Looking for a competitive car loan with low rates and flexible terms? Digital Federal Credit Union (DCU) has emerged as one of the top choices for auto financing in the U.S., but how exactly does the DCU auto loan work? What are the specific requirements, and how can you tell if it’s the perfect fit for your budget and credit profile? This detailed guide dives into everything you need to know about the DCU car loan—from eligibility criteria to the step-by-step application process—with exclusive insights you won’t easily find elsewhere.

Understanding the DCU Auto Loan: What Makes It Unique?

DCU is a federally chartered credit union known for offering exceptionally low interest rates and member-focused service, making it a strong alternative to banks and dealership financing. Here’s what sets the DCU auto loan apart:

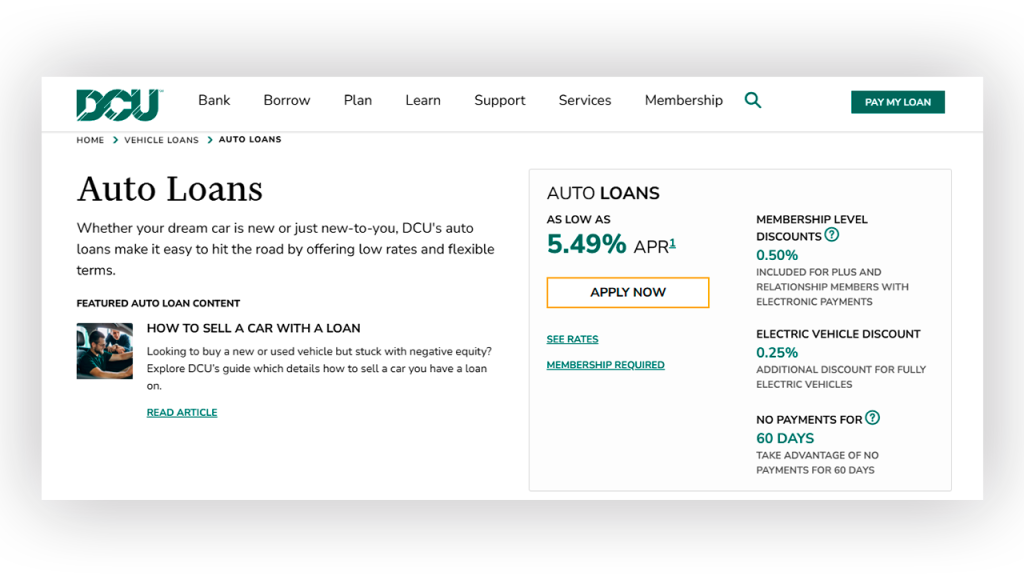

- Highly Competitive APR: DCU regularly offers rates below national averages, sometimes dipping as low as 1.99% APR for qualified buyers, which translates into big savings over a typical 5-year loan.

- Flexible Terms: Loan terms range from 12 to 84 months, letting you choose a monthly payment that fits your financial plan.

- No Application or Prepayment Penalties: You can apply without fees and pay off your loan early without extra costs—something many lenders don’t allow.

- Wide Vehicle Eligibility: New or used cars, motorcycles, RVs, and even refinancing existing auto loans with other lenders qualify.

- Exclusive Member Perks: Members get free credit score updates, budgeting tools, and personalized financial advice.

Who Can Apply? DCU Auto Loan Pre-Requisites and Membership Details

Unlike typical banks, DCU requires you to be a member before applying for any loan. But joining is often easier than you think. Here’s the breakdown:

Membership Eligibility

You must meet one of the following to join DCU:

- Live, work, worship, or attend school in select states (such as Massachusetts, Connecticut, New Hampshire, and a few others)

- Be employed by certain partner companies or organizations

- Have an immediate family member who is a current DCU member

- Donate $5 to a partnered charity (this opens membership to most U.S. residents)

Once you qualify, the membership cost is a one-time $5 deposit to open a savings account.

Loan Application Requirements

To apply for the DCU auto loan, you’ll need:

- Proof of DCU membership

- Valid government-issued ID

- Proof of income (pay stubs, tax returns, or bank statements)

- Vehicle details if purchasing (VIN, make, model, year)

- Proof of residence (utility bills or lease agreement)

- Social Security Number for credit check

How to Know If the DCU Auto Loan Is Right for You

Choosing the right loan depends on your unique financial situation and goals. Here’s how to assess if DCU’s auto loan fits your profile:

- You Have a Good to Excellent Credit Score (680+): While DCU accepts a range of credit scores, the best rates and terms go to those with solid credit history.

- You Want Low Fees and Transparent Terms: DCU prides itself on no hidden fees, no prepayment penalties, and clear loan disclosures.

- You Prefer Flexible Payment Terms: If you want options between short and long-term loans, DCU offers more flexibility than many lenders.

- You’re Buying or Refinancing a Vehicle: Whether it’s a new car or refinancing an existing loan, DCU covers a broad spectrum of auto loans.

- You’re Comfortable with Online and Phone Support: DCU has strong digital tools and customer service but doesn’t have physical branches nationwide, which may affect those who prefer in-person banking.

Step-by-Step Guide to Applying for a DCU Auto Loan

Here’s a detailed, insider look at the application process to help you get approved quickly and smoothly:

Step 1: Become a DCU Member

Visit DCU’s website and confirm your eligibility. Complete the $5 membership application online, which opens your savings account. This step unlocks all loan options.

Step 2: Check Your Credit Score with DCU Tools

Before applying, use DCU’s free credit score checker. This helps you know where you stand and avoid surprises during loan approval.

Step 3: Get Pre-Approved Online

Use DCU’s online pre-approval tool by entering basic info about yourself, your income, and the vehicle. This pre-approval process uses a soft credit inquiry, so your score won’t be impacted.

Step 4: Submit Required Documentation

Once pre-approved, upload or mail all necessary documents (proof of income, ID, vehicle info). Make sure everything is accurate to avoid delays.

Step 5: Receive Your Loan Offer

DCU will review your application and provide a detailed loan offer outlining your interest rate, monthly payment, and terms.

Step 6: Sign and Fund Your Loan

If you agree with the terms, electronically sign the loan documents. DCU will then fund the loan, often directly to the dealership or seller, streamlining your car purchase.

Step 7: Manage Your Loan Through DCU Online

Track payments, view statements, and make extra payments anytime via DCU’s secure online portal.

Insider Tips You Won’t Find on Most Sites

- DCU’s Membership Expansion Trick: If you don’t meet residency or employment criteria, a simple $5 charitable donation lets nearly anyone join, unlocking their loans.

- Use DCU’s Loan Calculator Creatively: Test multiple loan lengths and down payment scenarios to find your sweet spot without contacting a rep.

- Refinance Timing: Refinancing with DCU can save you significant interest, but only after you’ve made at least 6 months of payments on your current loan — this is often overlooked.

- Co-Signer Advantage: Adding a co-signer with stronger credit can drop your APR by up to 1% with DCU, a big deal on a $20,000 loan.

- Payoff Flexibility: DCU allows lump-sum payments anytime without penalty, helping you save on interest if your budget allows.

Is DCU Auto Loan the Smart Choice for Your Next Car?

If you’re after competitive rates, transparent terms, and flexible financing options, DCU stands out as a top contender in the crowded U.S. auto loan market. Their easy membership, no hidden fees, and excellent digital tools make the process accessible and smooth. While it’s best suited for those with decent credit and comfort using online banking, DCU’s unique perks and competitive APRs can save you significant money over the life of your loan.

Top Auto Loans in the US: Why Westlake Financial is a Smart Choice <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Looking for a car loan that works with your credit score—and not against it? Here's what you need to know before signing the dotted line </p>

Top Auto Loans in the US: Why Westlake Financial is a Smart Choice <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Looking for a car loan that works with your credit score—and not against it? Here's what you need to know before signing the dotted line </p>  How Westlake Financial Auto Loans Work: Step-by-Step Guide to Qualify and Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the real inside scoop on Westlake Financial car loans—how they work, who they’re for, and what you need to get approved today </p>

How Westlake Financial Auto Loans Work: Step-by-Step Guide to Qualify and Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the real inside scoop on Westlake Financial car loans—how they work, who they’re for, and what you need to get approved today </p>