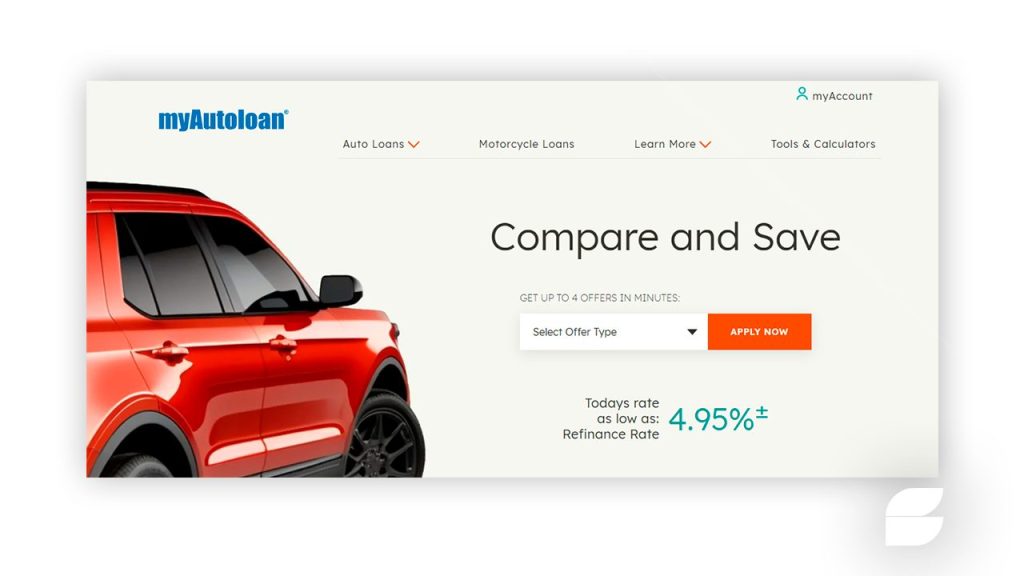

When it comes to financing a vehicle, finding a loan that fits your unique financial profile can be challenging. That’s where myAutoLoan via NPP enters the scene. This platform offers a tailored approach to car loans, making the process easier, faster, and more flexible for a wide range of buyers.

In this guide, you’ll get an in-depth look at how myAutoLoan via NPP operates, what requirements you need to meet, how to determine if this is the right loan for you, and a detailed step-by-step of the application process. Plus, you’ll learn lesser-known facts about the service that many other resources don’t cover.

How Does myAutoLoan via NPP Work?

Unlike traditional banks or direct lenders, myAutoLoan via NPP acts as a smart intermediary, connecting you to multiple lenders to find competitive financing options that suit your credit profile and vehicle choice. Their proprietary platform leverages data and technology to offer:

- Personalized loan offers based on your financial background.

- Access to multiple lending partners, increasing your chances of approval and better rates.

- A streamlined digital application that reduces paperwork and turnaround time.

- The ability to apply before selecting a car, giving you a clear budget upfront.

This multi-lender model means you’re not stuck with a single lender’s criteria or rates. Instead, myAutoLoan via NPP helps you navigate the market efficiently, whether you have excellent credit or are rebuilding your financial history.

What Are the Pre-Requisites to Apply?

Before diving into an application, it’s important to understand the minimum criteria to qualify for a loan through myAutoLoan via NPP:

1. Credit Score

- Typically, a minimum credit score of around 580 is needed. However, the platform’s wide lender network means even borrowers with fair or limited credit may find options.

- Scores above 650 usually unlock the best APRs.

2. Income Verification

- Proof of stable income is essential. This could be recent pay stubs, tax returns (for self-employed individuals), or bank statements.

- Lenders prefer applicants with consistent monthly income exceeding $1,500–$2,000, depending on loan amount.

3. Debt-to-Income Ratio (DTI)

- While exact thresholds vary by lender, aim for a DTI ratio below 45% to improve chances of favorable terms.

4. Residency and Identification

- You must be a U.S. resident with a valid driver’s license and Social Security number.

5. Vehicle Type

- Loans typically cover new or used cars, trucks, and SUVs, with most lenders favoring vehicles less than 10 years old.

Is myAutoLoan via NPP the Right Choice for You?

Deciding if myAutoLoan via NPP fits your needs comes down to matching their offering with your financial profile and buying goals.

Consider myAutoLoan via NPP if you:

- Want access to multiple lenders with one application to compare rates instantly.

- Have fair to good credit and want a better chance at approval.

- Prefer a digital-first experience with clear, upfront loan offers before shopping.

- Seek flexible loan terms tailored to your budget and credit.

- Appreciate expert support guiding you through financing options.

You might reconsider if you:

- Have excellent credit and prefer to negotiate directly with major banks.

- Want to finance vehicles older than 10 years or specialty cars.

- Need immediate funding without dealership involvement (some lenders require dealer sale).

Step-by-Step Guide: How to Apply for a myAutoLoan via NPP Car Loan

Applying is straightforward but being prepared helps you move faster and secure better terms.

Step 1: Gather Your Financial Documents

Collect recent pay stubs, tax returns (if self-employed), bank statements, valid ID, and proof of residence. Having these ready expedites verification.

Step 2: Check Your Credit Score

Review your credit report for inaccuracies using free tools like Credit Karma. Correct errors to boost your score before applying.

Step 3: Start Your Application Online

Visit the myAutoLoan via NPP website and fill out the digital application form with your personal and financial details. The platform uses a soft credit inquiry to pre-qualify you without hurting your score.

Step 4: Receive Personalized Loan Offers

Within minutes, you’ll see loan options from multiple lenders tailored to your credit and vehicle preferences. Take time to review APRs, loan terms, and monthly payments.

Step 5: Choose the Best Loan and Complete Formalities

Select the offer that best fits your budget and goals. You’ll then submit required documentation for final verification.

Step 6: Finalize the Loan with the Dealer

Most lenders require the vehicle to be purchased from a dealership partner. Coordinate with your dealer to complete the sale and loan closing.

Step 7: Manage Your Loan Online

After approval, use the myAutoLoan portal or lender-specific websites to make payments, track your balance, and manage your account.

Conclusion: Why myAutoLoan via NPP Could Be Your Smartest Financing Partner

By offering access to multiple lenders with one simple application, myAutoLoan via NPP empowers buyers with varied credit profiles to find better rates and terms than many traditional routes allow. Their user-friendly platform, combined with personalized offers and expert support, makes financing your next vehicle easier and less stressful.

If you’re looking for an auto loan solution that balances flexibility, competitive rates, and convenience — especially if your credit is less than perfect — myAutoLoan via NPP deserves a spot on your shortlist.

How Bank of America Auto Loans Work: Detailed Guide to Apply and Qualify <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Everything You Need to Know Before Applying for a Bank of America Auto Loan </p>

How Bank of America Auto Loans Work: Detailed Guide to Apply and Qualify <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Everything You Need to Know Before Applying for a Bank of America Auto Loan </p>  Complete Guide to State Farm Auto Loans: How They Work & Step-by-Step Application <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Your Guide to Affordable Auto Financing with Better Terms and Fewer Headaches </p>

Complete Guide to State Farm Auto Loans: How They Work & Step-by-Step Application <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Your Guide to Affordable Auto Financing with Better Terms and Fewer Headaches </p>  AutoPay Car Loan: Benefits, Requirements, and How to Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Everything you need to know about one of the top-rated auto loan solutions in the U.S. — and how to secure the best deal possible </p>

AutoPay Car Loan: Benefits, Requirements, and How to Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Everything you need to know about one of the top-rated auto loan solutions in the U.S. — and how to secure the best deal possible </p>