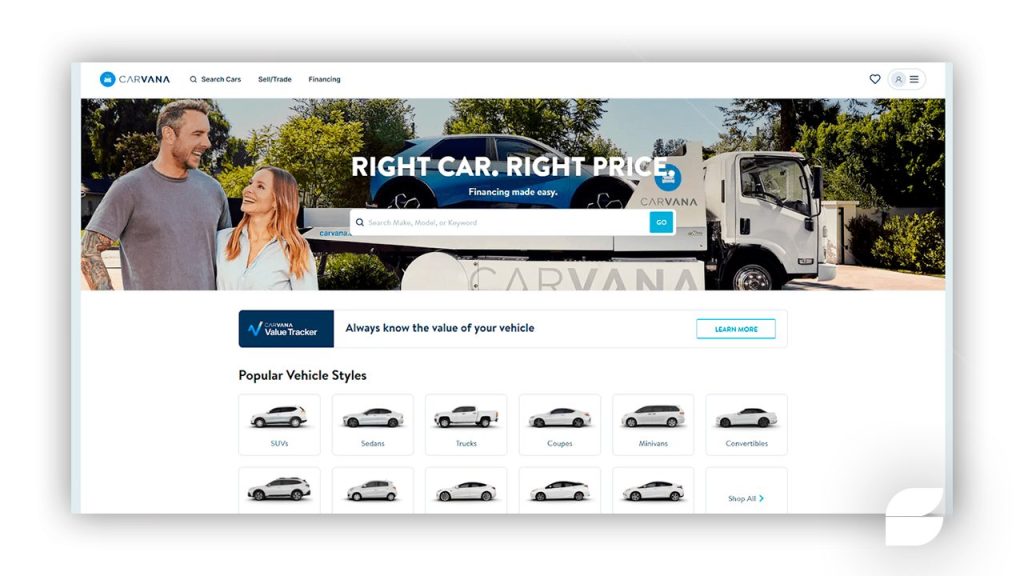

If you’re shopping for a car in 2025 and want to skip the dealership pressure, Carvana’s online financing might be exactly what you need. With a streamlined application process, no hidden fees, and terms built for real-life budgets, it’s quickly becoming a go-to solution — especially for buyers looking for low APR car loans or flexible financing even with less-than-perfect credit.

But how exactly does Carvana financing work? What do you need to qualify? And more importantly — is it really the right fit for your financial situation?

Let’s break it all down, with insights that go beyond what you’ll find on comparison sites.

How Carvana Financing Actually Works

Unlike traditional lenders, Carvana doesn’t just connect you to a loan — it owns the full process. That means:

- You browse used vehicles on Carvana’s platform

- You get prequalified (with no credit impact)

- You see real-time, personalized loan offers

- You choose your car and financing terms in the same platform

- You sign digitally and get the car delivered to your home (or pick it up at a vending machine)

It’s a frictionless experience from start to finish — something traditional banks and even most dealer-lender networks can’t fully replicate.

What’s different from bank loans?

With banks, you typically apply for a fixed loan amount before finding the car. With Carvana, the loan adapts to the car you choose — giving you more flexibility and visibility.

Who Qualifies for Carvana Financing?

Here’s where things get interesting. Carvana isn’t just for prime borrowers.

You may qualify for Carvana financing if you meet these general criteria:

- You’re at least 18 years old

- You have a minimum annual income of $4,000

- You don’t currently have an open bankruptcy

- Your credit score is not the only factor — Carvana evaluates your income, job stability, and existing debts too

Even buyers with credit scores in the 500s have reported approvals — especially when offering a down payment of 10% or more.

Bonus Insight: Carvana uses internal scoring algorithms based on data not always accessible to banks. That’s why people who are declined by traditional lenders are often approved by Carvana.

How to Know If It’s the Right Loan for You

Carvana financing isn’t for everyone. Here’s how to know if it fits your situation:

✅ Good Fit If You:

- Prefer shopping 100% online

- Want quick prequalification without a credit score hit

- Need flexible terms based on your real-world income

- Want to avoid dealing with multiple lenders or aggressive dealerships

🚫 Not Ideal If You:

- Want to buy a car from a private seller or another dealer

- Have access to a lower APR through your credit union

- Want to lease instead of finance

Pro Tip: Compare your Carvana loan offer with pre-approvals from Capital One Auto Navigator or LightStream. If Carvana’s total cost of financing is lower or comparable — it’s likely your best option, especially for convenience and transparency.

Step-by-Step: How to Apply for a Carvana Auto Loan

Ready to apply? Here’s exactly what to do:

Step 1: Get Prequalified Online

- Visit Carvana.com and click “Get Prequalified”

- Enter basic information: name, income, address

- No Social Security number or hard credit check needed at this stage

- Within 2 minutes, you’ll see loan offers with estimated terms

Step 2: Choose Your Car

- Filter results based on what your loan qualifies you for

- Use Carvana’s “Adjust Terms” tool to simulate different payments

- Add protection plans (optional) and see how they affect monthly cost

Step 3: Upload Verification Documents

- You’ll typically be asked for:

- Proof of income (pay stubs or bank statements)

- Proof of insurance

- Valid driver’s license

Step 4: Finalize the Loan

- Carvana runs a soft pull initially, but a hard inquiry will happen upon official application

- Once approved, e-sign your documents

- You can schedule delivery or pick-up — often within 48 to 72 hours

Conclusion: Is Carvana Financing Worth It?

For many car buyers, especially those seeking online auto financing with transparent terms, Carvana is one of the most seamless and competitive options available in 2025. It combines speed, accessibility, and smart credit evaluation in a way that traditional auto financing doesn’t.

That said, it’s always wise to compare offers. But if convenience, speed, and clarity are your top priorities — Carvana should definitely be on your list.

Top Auto Loans in the US: Why Westlake Financial is a Smart Choice <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Looking for a car loan that works with your credit score—and not against it? Here's what you need to know before signing the dotted line </p>

Top Auto Loans in the US: Why Westlake Financial is a Smart Choice <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Looking for a car loan that works with your credit score—and not against it? Here's what you need to know before signing the dotted line </p>  How Westlake Financial Auto Loans Work: Step-by-Step Guide to Qualify and Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the real inside scoop on Westlake Financial car loans—how they work, who they’re for, and what you need to get approved today </p>

How Westlake Financial Auto Loans Work: Step-by-Step Guide to Qualify and Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the real inside scoop on Westlake Financial car loans—how they work, who they’re for, and what you need to get approved today </p>