In today’s competitive business environment, having access to the right financial resources can make a significant difference in your company’s success. National Funding provides a range of business loan options designed to meet the diverse needs of small and medium-sized enterprises. This comprehensive guide will explore the key details, benefits, and requirements for National Funding Business Loans. We’ll also address frequently asked questions and walk you through the step-by-step process of applying for a loan to help you make informed decisions about financing your business.

More Details and Key Benefits

No Collateral Required

Unlike many traditional business loans that require collateral, National Funding offers unsecured loans that do not require you to put up valuable assets as security. This is a significant advantage for businesses that may not have substantial assets or prefer not to risk them. The ability to secure financing without collateral makes National Funding loans more accessible to a broader range of businesses, particularly smaller or newer companies.

High Approval Rates

National Funding is known for its high approval rates, even for businesses with less-than-perfect credit. While traditional banks often have stringent credit requirements, National Funding takes a more holistic approach, considering factors beyond just credit scores. This makes it easier for businesses that might not qualify for a bank loan to obtain the funding they need.

Personalized Customer Support

National Funding is known for its strong customer support, offering personalized assistance to help you navigate the loan process. Their team is available to answer questions, provide guidance, and offer solutions tailored to your business’s needs. This level of support ensures that you receive the help you need throughout the application process and beyond, enhancing your overall experience with National Funding.

Prerequisites for Applying for a National Funding Business Loan

- Business Operational History

To qualify for a National Funding Business Loan, your business should generally have been operational for at least 6 months. This requirement helps ensure that your business has a proven track record and stability to manage the loan effectively. - Revenue and Credit Score

National Funding considers both your business revenue and credit score when evaluating loan applications. Typically, businesses should have a minimum annual revenue of $100,000 to qualify. - Business Documentation

When applying for a loan, you’ll need to provide various documents, including business financial statements, bank statements, and tax returns. These documents help National Funding assess your business’s financial health and ability to repay the loan. - D. U.S. Business Operation

National Funding Business Loans are available to businesses operating within the United States. To be eligible, your business must be based in the U.S. and comply with local regulations and requirements.

Frequently Asked Questions (FAQ)

What Are the Typical Interest Rates for National Funding Loans?

Interest rates for National Funding Business Loans vary based on factors such as your credit profile and loan terms. Rates typically range from 7% to 35%. It’s important to review the rate offered and compare it with other financing options to ensure it aligns with your business’s financial strategy.

Can I Use a National Funding Loan for Any Business Purpose?

Yes, National Funding Business Loans can be used for a wide range of purposes, including working capital, equipment purchases, inventory, marketing, and expansion. The flexibility in usage allows you to apply the funds where they are most needed to support your business goals.

How Long Does It Take to Receive Funding?

Once approved, funds are usually disbursed within a few business days. National Funding’s fast processing times are designed to ensure that you receive the funds you need quickly, enabling you to address immediate financial needs or take advantage of new opportunities.

What Happens If I Miss a Payment?

If you miss a payment, contact National Funding’s customer service team immediately to discuss your options. They may offer solutions such as payment extensions or adjustments to help you manage your loan. It’s important to address any payment issues as soon as possible to avoid additional fees or negative impacts on your credit.

Are There Any Fees Associated with National Funding Loans?

National Funding may charge fees such as origination fees or processing fees, depending on the loan type and terms. Review the loan agreement carefully to understand any associated fees and how they will impact the overall cost of borrowing.

Step-by-Step Application Process

- Assess Your Business Needs

Determine the amount of funding you need and the purpose of the loan. This will help you select the most appropriate loan option and prepare for the application process. - Gather Required Documentation

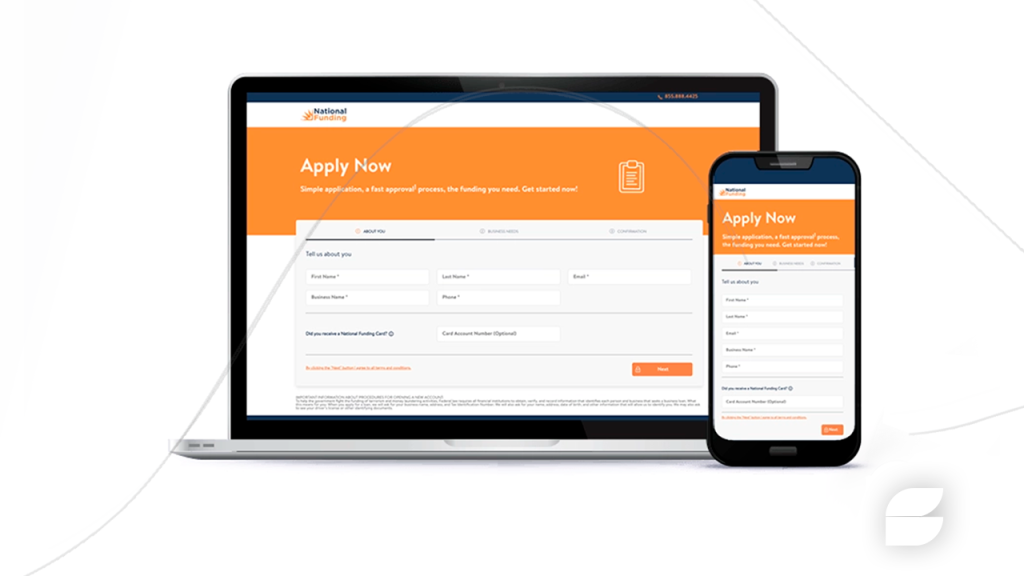

Collect necessary documents, including business financial statements, bank statements, and tax returns. Ensure that all documents are accurate and up-to-date to facilitate a smooth application process. - Complete the Online Application

Visit the National Funding website and fill out the online loan application form. Provide detailed information about your business, financial status, and loan requirements. - Submit and Review

Submit your application and review the loan offer once you receive it. Pay close attention to the terms, interest rates, and repayment schedule to ensure they meet your needs. - Accept the Loan Offer

If you agree with the loan terms, accept the offer electronically. National Funding will process your acceptance and prepare the funds for disbursement. - Receive and Manage Funds

Once approved, funds will be disbursed to your business account. Use the funds according to your plan and manage your loan payments according to the agreed-upon schedule.

Conclusion

National Funding Business Loans provide a valuable financing option for businesses seeking flexible terms, quick access to funds, and no prepayment penalties. By understanding the benefits, requirements, and application process, you can make an informed decision and secure the financial support needed to achieve your business goals. Apply for a National Funding Business Loan today and take the next step towards enhancing your business’s financial stability and growth.

Apply for a personal loan with Eagle Financial: step-by-step <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how to have the necessary funds to buy an asset you've always dreamed of </p>

Apply for a personal loan with Eagle Financial: step-by-step <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how to have the necessary funds to buy an asset you've always dreamed of </p>  Top Home improvement loan options

Top Home improvement loan options  Discover Personal Loans: A Flexible Financial Solution <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits, Requirements, and Application Process </p>

Discover Personal Loans: A Flexible Financial Solution <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits, Requirements, and Application Process </p>