In today’s evolving financial landscape, the Upstart Personal Loan stands out for its innovative approach to lending. Unlike traditional loans that rely solely on credit scores, Upstart uses a sophisticated AI-driven model to assess borrowers, offering a more nuanced view of creditworthiness. This comprehensive guide provides an in-depth look at the Upstart Personal Loan, including its benefits, application requirements, and how to apply.

More Benefits of Upstart Personal Loan

Flexible Repayment Options

Upstart offers flexibility in repayment terms, allowing you to choose a plan that aligns with your financial situation. You can select a term that fits your budget, making your monthly payments manageable. Additionally, there are no prepayment penalties, meaning you can pay off your loan early without incurring extra costs. This flexibility helps you save on interest and manage your loan according to your financial plans.

No Hidden Fees

Transparency is a key feature of Upstart’s lending model. Unlike some traditional loans that come with hidden fees, Upstart provides clear information about any costs associated with your loan. This transparency helps you understand the total cost of borrowing, allowing you to make informed financial decisions.

Online Convenience

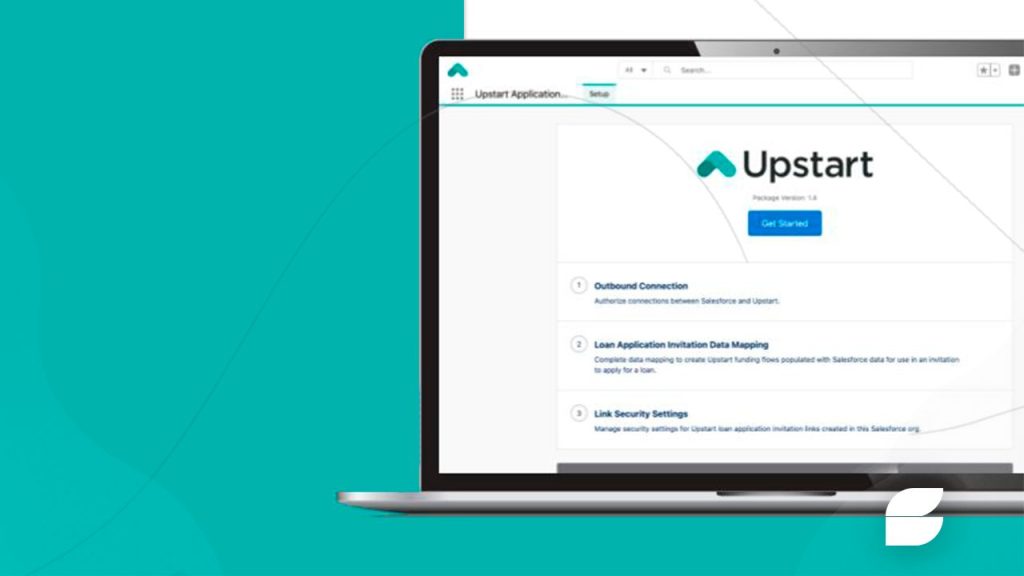

The entire application process for an Upstart Personal Loan is handled online, which means you can apply from the comfort of your home. This digital convenience streamlines the process, saving you time and effort compared to in-person applications. The online platform is user-friendly, making it easy to navigate and complete your application.

Prerequisites for Applying

- Credit Score

While Upstart considers a range of factors, having a minimum credit score is still important. Generally, a score of 600 or higher is recommended to increase your chances of approval. If your score is below this threshold, improving it before applying can enhance your eligibility. - Income Verification

You must provide proof of income to qualify for the loan. This could include recent pay stubs, bank statements, or tax returns. Upstart uses this information to assess your ability to repay the loan, so ensuring your documentation is accurate and up-to-date is crucial. - Employment Status

A stable employment history is another important factor in the application process. Upstart looks for evidence of steady income and employment, which indicates financial stability and reliability. - Age and Residency

You must be at least 18 years old and a U.S. citizen or permanent resident to apply for an Upstart Personal Loan. Additionally, you need to reside in a state where Upstart operates, so check the availability in your location before applying. - Debt-to-Income Ratio

Upstart evaluates your debt-to-income (DTI) ratio, which compares your monthly debt payments to your monthly income. A lower DTI ratio indicates that you have a manageable level of debt relative to your income, which is favorable in the loan approval process.

FAQ: Frequently Asked Questions

What can I use the Upstart Personal Loan for?

The Upstart Personal Loan can be used for various purposes, including consolidating high-interest debt, financing major purchases, paying for medical expenses, or covering unexpected costs. The flexibility of the loan allows you to use the funds in a way that best meets your financial needs.

How quickly will I receive my funds?

If approved, you could receive your funds as soon as the next business day. This quick turnaround is one of the key benefits of the Upstart Personal Loan, providing fast access to cash when you need it most.

Are there any prepayment penalties?

No, Upstart does not charge prepayment penalties. You can pay off your loan early without incurring additional fees, which can help you save on interest and reduce the total cost of your loan.

What is the maximum loan amount I can borrow?

Upstart offers personal loans ranging from $1,000 to $50,000, depending on your financial profile and creditworthiness. The exact amount you can borrow will be determined during the application process based on your specific financial situation.

How does Upstart determine my interest rate?

Your interest rate is determined based on a combination of factors, including your credit score, income, employment history, and other financial details. Upstart’s AI-driven model assesses these elements to provide a personalized rate that reflects your financial profile.

Step-by-Step Guide to Applying for the Upstart Personal Loan

- Check Your Eligibility

Before starting your application, review the basic eligibility requirements, including your credit score, income level, and residency. Ensuring you meet these criteria will help streamline the application process. - Gather Documentation

Prepare the necessary documents, such as proof of income (pay stubs, bank statements, or tax returns), identification, and any other relevant financial information. Having these documents ready will facilitate a smoother application process. - Complete the Online Application

Visit the Upstart website and fill out the online application form. Provide accurate information about your financial situation, including income, employment, and any existing debts. The application is user-friendly and designed to be completed quickly. - Submit Your Application

Once you’ve completed the application form and uploaded your documents, submit it for review. Upstart will process your application and provide a decision based on their AI-driven evaluation. - Review Your Loan Offer

If approved, you will receive a loan offer detailing the terms, including the loan amount, interest rate, and repayment schedule. Review this offer carefully to ensure it meets your needs and budget. - Accept the Offer

If you agree with the loan terms, accept the offer by signing the agreement. After acceptance, Upstart will disburse the funds to your account, often within one business day. - Manage Your Loan

Once you’ve received your funds, manage your loan by making regular payments according to the agreed-upon schedule. You can also use Upstart’s online platform to track your loan balance and make payments.

By following these steps, you can successfully apply for an Upstart Personal Loan and take advantage of its innovative approach to lending. Whether you need quick access to funds or a flexible repayment plan, Upstart provides a modern solution designed to meet your financial needs.

Apply for a personal loan with Eagle Financial: step-by-step <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how to have the necessary funds to buy an asset you've always dreamed of </p>

Apply for a personal loan with Eagle Financial: step-by-step <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how to have the necessary funds to buy an asset you've always dreamed of </p>  Top Home improvement loan options

Top Home improvement loan options  Discover Personal Loans: A Flexible Financial Solution <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits, Requirements, and Application Process </p>

Discover Personal Loans: A Flexible Financial Solution <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits, Requirements, and Application Process </p>