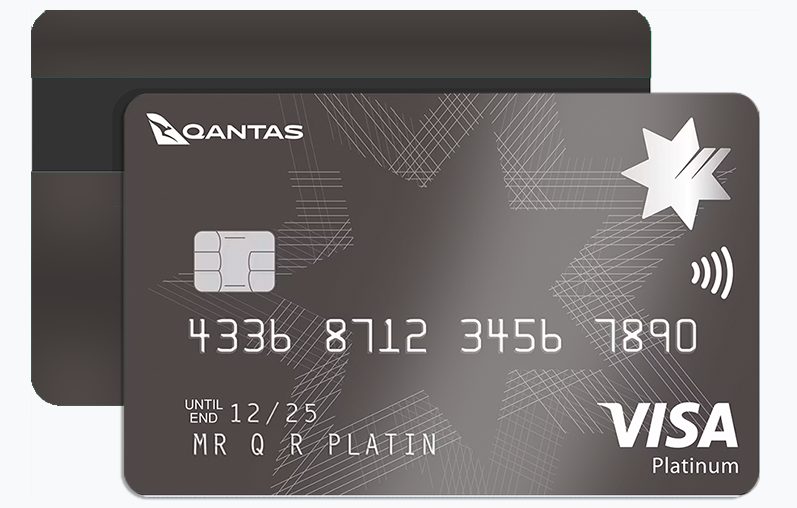

Well, the main purpose of the NAB Qantas Rewards Premium Card is to guarantee travel-related benefits. In addition to the possibility of exchanging your rewards for airline tickets, the credit card offers other advantages, being a great option for those who want to travel abroad.

With a modern system, it allows you to make payments anywhere in the world, as long as the store accepts Visa credit cards. This facilitates your purchases, making them faster and safer, as it also provides coverage and protection against fraud.

Despite offering some benefits of a standard Visa credit card, it is recommended for people who are always on the go, being able to enjoy the rewards in tickets and hotels, as its annual fee is very high. It also does not offer any type of benefits in airport lounges.

What are the NAB Qantas Rewards Premium main benefits?

If you like to travel, this credit card is sure to make you very happy. Here are the main advantages that NAB Qantas Rewards offers its users when booking flights and other features:

- You can earn up to 60,000 Qantas Points within the first few months of using the card.

- Every dollar spent on daily purchases earns you 0.66 Qanta points.

- For every $1.50 of qualifying purchases, you earn 1 Qanta point.

- Offers free travel insurance.

- 0% p.a. in transfer of the opening balance.

- Travel insurance for other countries.

To purchase travel insurance (Allianz) you must make eligible credit card purchases, including flights. Considered one of the best on the market, you can travel safely and peacefully, knowing that you and your family are protected.

NAB QANTAS

FREE TRAVEL INSURANCE VISADespite the excellent rewards program offered by the NAB Qantas Premium Card, it also has an interesting and advantageous sign-up offer, check out more details about it below.

Sign-up bonus and offers

The NAB Qantas Card also gives you 65,000 Qantas Points if you spend $2,500 on eligible purchases in the first three months after you sign up. After winning them there is no expiration date to use them, but the recommendation is not to take too long, as the bank can revoke or change them over time.

Another perk offered as a signup reward is the 0% interest rate for the first 12 months for balance transfers. But, the 3% balance fee still applies to all users. Remember to keep your balance payments on time to avoid high collection fees.

In addition, it is possible to request an additional credit card without fees for holders over 16 years old, as long as your account is under your responsibility.

Travel perks for NAB Qantas Rewards Premium Card

For those looking for an opportunity to become a Qantas Frequent Flyer member, the club allows you to collect and redeem Qatar points for stays, restaurants, flights and many other benefits that are related to your travels.

If you become a Qantas Frequent Flyer member, you also don’t need to pay the $99.50 membership fee, plus 24/7 concierge services, access and preference to the best flights and hotel reservations.

What are NAB Qantas Premium Card Cons?

One of the biggest downsides of NAB Qantas Rewards Premium is its high annual fee. Therefore, this credit card is not recommended if you do not travel often and cannot enjoy the benefits related to it, as the annual fee is not worth it.

Another important factor to note is that there is a limit on rewards. That way, the points you earn drop after you reach the $3,000 spending limit for 1 point for $3.

So if you’re a big spender, do the math before purchasing this card to see if it’s worth it for you. If you are someone who spends too much, there may be other better options.

How can I apply for NAB Qantas Rewards Premium?

If you are interested in purchasing your NAB Qantas Rewards Premium Card, it is available to those aged 18 and over and Australian citizens or those with a permanent visa.

When registering, you must provide some personal information. The form is very simple and quick to fill out, taking no more than 15 minutes. After this procedure, send and wait for about 60 seconds to have your response.

Revvi Visa: Tarjeta para Recuperar Crédito con Aceptación Global <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Inclusión financiera para consumidores con crédito limitado, aceptación Visa, tarifas más altas y gestión digital </p>

Revvi Visa: Tarjeta para Recuperar Crédito con Aceptación Global <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Inclusión financiera para consumidores con crédito limitado, aceptación Visa, tarifas más altas y gestión digital </p>  Discover Card: <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover Card: </p>

Discover Card: <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover Card: </p>  Citi Double Card: Doble Ventaja para Usuarios Modernos <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Maximice recompensas, controle gastos, aproveche alianzas y elija la versión del Citi Double Card según su perfil. </p>

Citi Double Card: Doble Ventaja para Usuarios Modernos <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Maximice recompensas, controle gastos, aproveche alianzas y elija la versión del Citi Double Card según su perfil. </p>