When it comes to buying a car, getting the right financing can be as important as finding the perfect vehicle. Capital One Auto Finance has gained huge popularity in recent years, thanks to its flexible options, transparent process, and one of the most user-friendly pre-approval tools on the market.

But how exactly does a Capital One auto loan work? What do you need to qualify? And how do you know if it’s the best fit for your financial situation? This guide answers all that and more, giving you insider tips you won’t find easily elsewhere.

How Capital One Auto Loans Work

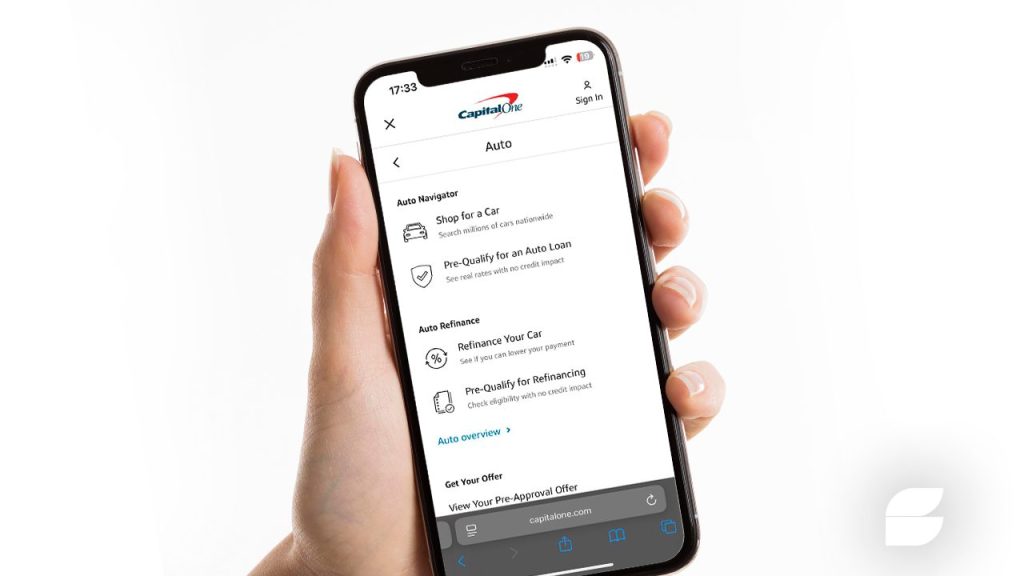

Capital One offers indirect auto loans, meaning you typically apply for financing through a dealership that partners with them. However, thanks to their powerful Auto Navigator platform, you can actually pre-qualify online without a hard credit inquiry, which means no damage to your credit score during rate shopping.

Here’s the typical process:

- Pre-qualify on Auto Navigator: Enter basic info to see personalized loan offers.

- Shop for your car: Capital One provides a list of dealers and cars that match your pre-approval.

- Finalize the loan at the dealership: Once you pick your car, the dealer submits your info to Capital One for formal approval.

- Sign paperwork and drive away: After approval, you complete financing documents and take your car home.

Capital One supports loans for new and used cars, lease buyouts, and even refinancing existing auto loans.

What Are the Eligibility Requirements?

Here’s what you generally need to qualify for a Capital One auto loan:

- Credit Score: While Capital One doesn’t disclose a minimum score, most approvals happen with scores above 600. Scores in the 600–700 range can still get competitive rates, especially with a solid income.

- Stable Income: Proof of consistent income to cover monthly payments.

- Debt-to-Income Ratio: Ideally below 40% to show you can manage new debt.

- Valid Driver’s License and Insurance: Required at loan closing.

- Down Payment: While not always mandatory, a down payment (usually 5–20%) can improve your chances and lower your rate.

💡 Pro tip: If your credit score is borderline, consider improving it for a few months before applying or use a co-signer to increase approval odds.

Is Capital One Auto Loan the Right Option for You?

Capital One’s loan works best if:

- You want to pre-qualify online without hurting your credit score.

- You prefer a streamlined digital process that makes shopping and financing easier.

- You’re buying through a partner dealership that accepts Capital One.

- You’re looking for flexible loan terms and competitive interest rates.

- You want transparent offers upfront to compare before you buy.

You might want to consider other options if:

- You’re buying privately and can’t finance through a dealer.

- You have very poor credit (below 580), as Capital One tends to focus on fair to good credit borrowers.

- You want an instant cash loan unrelated to a vehicle purchase.

Step-by-Step Guide: How to Apply for a Capital One Auto Loan

Step 1: Check Your Pre-Approval Online

Visit the Capital One Auto Navigator website and enter your basic financial info to get pre-qualified with a soft credit pull. This step lets you see estimated loan terms without affecting your credit score.

Step 2: Browse Cars That Fit Your Pre-Approved Budget

Auto Navigator also helps you search for cars at nearby dealers who accept Capital One financing, showing prices within your pre-approved amount.

Step 3: Visit the Dealer and Finalize Your Loan

Once you find the car you want, visit the dealership and let the finance team submit your official loan application to Capital One. You’ll need to provide documents like proof of income, ID, and insurance.

Step 4: Review and Sign the Loan Agreement

Capital One reviews your application (this time with a hard credit pull) and, if approved, sends a final offer. Review the terms carefully before signing.

Step 5: Drive Away with Confidence

After signing, the dealer handles paperwork and you take your new car home. Capital One’s online account lets you manage payments and track your loan status anytime.

Little-Known Tips to Boost Your Approval Odds With Capital One

- Improve your credit score beforehand: Pay down revolving debt and avoid new credit inquiries 3 months before applying.

- Make a decent down payment: Even 10% down can help reduce your APR.

- Shop within your pre-approval limits: Dealers are more likely to get your loan approved if you stay in the suggested price range.

- Keep documentation ready: Income verification, proof of residence, and insurance speed up approval.

- Ask about dealer incentives: Some Capital One partner dealers offer special APR promotions or cash rebates.

Conclusion: Why Capital One Auto Loans Could Be Your Best Car Financing Choice

With its innovative soft credit pull pre-approval, transparent loan offers, and extensive dealer network, Capital One makes car financing easier and less stressful than ever. For borrowers with fair to excellent credit looking for a smooth digital experience and competitive rates, Capital One should be at the top of your list.

If you want to avoid surprises, shop confidently within your budget, and enjoy flexible loan terms, applying through Capital One’s Auto Navigator is a smart move.

Top Auto Loans in the US: Why Westlake Financial is a Smart Choice <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Looking for a car loan that works with your credit score—and not against it? Here's what you need to know before signing the dotted line </p>

Top Auto Loans in the US: Why Westlake Financial is a Smart Choice <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Looking for a car loan that works with your credit score—and not against it? Here's what you need to know before signing the dotted line </p>  How Westlake Financial Auto Loans Work: Step-by-Step Guide to Qualify and Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the real inside scoop on Westlake Financial car loans—how they work, who they’re for, and what you need to get approved today </p>

How Westlake Financial Auto Loans Work: Step-by-Step Guide to Qualify and Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the real inside scoop on Westlake Financial car loans—how they work, who they’re for, and what you need to get approved today </p>