Choosing the right car is only half the equation — the way you finance it can impact your budget, credit score, and long-term financial health. While most buyers focus on dealerships or traditional banks, TD Auto Finance is a lender that offers a powerful combination of competitive rates, flexible approval options, and real customer service.

This guide gives you a clear, no-fluff breakdown of how TD Auto Finance works, what it takes to qualify, and whether it’s the right move based on your credit profile and car-buying goals.

What Makes TD Auto Finance Different from Other Lenders?

TD Auto Finance is a division of TD Bank, one of the top 10 banks in the U.S., and it specializes in indirect auto financing. That means instead of offering loans directly to consumers online, TD partners with thousands of dealerships to streamline the car buying and financing experience at the same time.

Here’s what sets them apart:

- Highly competitive auto loan rates, especially for borrowers with FICO scores over 660.

- Willingness to work with mid-tier credit profiles, particularly with stable income or co-signers.

- Partnership with a vast dealership network, meaning faster processing and negotiation power.

- Reputation for strong customer support, both during and after loan approval.

Unlike many online-only lenders, TD provides in-person dealership support, meaning you can finalize your loan and drive home the same day — without endless forms or calls.

TD Auto Finance Requirements: Who Can Qualify?

While TD Auto Finance is more flexible than some prime-only lenders, it still requires that borrowers meet several key criteria. Here’s what you’ll typically need:

1. Minimum Credit Score

- TD generally looks for a minimum FICO score of 620, though rates are significantly better at 660+.

- They do offer options for those with fair credit, especially if backed by solid income or a trade-in.

2. Stable Employment & Income

- You’ll typically need proof of steady employment or a reliable income stream (including freelance or self-employed income with documentation).

- Monthly income should generally exceed $1,800–$2,200 depending on loan size.

3. Debt-to-Income (DTI) Ratio

- A DTI under 45% is ideal. TD uses this metric to assess how comfortably you can take on a car loan.

4. U.S. Residency and ID

- Valid driver’s license, Social Security number, and proof of address (utility bills or lease agreements).

5. Vehicle Eligibility

- TD generally finances new and late-model used cars (up to 10 years old) sold through partner dealerships.

Beyond the Basics: Benefits Most Buyers Don’t Know

Most blog posts stop at the rates. But here are little-known TD Auto Finance advantages that could really matter to you:

- Rate matching with select dealerships: Some dealers will match or beat other lender offers through TD’s system.

- Deferred first payment: Depending on your credit and the promotion, you may qualify for 45–60 days before your first payment is due.

- Credit recovery options: If you’ve had a bankruptcy (discharged), TD may still approve your loan after a review — a rare policy among mainstream lenders.

- Soft pull pre-qualifications in some cases: Some dealerships working with TD can offer soft credit checks before submitting a full app.

Step-by-Step: How to Apply for a TD Auto Finance Loan

Here’s the simplified (but effective) process to go from planning to parked in the driveway:

1. Check Your Credit

Use free tools like Credit Karma or your bank to see your current score. This helps you predict your APR range and prepare any needed documents.

2. Visit a TD-Partnered Dealership

TD Auto Finance doesn’t offer direct-to-consumer applications — you’ll apply through the dealership when selecting your vehicle. Ask upfront: “Do you work with TD Auto Finance?”

3. Choose Your Car

Your loan terms will depend on the vehicle’s age, price, and mileage. TD typically offers better rates on new or certified pre-owned (CPO) cars.

4. Submit Your Application

The dealer submits your info (credit score, income, trade-in, etc.) directly to TD. You’ll often receive a decision within minutes.

5. Review Terms and Sign

Compare the APR, loan term, and monthly payment. If you have a trade-in or down payment, this will reduce your total financing amount.

6. Drive Away Same Day

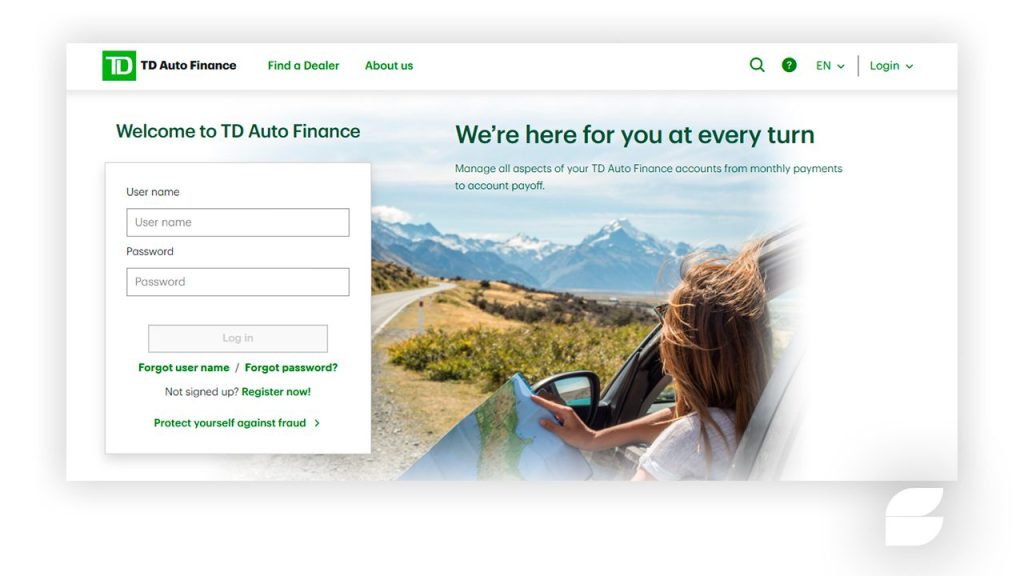

Once approved, you’ll sign the contract, and the dealer finalizes everything with TD. You can start your loan account management via TD’s online portal immediately after.

Conclusion: Is TD Auto Finance Worth It?

If you’re looking for a loan that balances strong rates, flexible credit requirements, and the convenience of applying through a dealership, TD Auto Finance should be high on your list.

It’s especially attractive if you want:

- A new or certified pre-owned vehicle

- To work with a lender that considers more than just your FICO

- Real-time support through local dealerships

- A seamless, same-day approval and drive-away experience

How Westlake Financial Auto Loans Work: Step-by-Step Guide to Qualify and Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the real inside scoop on Westlake Financial car loans—how they work, who they’re for, and what you need to get approved today </p>

How Westlake Financial Auto Loans Work: Step-by-Step Guide to Qualify and Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the real inside scoop on Westlake Financial car loans—how they work, who they’re for, and what you need to get approved today </p>  How Huntington Auto Loans Work: Complete Guide for Smart Borrowers <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> A complete, insider’s guide to Huntington auto loans — how they work, who qualifies, and the easy steps to get approved faster. </p>

How Huntington Auto Loans Work: Complete Guide for Smart Borrowers <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> A complete, insider’s guide to Huntington auto loans — how they work, who qualifies, and the easy steps to get approved faster. </p>  How SoFi Auto Loans Work – Step-by-Step Guide to Qualify <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Everything You Need to Know Before Applying for a SoFi Car Loan </p>

How SoFi Auto Loans Work – Step-by-Step Guide to Qualify <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Everything You Need to Know Before Applying for a SoFi Car Loan </p>