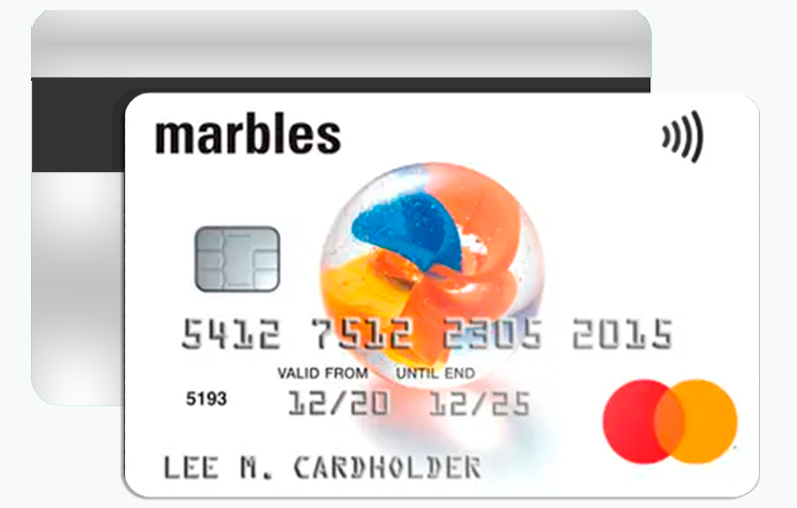

The Marbles Credit Card UK remains one of the top credit-building cards in 2025, thanks to its smart balance of accessibility, security, and innovation. Built to help individuals improve their credit rating, Marbles offers a transparent experience powered by NewDay’s technology. In this comprehensive guide, we’ll explore its additional perks, eligibility criteria, frequently asked questions, and expert-approved strategies to help you get accepted faster and use the card strategically for long-term financial growth.

More Hidden Benefits of the Marbles Credit Card UK

1. Real-Time Credit Score Monitoring

One of the lesser-known perks of the Marbles Credit Card is access to free credit score tracking through its partner credit reference tools. This helps users see the direct impact of their repayment habits and adjust behaviour in real time — a unique advantage that few credit-builder cards offer.

2. Instant Account Updates & Transaction Insights

Every transaction made with your Marbles Credit Card appears in the mobile app almost instantly. You can view spending categories, create custom budgets, and receive alerts for unusual activity. This level of transparency is perfect for users aiming to manage their financial habits proactively.

3. Flexible Payment Dates & No Annual Fee

Unlike many starter cards, the Marbles Credit Card allows users to choose their preferred payment due date, helping align repayments with salary schedules. Combined with no annual fees, it’s one of the most budget-friendly credit-building solutions available.

4. Contactless and Digital Wallet Integration

Marbles supports Apple Pay and Google Pay, giving users instant digital access without needing the physical card. This is particularly useful for those who want to make quick, secure payments while earning credit history from day one.

5. Educational Credit Tips Built into the App

The Marbles app doesn’t just track spending — it also delivers personalised financial tips. These in-app insights teach users how to manage balances, understand interest rates, and improve credit utilisation. It’s an educational ecosystem designed for long-term credit success.

Eligibility Requirements for the Marbles Credit Card

Before applying, it’s important to ensure you meet the Marbles Credit Card UK eligibility criteria. While Marbles is designed to be inclusive, meeting the basic requirements increases your chances of approval and can unlock higher starting limits.

- Age: Must be at least 18 years old.

- Residency: Must be a UK resident with a permanent address.

- Credit History: No recent defaults or bankruptcy within the last 12 months.

- Income: Regular, verifiable income (employment, self-employment, or benefits).

- Bank Account: A valid UK current account for direct debit setup.

💡 Pro Tip: Having stable employment and a low debt-to-income ratio (under 35%) can significantly enhance your approval odds for Marbles and increase your credit limit over time.

FAQ – Frequently Asked Questions About the Marbles Credit Card UK

1. Is the Marbles Credit Card good for beginners?

Yes. It’s designed specifically for people new to credit or looking to rebuild their score. It provides clear payment reminders, low initial limits, and the chance to grow responsibly over time.

2. How often can my credit limit be increased?

Marbles reviews accounts every 4–6 months. Responsible users who pay on time and stay within their limit may receive automatic credit limit increases without needing to reapply.

3. Does applying for the Marbles card affect my credit score?

Using the Marbles eligibility checker will not affect your credit score, as it uses a soft search. Only when you formally apply will a hard search appear on your report.

4. Can I use the card abroad?

Yes, the Marbles Credit Card can be used internationally wherever Visa is accepted. However, a small foreign transaction fee applies.

5. What happens if I miss a payment?

Missing a payment may result in late fees and a negative mark on your credit report. Setting up an automatic direct debit is the best way to avoid this.

Step-by-Step Guide: How to Apply for the Marbles Credit Card UK

- Step 1: Visit the Marbles website and click on “Check Your Eligibility.”

- Step 2: Complete the short questionnaire with your income, employment, and financial details.

- Step 3: Review your eligibility result. If pre-approved, proceed to the full application.

- Step 4: Confirm your identity using your photo ID and address verification documents.

- Step 5: Submit your application and wait for a quick decision — most applicants receive a response within minutes.

- Step 6: Once approved, activate your digital card instantly in the Marbles app and begin using it with Apple Pay or Google Pay.

📱 Tip: Always use the Marbles mobile app to manage payments and spending to ensure better financial control and credit growth.

Expert Tips to Increase Your Approval Chances

1. Lower Your Credit Utilisation Ratio

Keep your overall credit usage below 30%. This shows lenders that you’re managing your credit responsibly and improves your score faster.

2. Avoid Recent Credit Applications

If you’ve applied for several credit products in the past two months, wait before applying for Marbles. Too many applications in a short period can hurt your credit score.

3. Keep Your Financial Data Consistent

Ensure that your address, employment, and income details match those on your credit file. Inconsistencies can lead to delays or rejections.

4. Build a Relationship with NewDay

Using other NewDay-backed products, such as Aqua or Fluid, with good payment history can make approval for Marbles easier since it demonstrates reliability within the same issuer network.

5. Use the Eligibility Checker First

Always use Marbles’ free eligibility checker before submitting a full application. This tool helps you see your approval likelihood without impacting your credit score.

Final Thoughts: Why Marbles Is a Smart Choice for

The Marbles Credit Card UK stands out as one of the most strategic tools for anyone aiming to build or rebuild credit efficiently. With its powerful app, real-time alerts, and automatic reviews, it provides both flexibility and structure for responsible financial growth.

Whether you’re taking your first step into credit or recovering from past challenges, Marbles gives you control, education, and confidence to manage your finances like a pro. Combine that with consistent on-time payments and the smart approval tips shared above, and you’ll be on the path to stronger credit and better financial opportunities.

➡️ Ready to take control of your credit future? Apply for your Marbles Credit Card today and start building your financial freedom responsibly.

Zopa Credit Card: Financial Management Upgrade <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Learn How the Zopa Credit Card Can Improve Your Financial Management and Provide Exclusive Benefits in Your Daily Life. </p>

Zopa Credit Card: Financial Management Upgrade <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Learn How the Zopa Credit Card Can Improve Your Financial Management and Provide Exclusive Benefits in Your Daily Life. </p>  Zopa Credit Card: Key Benefits & Features <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits and Features of the Zopa Credit Card to Improve Your Financial Management and Maximize Your Purchases. </p>

Zopa Credit Card: Key Benefits & Features <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits and Features of the Zopa Credit Card to Improve Your Financial Management and Maximize Your Purchases. </p>  Zilch Credit Card: Main Features, Tips, and How to Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how the Zilch Credit Card can transform your financial life with interest-free payments and exclusive benefits. </p>

Zilch Credit Card: Main Features, Tips, and How to Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how the Zilch Credit Card can transform your financial life with interest-free payments and exclusive benefits. </p>