If you’re on the hunt for a car loan that’s flexible, accessible, and tailored to your credit situation, OneMain Financial might just be your best bet. In this detailed guide, we’ll break down exactly how OneMain Financial car loans work, the key requirements you need to know before applying, and a step-by-step walkthrough to get you started. Plus, you’ll learn insider tips and information that you won’t find easily elsewhere — perfect if you want to speed up approval and secure the best terms.

What Makes OneMain Financial Stand Out for Car Loans?

Unlike traditional banks or credit unions that can be strict with credit requirements, OneMain Financial specializes in personal and auto loans for people with a wide range of credit scores, including those considered subprime or rebuilding credit.

Here’s what makes their auto loans unique:

- Flexible Credit Criteria: OneMain often approves applicants with credit scores from the low 500s and up.

- Loan Amounts: Typically between $1,500 and $20,000, which covers everything from used cars to modest new car purchases.

- In-Person & Online Application Options: You can visit a branch or apply online, offering convenience and personal service.

- Fast Decisions & Funding: Loan approvals can happen within minutes, and funds may be available the same day.

- No Prepayment Penalties: If you want to pay off your loan early, OneMain won’t charge extra fees.

- Collateral Options: You can choose a secured loan using your vehicle or opt for unsecured financing, depending on your needs.

What Are the Basic Requirements to Apply?

While OneMain Financial is known for being flexible, there are still some essential prerequisites you must meet to qualify for their car loans:

- Age & Residency: You must be at least 18 years old and a US citizen or permanent resident.

- Proof of Income: Stable income is critical. They typically require proof of employment or other income sources, whether full-time, part-time, or even retirement income.

- Valid Identification: Government-issued ID such as a driver’s license or passport.

- Social Security Number: Required for credit checks and identity verification.

- Bank Account: You’ll need a checking or savings account to receive funds and make payments.

- Credit Profile: While OneMain is more forgiving than most lenders, your credit history will be reviewed. Having a credit score under 600 is possible but could lead to higher interest rates.

- Vehicle Information (if secured loan): For secured loans, details about the car you plan to buy or already own will be needed (make, model, year, VIN).

How to Know if OneMain Financial Is the Right Choice for You

Choosing the right car loan depends on your unique financial profile and goals. Consider these points:

- Credit Challenges? If your credit score is below average or you have past credit issues, OneMain’s acceptance of lower scores makes it a strong contender.

- Need Fast Approval? OneMain’s quick approval and funding process can get you behind the wheel faster than traditional banks.

- Prefer Personal Service? Unlike many purely online lenders, OneMain offers in-branch help nationwide—great if you want face-to-face guidance.

- Want Flexible Terms? Their loans often feature adjustable terms and no prepayment penalties, giving you financial flexibility.

- Looking to Rebuild Credit? On-time payments with OneMain are reported to credit bureaus, helping to repair or build credit over time.

- Loan Amount Fit? Their loan limits fit most used car purchases but may be restrictive if you’re buying a luxury or brand-new car with a very high price tag.

Step-by-Step Guide to Applying for a OneMain Financial Car Loan

Ready to take the plunge? Here’s how to get started with OneMain Financial:

Step 1: Check Your Eligibility

Before applying, verify you meet the basic requirements—age, income, residency—and have your documents ready (ID, proof of income, bank account info).

Step 2: Get Your Credit Score (Optional but Helpful)

Although OneMain approves a range of scores, knowing your current credit rating can help you anticipate loan terms and rates.

Step 3: Decide on Secured vs. Unsecured Loan

- Secured Loan: Use your car as collateral. This usually means lower interest rates and higher loan amounts.

- Unsecured Loan: No collateral needed, but expect higher rates.

Step 4: Gather Vehicle Information (if secured)

Have details like VIN, purchase price, and seller information handy if you already know the car you want.

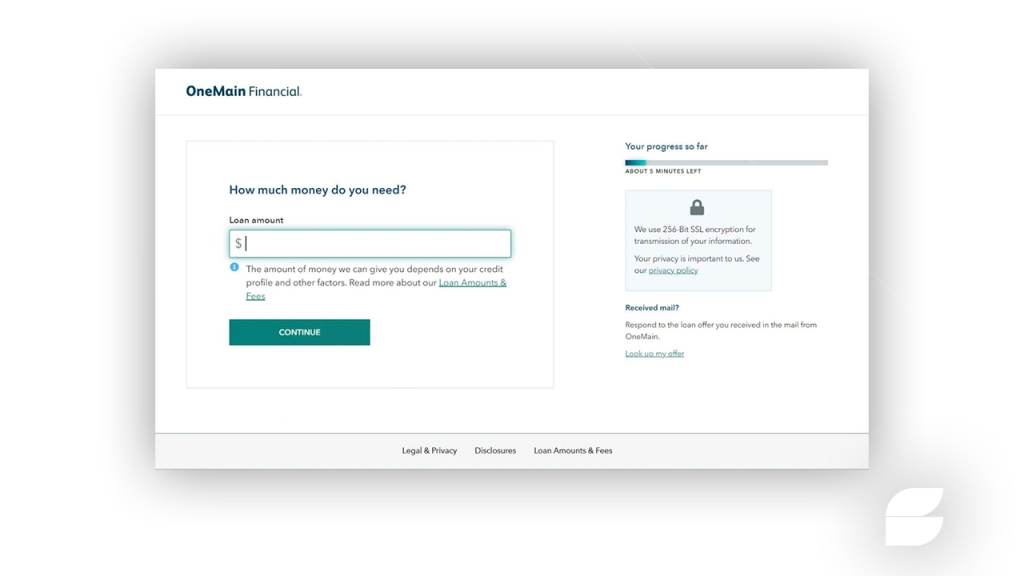

Step 5: Apply Online or Visit a Branch

You can fill out the application on OneMain’s website or walk into a local branch. The online form asks for personal info, income, and loan preferences.

Step 6: Wait for Approval

In many cases, approval is instant or takes just a few hours. OneMain will review your information and credit history.

Step 7: Review Your Loan Offer Carefully

Look at the interest rate, loan term, monthly payment, and any fees. Don’t hesitate to ask the representative questions or negotiate terms if possible.

Step 8: Accept the Loan and Receive Funds

Once you accept, funds are either sent directly to you or, in the case of a dealer purchase, directly to the seller.

Step 9: Make Payments On Time

Set up automatic payments or reminders to keep your loan in good standing and maximize positive credit impact.

Insider Tips You Won’t Find on Every Site

- Branch Visits Can Help: Talking to a loan officer in person can sometimes help negotiate better terms or get pre-approved faster.

- Use Pre-Qualification Tools: OneMain offers soft credit checks for pre-qualification, which won’t hurt your score.

- Debt-to-Income Ratio Matters: Even if your credit isn’t perfect, a healthy ratio (ideally under 40%) improves your approval chances.

- Consider a Co-Signer: If possible, adding a co-signer with stronger credit can reduce your interest rate and improve loan approval odds.

- Early Payoff Strategy: Since no prepayment penalties exist, paying off faster can save you money on interest without fees.

Is OneMain Financial the Right Auto Loan for You?

OneMain Financial stands out in the crowded US auto loan market by combining flexible approval criteria, quick funding, and personalized service. It’s an excellent choice for borrowers who face credit challenges, want fast access to funds, or appreciate having the option to work with a local branch.

If you value clear terms, the possibility of both secured and unsecured loans, and want to rebuild your credit responsibly, OneMain Financial could be the smart vehicle financing partner you’ve been searching for.

Top Auto Loans in the US: Why Westlake Financial is a Smart Choice <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Looking for a car loan that works with your credit score—and not against it? Here's what you need to know before signing the dotted line </p>

Top Auto Loans in the US: Why Westlake Financial is a Smart Choice <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Looking for a car loan that works with your credit score—and not against it? Here's what you need to know before signing the dotted line </p>  How Westlake Financial Auto Loans Work: Step-by-Step Guide to Qualify and Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the real inside scoop on Westlake Financial car loans—how they work, who they’re for, and what you need to get approved today </p>

How Westlake Financial Auto Loans Work: Step-by-Step Guide to Qualify and Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the real inside scoop on Westlake Financial car loans—how they work, who they’re for, and what you need to get approved today </p>