When buying a car, choosing the right loan can save you thousands in interest and stress. BMO Harris Bank, a lesser-known but highly competitive lender in the auto financing space, offers flexible terms, competitive interest rates, and a customer-friendly process that makes car buying easier.

In this article, we’ll break down how BMO Harris Auto Loans function, what you need to qualify, whether it’s a good fit for your financial situation, and walk you through the step-by-step application process. We’ll also reveal insider details you rarely find on other sites.

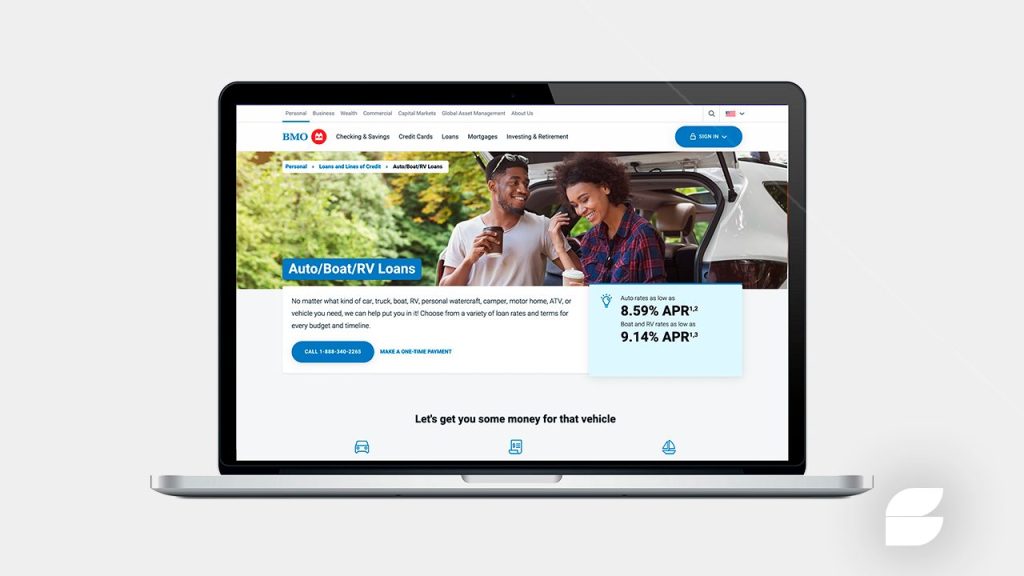

How Do BMO Harris Auto Loans Work?

BMO Harris provides both new and used car loans, catering to a broad range of buyers—from first-timers to credit-savvy shoppers looking for competitive rates. Here’s what makes them stand out:

- Competitive Interest Rates: BMO Harris offers fixed rates that tend to be below the national average, especially if you have good credit. Their rates can start as low as 3% APR for qualified borrowers.

- Flexible Loan Terms: Loan lengths range from 24 to 72 months, letting you balance your monthly payments against total interest paid.

- Prequalification Without Credit Impact: You can check your estimated rate via a soft credit inquiry—this lets you shop around without hurting your credit score.

- No Hidden Fees: BMO Harris emphasizes transparency, with no application or prepayment penalties.

- Quick Funding: Once approved, many borrowers get their funds within 1-3 business days, speeding up the car buying process.

Who Qualifies for a BMO Harris Auto Loan?

Knowing if you meet the eligibility criteria before applying saves time and boosts approval chances. Here’s what BMO Harris looks for:

- Credit Score: Generally, a credit score of 620 or higher improves your chances. Scores above 700 often unlock the best rates.

- Stable Income: Proof of steady income is required. Self-employed applicants may need to provide tax returns or bank statements.

- Debt-to-Income Ratio: Ideally below 40%, but BMO Harris considers other factors like payment history.

- Age and Residency: You must be at least 18 years old and a U.S. resident with a valid Social Security number.

- Vehicle Type: The loan covers cars, trucks, SUVs, and some motorcycles that meet BMO Harris’s model year and condition requirements.

Is BMO Harris Auto Loan the Right Choice for You?

Here are key factors to evaluate if this loan fits your profile:

- You Have Good to Excellent Credit: Borrowers with credit scores above 700 get the most benefit from BMO Harris’s low rates.

- You Want Transparent, No-Fee Financing: BMO Harris is a good fit if you want a straightforward process without surprises.

- You Prefer a Regional Bank with Local Support: If you value in-person banking or strong customer service, BMO Harris’s physical branches may be a plus.

- You’re Financing New or Used Vehicles: Their loan options are flexible across various vehicle types and ages.

- You Need Fast Funding: When timing matters, BMO Harris’s quick approval and funding can speed your purchase.

If you don’t fit these criteria exactly, consider getting prequalified first to understand your rate and terms risk-free.

Step-by-Step Guide to Applying for a BMO Harris Auto Loan

Here’s a detailed roadmap to get your BMO Harris Auto Loan approved smoothly:

1. Check Your Credit Score and Financial Health

Start by pulling your credit report from all three bureaus. Look for errors or outdated debts to fix before applying. Also, assess your income and monthly obligations to confirm affordability.

2. Get Prequalified Online

Visit the BMO Harris Auto Loans page and fill out the prequalification form. This uses a soft credit check to provide estimated rates without affecting your credit.

3. Gather Required Documents

Prepare:

- Proof of income (pay stubs, tax returns)

- Valid driver’s license or ID

- Proof of residence (utility bill, lease)

- Vehicle information (VIN, make, model, year) if you already chose a car

4. Submit Your Formal Application

Once prequalified, you can complete the full application online or at a local branch. Be ready to provide detailed info about yourself and the vehicle you want.

5. Wait for Approval

BMO Harris usually responds within 24-48 hours. During this time, they may contact you for clarifications or additional documents.

6. Review and Sign Your Loan Agreement

Carefully read the loan terms. If all looks good, sign electronically or in person.

7. Receive Funds and Buy Your Car

Funds are typically disbursed quickly to your dealership or your account, so you can finalize your vehicle purchase without delay.

Insider Tips You Won’t Find Easily Elsewhere

- Auto-Pay Discount: Enroll in automatic payments from a BMO Harris checking account to snag a lower interest rate.

- Flexible Early Payoff: No penalties for early repayment means you can save on interest if your financial situation improves.

- Refinance Options: If you start with a higher rate, BMO Harris allows refinancing down the line without new fees.

- Use Their Mobile App: Manage payments, check balances, and get alerts—all on the go, improving loan management and on-time payments.

Conclusion

If you’re looking for a transparent, competitive, and customer-friendly auto loan, BMO Harris stands out as an excellent option. Their flexible terms, low rates for qualified borrowers, and quick funding process can make your car buying experience less stressful and more affordable.

Make sure to check your credit, get prequalified, and follow the step-by-step application guide to boost your chances of approval. And remember—smart financing is not just about the lowest monthly payment but a loan that fits your overall financial health and goals.

Top Auto Loans in the US: Why Westlake Financial is a Smart Choice <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Looking for a car loan that works with your credit score—and not against it? Here's what you need to know before signing the dotted line </p>

Top Auto Loans in the US: Why Westlake Financial is a Smart Choice <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Looking for a car loan that works with your credit score—and not against it? Here's what you need to know before signing the dotted line </p>  How Westlake Financial Auto Loans Work: Step-by-Step Guide to Qualify and Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the real inside scoop on Westlake Financial car loans—how they work, who they’re for, and what you need to get approved today </p>

How Westlake Financial Auto Loans Work: Step-by-Step Guide to Qualify and Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the real inside scoop on Westlake Financial car loans—how they work, who they’re for, and what you need to get approved today </p>