et’s be honest: getting approved for a car loan when your credit isn’t perfect can feel like running an obstacle course. That’s why lenders like Westlake Financial Services stand out—they offer more flexible financing options for everyday people, not just those with 750+ credit scores.

But what exactly does a Westlake Financial auto loan involve? Is it a good fit for your situation? And how do you improve your chances of approval without falling into hidden fees or high-interest traps? This guide breaks down everything you need to know, including some lesser-known tips most websites skip.

How a Westlake Financial Auto Loan Works

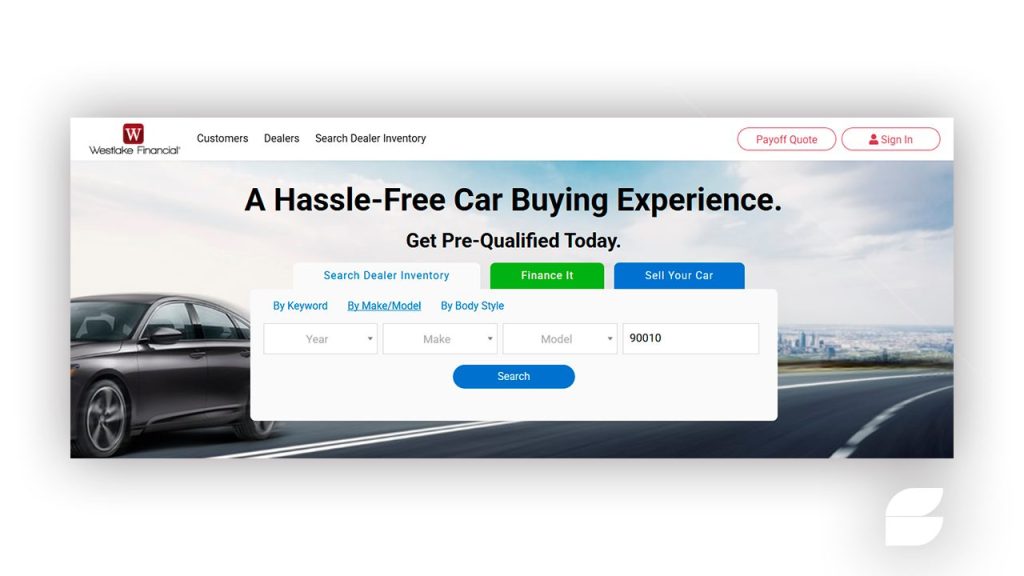

Unlike traditional lenders, Westlake Financial operates as an indirect auto lender—this means you don’t apply directly through them in most cases. Instead, they partner with over 20,000 dealerships across the U.S. to offer loan options at the point of sale.

Here’s how it works:

- You visit a participating dealership

- You choose your vehicle

- The dealership submits your application to Westlake (and possibly other lenders)

- If approved, your financing is handled through Westlake

- You make monthly payments directly to Westlake via app, website, or mail

They use advanced risk-based pricing, meaning your interest rate is tailored to your unique credit profile—so you’re not lumped into a “one-size-fits-all” offer.

Pre-Approval Requirements: Who Qualifies?

Westlake is known for its inclusive underwriting, making it one of the top auto loan options for bad credit or limited credit history. That said, there are still some key eligibility criteria:

- Minimum income: At least $1,500/month (verifiable through pay stubs, bank statements, or tax returns)

- Residency: Must be a U.S. citizen or permanent resident

- Valid driver’s license: No exceptions

- Vehicle eligibility: Must be purchased from a Westlake-partnered dealership; no private sales

- Down payment: Not always required, but offering one can improve your terms

- No active bankruptcies: Discharged bankruptcies may still qualify

💡 Hidden insight: Many borrowers don’t realize that Westlake doesn’t require a minimum credit score. They use a proprietary scoring model that factors in employment stability, DTI (debt-to-income), and even previous auto loan behavior—making them ideal for second-chance financing.

Is a Westlake Financial Loan Right for You? Here’s How to Decide

Before jumping in, consider these 3 important filters to know if this loan suits your financial profile:

- Your credit score is under 640

Traditional banks and credit unions might not approve you—or offer painful APRs. Westlake offers realistic interest rates based on your unique situation, not just your FICO score. - You’re buying through a dealership

Since Westlake doesn’t finance private party or online-only purchases, it’s ideal if you’re planning to visit a physical dealership. - You want payment flexibility

Westlake gives you access to online payment options, autopay, payment reminders, and a user-friendly app. Perfect for first-time buyers or budget-conscious consumers.

Step-by-Step: How to Apply for a Westlake Financial Auto Loan

You don’t need to walk in blind. Here’s the full process, with some strategic tips most people overlook:

Step 1: Check Your Budget & DTI

Use a car loan affordability calculator to determine your budget. Westlake typically prefers a debt-to-income ratio under 40%, so trim unnecessary debts beforehand.

Step 2: Get Prequalified (Soft Pull)

Visit the Westlake website or partner dealership’s site for a prequalification tool that doesn’t impact your credit score. This gives you a ballpark range of your potential loan terms.

Step 3: Gather Documents

You’ll need:

- Proof of income (2 most recent pay stubs or tax forms)

- Proof of residence (utility bill or lease)

- Government-issued ID

- Insurance information

- Trade-in title or loan details (if applicable)

Step 4: Visit a Westlake Partner Dealership

Let the dealer know upfront that you’re interested in financing with Westlake. They’ll submit the application on your behalf and return with offers.

Step 5: Review Terms Carefully

Westlake may offer several options—varying in term length, down payment, and APR. Don’t rush. Ask about dealer markups, which can inflate your rate unnecessarily.

Step 6: Finalize & Sign

Once you agree to the terms, sign the contract and drive away. You’ll start making monthly payments to Westlake directly. Their portal and mobile app make it easy to track your loan and stay current.

The Long-Term Benefits of Financing with Westlake

Aside from getting you on the road quickly, a Westlake loan can help you long-term if managed wisely:

- Credit Score Boost: Timely payments are reported to major credit bureaus, helping rebuild credit fast.

- Loan Refinance Opportunity: After 6–12 months of on-time payments, many borrowers refinance for better terms.

- Trade-In Leverage: Having a positive payment history increases your negotiation power when trading in or upgrading your vehicle.

💡 Insider Tip: Westlake offers a lesser-known Premier Program for customers with good payment history. This can open doors to lower future rates or special refinancing offers not publicly advertised.

Conclusion: Westlake Might Just Be the Auto Loan You Didn’t Know You Needed

Getting approved for a car loan shouldn’t feel like an uphill battle. Westlake Financial Services offers a rare combination of flexibility, accessibility, and digital convenience—especially for borrowers who’ve been turned down by traditional banks.

It’s not just about buying a car—it’s about building a stronger financial future, one payment at a time.

Top Auto Loans in the US: Why Westlake Financial is a Smart Choice <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Looking for a car loan that works with your credit score—and not against it? Here's what you need to know before signing the dotted line </p>

Top Auto Loans in the US: Why Westlake Financial is a Smart Choice <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Looking for a car loan that works with your credit score—and not against it? Here's what you need to know before signing the dotted line </p>  How Huntington Auto Loans Work: Complete Guide for Smart Borrowers <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> A complete, insider’s guide to Huntington auto loans — how they work, who qualifies, and the easy steps to get approved faster. </p>

How Huntington Auto Loans Work: Complete Guide for Smart Borrowers <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> A complete, insider’s guide to Huntington auto loans — how they work, who qualifies, and the easy steps to get approved faster. </p>