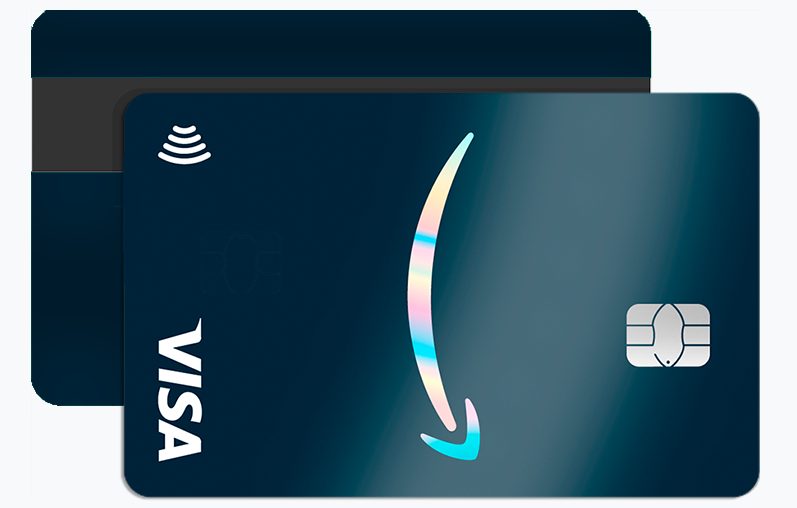

The Amazon Rewards UK Credit Card, powered by Barclaycard, offers more than simple cashback. This extended guide reveals additional perks, lesser-known conditions, and strategies to boost approval chances.

If you’re an active Amazon shopper or building your credit portfolio, this is your roadmap to using the card effectively.

More Positive Features Beyond the Basics

1. Exclusive Shopping & Event Offers

Cardholders occasionally gain access to exclusive event pre-sales, early Amazon Prime deals, and limited-time discount codes that amplify the value of the standard reward structure.

2. Instalment Flexibility for Larger Purchases

Eligible transactions can be split into interest-free instalments, transforming the card into a versatile finance tool for bigger purchases such as electronics or seasonal shopping.

3. Global Coverage and Built-In Protection

As a Visa card, it’s accepted worldwide and includes zero-liability fraud protection. For online buyers, that means extra peace of mind and strong dispute support.

4. Event-Based Cashback Boosts

During high-spending seasons, reward rates often increase temporarily for Prime members. Timing purchases strategically can multiply your effective cashback returns.

Eligibility & Pre-Requisites

Before applying, check these essential conditions:

- Age and Residency: Applicants must be UK residents aged 18 or older.

- Stable Address History: Ideally, two years at the same address improves approval odds.

- No Recent Barclaycard Ownership: You must not currently hold or have recently closed a Barclaycard within six months.

- Proof of Income: Applicants must demonstrate consistent income and affordability.

- Amazon Account Requirement: A valid Amazon.co.uk account is needed to redeem rewards.

Frequently Asked Questions (FAQ)

Q: How are rewards redeemed?

Rewards are issued in £5 increments and can be applied directly to your Amazon balance within hours.

Q: What is the introductory offer?

You’ll receive a £20 Amazon voucher and 0% APR for six months on new purchases.

Q: Are foreign purchases allowed?

Yes, but a 2.99% fee applies on non-sterling transactions.

Q: Can existing Barclaycard users apply?

No. Applicants must wait at least six months after closing a previous Barclaycard account.

Q: Does the card support mobile payments?

Currently, it does not support Apple Pay, though it’s compatible with some Android wallets.

Q: Is this card good for everyday spending?

It’s best optimized for Amazon purchases and as a complementary card to others offering higher general cashback.

How to Apply — Step-by-Step

- Check Eligibility: Use Barclaycard’s eligibility tool for a soft credit check.

- Start Application: Visit Amazon or Barclaycard’s credit card portal and click “Apply Now.”

- Fill Out the Form: Enter personal, financial, and address information.

- Verify Documents: Upload income or ID documents if requested.

- Wait for a Decision: Some are approved instantly; others take 1–3 business days.

- Activate Your Card: Once received, activate it via the Barclaycard app.

- Start Earning Rewards: Use it for Amazon purchases to start collecting vouchers immediately.

Tips to Boost Your Approval Odds

- Keep Credit Utilization Below 30% before applying.

- Avoid Multiple Applications within a short period.

- Pay Off Existing Balances to improve your credit ratio.

- Maintain Consistent Income and Address History for at least two years.

- Apply During Promotional Periods — issuers tend to approve more active shoppers during event campaigns.

- Use the Pre-Check Tool First to avoid unnecessary hard credit checks.

- Demonstrate Responsible Credit Use — recent positive payment history boosts your score.

- Highlight Amazon Loyalty — being an active Amazon Prime member often supports your case.

When managed correctly, the Amazon Rewards UK Credit Card can transform your regular Amazon shopping into a source of ongoing savings. Combine smart application timing, good credit habits, and awareness of the lesser-known rules, and you’ll unlock a financial tool that delivers genuine value without annual fees.

Capital One Credit Card UK: A Smarter Way to Build Credit and Manage Debt <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the key advantages, drawbacks, and how to apply for your Capital One card in the UK today </p>

Capital One Credit Card UK: A Smarter Way to Build Credit and Manage Debt <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the key advantages, drawbacks, and how to apply for your Capital One card in the UK today </p>  Capital One Credit Card UK – How to Qualify, Apply & Get Approved Fast <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> A full guide to unlocking the Capital One UK credit card — including exclusive tips, eligibility insights, and a step-by-step application tutorial </p>

Capital One Credit Card UK – How to Qualify, Apply & Get Approved Fast <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> A full guide to unlocking the Capital One UK credit card — including exclusive tips, eligibility insights, and a step-by-step application tutorial </p>