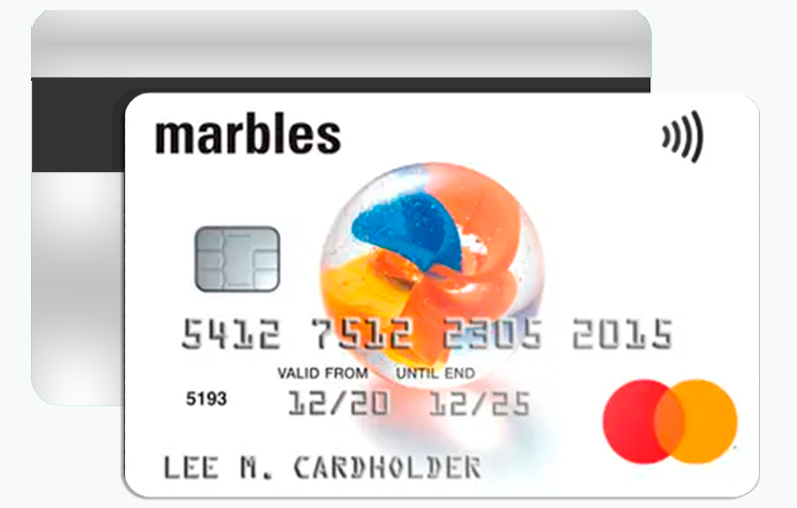

MARBLES MASTERCARD

INTELLIGENT CREDIT BUILDING TECHNOLOGY QUICK AND TRANSPARENT ELIGIBILITY CHECKThe Marbles Credit Card has earned a solid reputation among UK users looking to improve their credit score, manage spending, and access exclusive online tools for financial control. Issued by NewDay Ltd., Marbles isn’t just another credit product—it’s a gateway to responsible credit use backed by innovation, smart technology, and flexibility.

While many UK cards focus only on credit limits and APR, Marbles goes beyond, providing personalized insights, instant eligibility checks, and real-time spending analysis—features often overlooked on other websites or competitor cards. Whether you’re rebuilding credit or simply want a reliable everyday card, Marbles offers a digital-first experience built around accessibility and growth.

Top 3 Advantages of the Marbles Credit Card

1. Intelligent Credit Building Technology

Unlike traditional cards, Marbles integrates AI-based algorithms that track your payment behavior, providing personalized tips to boost your credit score faster. Users receive monthly “credit health” summaries that identify patterns—helping you stay on top of your progress and avoid costly mistakes.

2. Quick and Transparent Eligibility Check

The Marbles online eligibility checker provides a soft search tool that won’t affect your credit file. Within seconds, applicants can know their approval chances—reducing unnecessary credit inquiries and protecting your long-term financial profile.

3. Flexible Account Management via App

Through the Marbles mobile app, you can manage balances, set alerts, and lock or unlock your card instantly. The app’s smart budgeting assistant categorizes your spending into lifestyle segments—groceries, travel, and entertainment—helping you maintain financial discipline without extra effort.

2 Main Disadvantages to Consider

1. Higher Variable APR for New Users

As Marbles is designed for those with limited or fair credit histories, initial APR rates can be higher compared to premium cards. However, responsible usage and on-time payments can lead to credit limit reviews and better terms within months.

2. Limited Rewards or Cashback Options

The focus of the Marbles card is on credit improvement, not cashback or travel rewards. While some users may miss loyalty perks, the long-term gain in credit reliability often outweighs the lack of bonus incentives.

Ready to Learn More? Discover How to Apply for Your Marbles Card Today

If you’re looking for a credit card that supports growth, offers transparency, and delivers digital convenience, the Marbles Credit Card stands out in the UK market. Its user-friendly app, personalized tools, and quick application process make it ideal for anyone ready to build a stronger financial foundation.

Continue reading to explore the full application process, understand eligibility requirements, and uncover insider tips for maximizing your approval chances. Don’t wait—apply for your Marbles Credit Card today and take the first step toward better credit and smarter financial control.

PayPal Credit Card: The Smarter Way to Earn Rewards and Manage Your Spending <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the unique benefits, potential downsides, and insider insights about the PayPal Credit Card UK that most users don’t know </p>

PayPal Credit Card: The Smarter Way to Earn Rewards and Manage Your Spending <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the unique benefits, potential downsides, and insider insights about the PayPal Credit Card UK that most users don’t know </p>  How to Apply for the PayPal Credit Card: Full Guide & Approval Tips <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Everything you need to know before applying for the PayPal Credit Card UK </p>

How to Apply for the PayPal Credit Card: Full Guide & Approval Tips <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Everything you need to know before applying for the PayPal Credit Card UK </p>