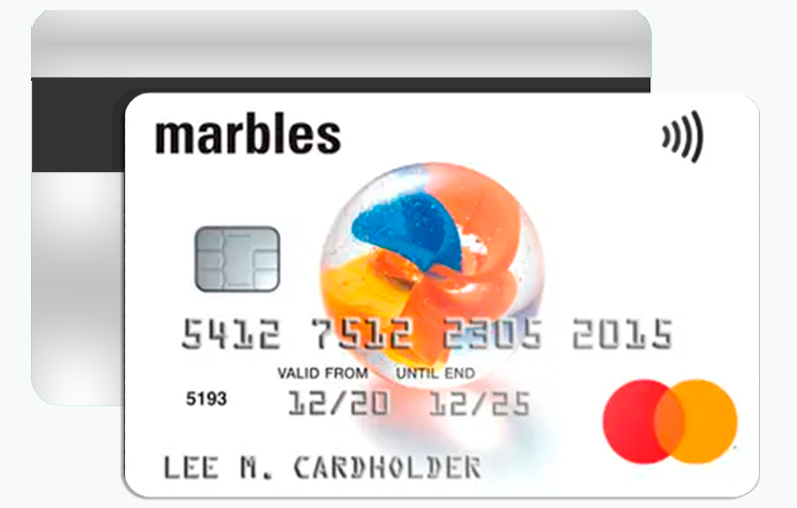

This card stands out in the market by focusing on essential features that aid users in managing their finances better without overwhelming them with unnecessary complexities. By combining practicality with user-friendly tools, the Marbles credit card is a great option for those looking for a no-nonsense approach to credit.

Key Features and Advantages

One of the primary advantages of the Marbles credit card is its straightforward application process, which allows potential users to quickly determine their eligibility online. The card typically offers a competitive interest rate, making it an appealing option for those looking to maintain a balance without incurring excessive charges. This flexibility is advantageous for individuals who may need to carry a balance from month to month due to unforeseen expenses.

Additionally, cardholders often benefit from access to exclusive discounts and offers from various retailers, enhancing the overall value of the card. These partnerships can range from cashback offers to limited-time promotions that encourage users to save while they spend. Such features make the Marbles credit card not only a useful financial tool but also an opportunity to save money on everyday purchases.

Financial Management Tools

A noteworthy aspect of the Marbles credit card is its commitment to helping users manage their finances effectively. The card comes equipped with various financial management tools, such as spending reports and budgeting calculators, which allow users to track their expenditures and set financial goals. This feature can be particularly beneficial for individuals aiming to improve their saving habits or reduce their overall debt.

The spending reports provide an insightful overview of where money is being spent, categorizing expenses into different areas like groceries, entertainment, and utilities. This categorization can help users identify areas where they may be overspending and adjust their habits accordingly. The budgeting calculator enables cardholders to set realistic budgets based on their income and spending patterns, fostering better financial discipline.

Reward Program Flexibility

While the Marbles credit card does not emphasize traditional reward points, it does provide some flexibility through cashback opportunities on certain purchases. This feature allows cardholders to earn a small percentage back on their spending, making it a practical choice for everyday expenses. Users can take advantage of these cashback offers without the pressure of complex reward systems that often come with other credit cards.

The cashback feature is particularly appealing to users who prefer tangible benefits from their spending rather than accumulating points that may take time to redeem. This straightforward approach ensures that users feel rewarded for their spending without the hassle of navigating complicated redemption processes.

Customer-Centric Approach

Marbles prioritizes customer satisfaction by providing an accessible and responsive support system. Users can easily reach out for assistance via various channels, including phone and online chat, ensuring that help is readily available whenever needed. This commitment to customer service sets Marbles apart from many other credit card providers, making it a reliable choice for consumers.

The customer support team is trained to handle a wide range of inquiries, from technical issues with the mobile app to questions about billing. This level of support not only enhances the user experience but also builds trust in the Marbles brand, encouraging long-term customer loyalty.

Security Features

In an age where online security is paramount, the Marbles credit card incorporates advanced security features to protect users against fraud and unauthorized transactions. Cardholders benefit from real-time alerts for transactions, enabling them to monitor their accounts actively. This proactive approach to security helps users feel more confident in their financial dealings.

Additionally, the card offers features like temporary card locking, allowing users to disable their card immediately if they suspect it has been lost or stolen. These security measures are crucial in today’s digital age, where identity theft and fraud are prevalent concerns.

Travel Benefits

For those who travel frequently, the Marbles credit card offers additional advantages. While international transaction fees may apply, the card’s competitive exchange rates can help minimize costs when making purchases abroad. Additionally, cardholders can enjoy the convenience of not needing to carry large amounts of cash, as the card is widely accepted in various countries.

Traveling with a credit card like Marbles can also provide peace of mind, as users can easily track their spending and manage their budgets while abroad. The ability to receive real-time notifications about transactions can also help travelers stay on top of their finances, ensuring they are aware of any unusual charges.

Applying for the Marbles Credit Card

Applying for the Marbles credit card is a straightforward process designed to be user-friendly. Prospective cardholders can begin by visiting the Marbles website and checking their eligibility online. The application requires basic personal information, including name, address, income details, and employment status.

Once the application is submitted, users typically receive a decision within minutes, which can lead to a quick and hassle-free onboarding experience. Approval is based on various factors, including credit history and financial stability, ensuring that the card is issued to those who can manage it responsibly.

Frequently Asked Questions (FAQs)

- What are the eligibility requirements for the Marbles credit card?

To apply for the Marbles credit card, applicants must be at least 18 years old, a resident of the UK, and have a stable income. A good credit score will also improve the chances of approval. - Are there any fees associated with the Marbles credit card?

While the Marbles credit card has competitive interest rates, there may be fees for late payments, cash withdrawals, and foreign transactions. It’s essential to review the terms and conditions before applying. - How can I manage my account?

Cardholders can manage their accounts through the Marbles mobile app or online banking platform. These tools provide access to transaction history, spending reports, and payment options, making it easy to stay on top of finances. - What should I do if I lose my card?

If your Marbles credit card is lost or stolen, you should immediately lock it through the mobile app or contact customer support to report it. This will help prevent unauthorized transactions. - Can I increase my credit limit?

Yes, Marbles may offer credit limit increases based on your spending habits and payment history. Users can also request a temporary limit increase for larger purchases. - Is cashback available on all purchases?

Cashback opportunities may vary depending on the purchase category. It’s advisable to check the terms regarding which transactions qualify for cashback.

The Marbles credit card is a fantastic option for those looking for a reliable and user-friendly financial tool. It emphasizes practical features, effective financial management, and strong customer support, enabling users to take control of their spending and achieve their financial goals. Ideal for daily purchases or travel, the Marbles card simplifies financial management. With its focus on simplicity and transparency, Marbles is a standout choice among credit cards.

Ready to take control of your finances? Apply for the Marbles credit card today!

Zopa Credit Card: Financial Management Upgrade <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Learn How the Zopa Credit Card Can Improve Your Financial Management and Provide Exclusive Benefits in Your Daily Life. </p>

Zopa Credit Card: Financial Management Upgrade <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Learn How the Zopa Credit Card Can Improve Your Financial Management and Provide Exclusive Benefits in Your Daily Life. </p>  Zopa Credit Card: Key Benefits & Features <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits and Features of the Zopa Credit Card to Improve Your Financial Management and Maximize Your Purchases. </p>

Zopa Credit Card: Key Benefits & Features <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits and Features of the Zopa Credit Card to Improve Your Financial Management and Maximize Your Purchases. </p>  Zilch Credit Card: Main Features, Tips, and How to Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how the Zilch Credit Card can transform your financial life with interest-free payments and exclusive benefits. </p>

Zilch Credit Card: Main Features, Tips, and How to Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how the Zilch Credit Card can transform your financial life with interest-free payments and exclusive benefits. </p>