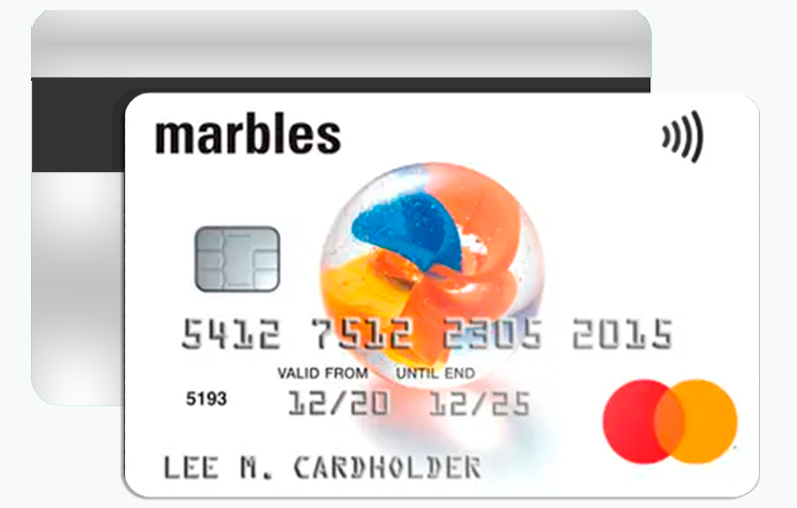

The Marbles Credit Card remains one of the most popular credit-building cards in the UK, but few people truly understand how to maximize its features and fast-track approval. While most websites only repeat the basics—APR rates, limits, and standard benefits—this in-depth guide reveals insider strategies, unique advantages, and approval factors often overlooked elsewhere.

Whether you’re working to rebuild your credit score, establish a financial footprint, or simply want a smart everyday spending tool, the Marbles card is designed for transparency and long-term growth. Below, you’ll find hidden perks, step-by-step application guidance, and expert tips to improve your chances of approval.

More Hidden Benefits of the Marbles Credit Card

1. Predictive Spending Insights

The Marbles mobile app doesn’t just display your balance — it uses predictive algorithms to estimate upcoming expenses based on your transaction history. This helps you plan ahead and avoid late payments, which can directly improve your credit score over time.

2. Early Payment Recognition System

Unlike many competitors, Marbles rewards punctual users. Making payments before the due date can trigger automatic credit line reviews every 4 months, allowing your credit limit to grow faster. This feature is rarely mentioned on official pages but can make a huge difference for those rebuilding credit.

3. Financial Wellness Dashboard

Beyond tracking spending, Marbles offers a Financial Wellness Score, combining credit utilization, payment behavior, and spending diversity. Users receive customized recommendations directly through the app to enhance their credit health month by month.

4. Contactless and Virtual Card Integration

Marbles provides instant virtual card access through its mobile app — meaning you can start using your card online or via digital wallets like Google Pay and Apple Pay even before the physical card arrives.

5. Advanced Fraud Protection

Using machine learning systems, Marbles detects suspicious activities in real time. Customers are immediately notified via push alerts, allowing instant card lock or verification within seconds — an extra layer of digital safety that few credit-building cards offer.

Eligibility Requirements to Apply for a Marbles Credit Card

Before applying, ensure you meet the minimum eligibility criteria. Marbles focuses on inclusivity, but certain requirements apply:

- Age Requirement: You must be at least 18 years old and a permanent UK resident.

- Credit History: Applicants with limited or fair credit are welcome, but serious defaults or recent bankruptcies may reduce approval odds.

- Income Verification: A minimum annual income of £10,000 is recommended. This includes salaries, pensions, or benefits.

- Address Consistency: You should have a stable UK address for at least 12 months. Address consistency improves verification speed.

- Valid ID and Bank Account: Proof of identity and a UK bank account are required for verification and payment setup.

These eligibility filters are automated, meaning the application algorithm analyses data instantly to determine creditworthiness before a final human review.

Frequently Asked Questions (FAQ)

Q1: Will applying for a Marbles Credit Card affect my credit score?

No, using the soft eligibility checker will not impact your score. A full credit check only happens once you formally apply and confirm your intent.

Q2: What is the typical credit limit for new Marbles cardholders?

New users usually start with £250 to £1,200, but regular, timely payments can result in limit increases every few months.

Q3: Is there a monthly or annual fee?

No annual fee applies to standard Marbles accounts, making it one of the most affordable options for credit-building users.

Q4: Can I manage everything digitally?

Yes. The Marbles app offers full control over payments, balance checks, spending insights, and customer support 24/7.

Q5: How fast can I start using the card?

Once approved, you’ll receive instant virtual card access within minutes to start using online or in mobile wallets.

Step-by-Step Guide to Apply for Your Marbles Credit Card

Step 1: Visit the Official Marbles Website

Go to the Marbles homepage and select “Check Your Eligibility.” This step performs a soft search without affecting your credit score.

Step 2: Complete the Online Form

Provide your name, address history, employment status, and annual income. Accuracy here is crucial — even small inconsistencies can trigger rejection.

Step 3: Review Pre-Approval Terms

If pre-approved, you’ll see your potential credit limit and APR rate. This transparency helps you decide whether to proceed before submitting a full application.

Step 4: Submit for Full Application Review

Once you confirm, a full credit check will be run. If successful, you’ll receive instant approval and your virtual card will be available immediately.

Step 5: Activate and Manage via the App

Download the Marbles app to set up automatic payments, alerts, and spending goals right away.

Expert Tips to Increase Your Approval Odds

1. Keep Your Credit Utilization Low

Try to use no more than 30% of your total available credit on existing accounts before applying. High utilization can signal financial stress to lenders.

2. Correct Errors on Your Credit Report

Check your credit file with Experian or Equifax before applying. Outdated or incorrect information can drastically lower your score and lead to automatic rejection.

3. Avoid Multiple Credit Applications

Submitting multiple credit applications within a short time frame can reduce your chances of approval. Wait at least 60 days between applications.

4. Use a Stable Income Source

Applicants with regular employment or consistent income (including pensions or verified benefits) are more likely to be approved.

5. Add a Mobile Number and Active Email Address

Having verifiable contact details linked to your credit file adds legitimacy and improves your approval likelihood.

6. Apply During Off-Peak Times

Few people know this, but credit systems are often less congested early in the week (Monday to Wednesday mornings), which can slightly speed up verification and reduce data queue errors during high-volume periods.

Final Thoughts

The Marbles Credit Card UK continues to stand out as one of the best solutions for individuals looking to rebuild or establish a healthy credit profile. With AI-driven tools, real-time financial insights, and a user-friendly digital platform, it delivers both practicality and innovation.

By understanding the eligibility requirements, following the step-by-step process, and applying the expert approval tips above, you can significantly boost your chances of getting approved — and start building a better financial future today.

PayPal Credit Card: The Smarter Way to Earn Rewards and Manage Your Spending <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the unique benefits, potential downsides, and insider insights about the PayPal Credit Card UK that most users don’t know </p>

PayPal Credit Card: The Smarter Way to Earn Rewards and Manage Your Spending <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the unique benefits, potential downsides, and insider insights about the PayPal Credit Card UK that most users don’t know </p>  How to Apply for the PayPal Credit Card: Full Guide & Approval Tips <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Everything you need to know before applying for the PayPal Credit Card UK </p>

How to Apply for the PayPal Credit Card: Full Guide & Approval Tips <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Everything you need to know before applying for the PayPal Credit Card UK </p>