit card balances increases your financial stability, improving your approval chances.

5. Use a UK Address and Verified Bank Account

Ensure all your documents match your current UK address, as inconsistencies can delay or block approval.

Quick Overview of Yonder Benefits

| Feature | Benefit |

|---|---|

| Dining Rewards | Earn 3x points at partner restaurants |

| Travel Freedom | Zero foreign transaction fees |

| Credit Building | Monthly reports to UK credit agencies |

| Membership Control | Cancel or pause anytime through the app |

| Sustainable Design | Eco-friendly card materials |

Conclusion: Is the Yonder Credit Card Worth It?

If you’re looking for a modern, flexible, and rewarding credit card, Yonder stands out from traditional UK credit options. With its real-world rewards, app-based control, and commitment to credit-building, it offers a perfect balance between financial growth and lifestyle value.

Whether you’re enjoying Michelin-star meals, booking international trips, or building your credit history, Yonder empowers you to spend smarter and live better.

💳 Ready to apply? Follow the steps above and discover how the Yonder Credit Card UK can redefine your financial experience — starting today.

Zopa Credit Card: Financial Management Upgrade <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Learn How the Zopa Credit Card Can Improve Your Financial Management and Provide Exclusive Benefits in Your Daily Life. </p>

Zopa Credit Card: Financial Management Upgrade <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Learn How the Zopa Credit Card Can Improve Your Financial Management and Provide Exclusive Benefits in Your Daily Life. </p>  Zopa Credit Card: Key Benefits & Features <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits and Features of the Zopa Credit Card to Improve Your Financial Management and Maximize Your Purchases. </p>

Zopa Credit Card: Key Benefits & Features <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits and Features of the Zopa Credit Card to Improve Your Financial Management and Maximize Your Purchases. </p>  Zilch Credit Card: Main Features, Tips, and How to Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how the Zilch Credit Card can transform your financial life with interest-free payments and exclusive benefits. </p>

Zilch Credit Card: Main Features, Tips, and How to Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how the Zilch Credit Card can transform your financial life with interest-free payments and exclusive benefits. </p>