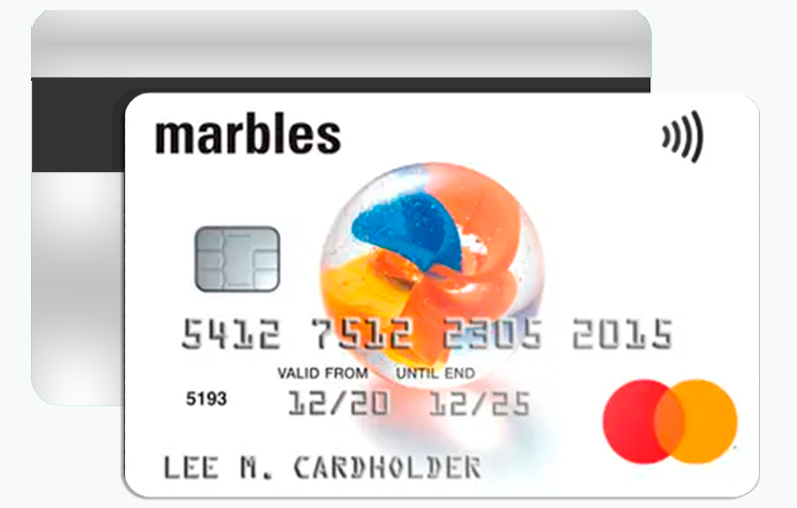

MARBLES MASTERCARD

INTELLIGENT CREDIT BUILDING TECHNOLOGY QUICK AND TRANSPARENT ELIGIBILITY CHECKThe Marbles Credit Card UK has become one of the most reliable and accessible credit solutions in the market, especially for people looking to improve their credit score while enjoying the benefits of a flexible and transparent card. Issued by NewDay, this card provides a perfect balance between convenience, security, and responsible financial management. In 2025, Marbles continues to stand out thanks to its intuitive app, adaptive credit limits, and credit-building support.

The 3 Main Advantages of the Marbles Credit Card UK

1. Designed for Credit Building and Smart Growth

The Marbles Credit Card is specifically built for individuals who want to improve or rebuild their credit rating. Every on-time payment is reported to major UK credit reference agencies, helping you establish a solid track record. Over time, this can increase your credit score and unlock access to cards and loans with lower interest rates.

2. Intelligent Mobile Management

Marbles offers an advanced mobile app that allows full control of your account in real time. You can check your balance, track spending, set alerts, and even freeze or unfreeze your card instantly. This app-based system gives users peace of mind and promotes responsible credit use through clear visibility of every transaction.

3. Adaptive Credit Limits with Responsible Use

After demonstrating consistent repayment behaviour, Marbles may automatically increase your credit limit to reward responsible financial habits. This feature is especially valuable for those working on credit improvement, as it reduces credit utilisation and further boosts credit score performance.

The 2 Main Drawbacks of the Marbles Credit Card UK

1. Higher APR for New Borrowers

While Marbles provides flexibility and accessibility, new customers may face a relatively high APR compared to mainstream credit cards. This is common with credit-builder cards, as they are designed to help individuals with limited or poor credit history. However, consistent on-time payments can lead to better rates in future upgrades.

2. Limited Rewards Programme

Unlike premium credit cards, the Marbles Credit Card focuses on credit-building benefits rather than cashback or travel rewards. Although this makes it less appealing for frequent spenders, it remains one of the most effective tools for improving credit health responsibly.

Discover More Details & Apply for the Marbles Credit Card Today

The Marbles Credit Card UK is more than a typical starter card — it’s a personalised financial tool that grows with you. With strong digital features, flexible limits, and transparent policies, it stands out as one of the most practical credit-building cards available in 2025.

If your goal is to take control of your finances, build a stronger credit history, and gain access to higher credit limits over time, the Marbles Credit Card is a strategic first step. Its simplicity and digital-first approach make it ideal for those who prefer managing their credit entirely from their phone.

➡️ Continue reading our full guide to discover hidden features, eligibility criteria, and insider tips to increase your approval chances — and apply for your Marbles Credit Card today.

MBNA Credit Card: Low Interest, High Rewards, Easy Approval <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover why the MBNA Credit Card remains one of the most competitive options for balance transfers, rewards, and smart money management </p>

MBNA Credit Card: Low Interest, High Rewards, Easy Approval <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover why the MBNA Credit Card remains one of the most competitive options for balance transfers, rewards, and smart money management </p>  MBNA Credit Card: Extra Benefits, Eligibility, FAQs & Approval Tips <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Everything you need to know about the MBNA Credit Card UK </p>

MBNA Credit Card: Extra Benefits, Eligibility, FAQs & Approval Tips <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Everything you need to know about the MBNA Credit Card UK </p>  Marbles Credit Card: Complete Guide with Extra Benefits, Eligibility, FAQs & Approval Tips <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> The essential guide to unlocking smarter credit management with the Marbles Credit Card </p>

Marbles Credit Card: Complete Guide with Extra Benefits, Eligibility, FAQs & Approval Tips <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> The essential guide to unlocking smarter credit management with the Marbles Credit Card </p>