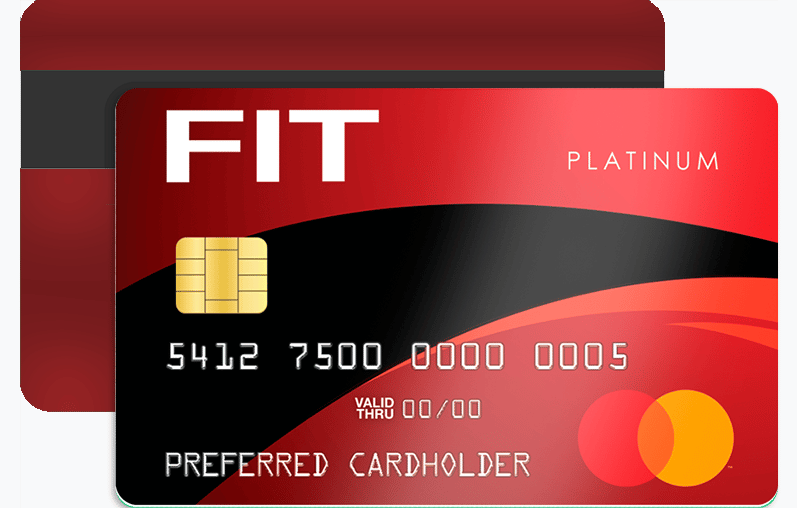

The Fit Mastercard Credit Card was designed for individuals ready to take control of their financial future. Whether you’re rebuilding your credit score or starting from scratch, this card offers a unique pathway toward progress. Unlike prepaid or secured cards, the Fit Mastercard provides an unsecured line of credit, making it an accessible option for users seeking flexibility without locking away cash as a deposit.

Beyond offering purchasing power, the Fit Mastercard helps users demonstrate creditworthiness through consistent, reportable activity. It’s more than just a card—it’s a system designed to help users prove financial responsibility and earn their way back into higher credit tiers.

More Benefits That Make the Fit Mastercard Worth Considering

1. Credit Limit Growth Opportunities

One of the most powerful features of the Fit Mastercard is its potential for automatic credit line increases. After six months of consistent, on-time payments, you can qualify for a higher limit. This increase not only boosts purchasing power but also helps lower your credit utilization ratio—a key factor in raising your overall credit score faster than many competitors.

2. Easy Approval with No Perfect Credit Needed

Fit Mastercard was built for inclusivity. Applicants with limited or poor credit history still stand a strong chance of approval, provided they meet basic financial requirements. The issuer uses a soft qualification model during pre-approval to minimize credit score impact—an advantage that’s rarely emphasized by other lenders.

3. Active Reporting to All Three Major Bureaus

Each month, Fit reports account activity to Experian, Equifax, and TransUnion. This ensures every responsible payment contributes directly to improving your credit record. Over time, these consistent updates can significantly influence your FICO® and VantageScore ratings.

4. Built-In Security and Fraud Protection

All transactions are protected under zero liability coverage from Mastercard. Users are safeguarded from unauthorized charges, providing peace of mind during online or in-store purchases. This feature is crucial for those re-entering the credit market after financial setbacks.

5. User-Friendly Online Tools and Budget Coaching

Few people know that Fit Mastercard provides access to interactive budgeting tools and personalized account insights through its online dashboard. These resources help cardholders manage expenses, track credit progress, and set monthly goals—all from a secure interface.

Eligibility Requirements: What You Need to Apply

Although the Fit Mastercard is known for its accessibility, there are certain qualifications to meet before applying. Meeting these ensures not only approval but also favorable terms.

- Minimum Age: Applicants must be at least 18 years old (or 21 in some states).

- Credit Score: Typically suited for users with a FICO® score between 560–670, but approval can occur with lower scores if other factors are strong.

- Income Verification: Must demonstrate reliable monthly income or employment to prove ability to make payments.

- U.S. Residency: Only available to U.S. citizens or permanent residents with a valid Social Security Number.

- Financial Stability: Applicants with limited recent delinquencies and manageable debt-to-income ratios have the best approval odds.

Frequently Asked Questions (FAQ)

1. Is the Fit Mastercard secured or unsecured?

The Fit Mastercard is an unsecured credit card, meaning no upfront deposit is required. This gives users immediate credit-building potential without locking away funds.

2. Does Fit Mastercard help increase credit scores?

Yes. Regular, on-time payments and responsible usage directly improve your credit profile, especially since Fit reports to all three major credit bureaus monthly.

3. Can I use my Fit Mastercard anywhere?

Absolutely. It’s accepted nationwide and globally wherever Mastercard is accepted, giving users flexibility for both everyday purchases and online transactions.

4. What happens if I miss a payment?

Missing a payment can result in a late fee and temporary limit restriction. However, consistent on-time payments afterward can help you quickly recover and rebuild positive reporting momentum.

5. Is there an app to manage the Fit Mastercard?

Yes. The Fit Mastercard’s online portal and mobile app allow users to check balances, make payments, and view their FICO® progress 24/7—all in real time.

Step-by-Step Guide: How to Apply for the Fit Mastercard Credit Card

- Pre-Qualify Online: Begin with the Fit Mastercard’s pre-qualification tool. This uses a soft inquiry that won’t affect your credit score.

- Complete the Application Form: Enter accurate details about your income, housing status, and employment.

- Review the Terms and Fees: Read through the annual fee, APR, and credit limit details to ensure alignment with your financial goals.

- Submit Your Application: Once submitted, most applicants receive a decision within 60 seconds.

- Activate and Start Building: Upon approval, activate your card online and start using it responsibly to begin rebuilding credit immediately.

Expert Tips to Boost Your Fit Mastercard Approval Chances

- Lower Existing Debt: Keep your credit utilization below 30% before applying to demonstrate financial responsibility.

- Stabilize Employment: Lenders value consistent income and job stability over short-term earnings spikes.

- Check for Errors: Review your credit report to dispute any inaccuracies before applying. Small corrections can improve your score quickly.

- Apply Strategically: Avoid submitting multiple credit applications within a short period. Too many hard inquiries can reduce your approval odds.

- Pay on Time—Always: After approval, even one late payment can slow your progress. Set up autopay or alerts to maintain perfect payment history.

Final Thoughts: Why the Fit Mastercard Is Worth It

The Fit Mastercard Credit Card stands out because it’s designed for people rebuilding—not punishing—their credit journey. Its unsecured design, consistent bureau reporting, and digital account tools empower users to restore trust with lenders and establish lasting financial stability.

By following the steps above and applying responsible practices, you can use the Fit Mastercard to transform your financial habits and open doors to stronger credit opportunities. Continue reading our next guide to learn advanced strategies for leveraging Fit’s credit reporting system to fast-track your score improvement and achieve lasting financial confidence.

Revvi Visa: Tarjeta para Recuperar Crédito con Aceptación Global <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Inclusión financiera para consumidores con crédito limitado, aceptación Visa, tarifas más altas y gestión digital </p>

Revvi Visa: Tarjeta para Recuperar Crédito con Aceptación Global <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Inclusión financiera para consumidores con crédito limitado, aceptación Visa, tarifas más altas y gestión digital </p>  Credit Card Revvi Visa — Visión general, aceptación y características principales <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Tarjeta accesible para la reconstrucción del crédito, amplia aceptación Visa, funcionalidades digitales y control financiero básico. </p>

Credit Card Revvi Visa — Visión general, aceptación y características principales <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Tarjeta accesible para la reconstrucción del crédito, amplia aceptación Visa, funcionalidades digitales y control financiero básico. </p>  Discover Card: <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover Card: </p>

Discover Card: <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover Card: </p>