If you’ve ever spotted an unfamiliar or unauthorized charge on your credit card statement, you’re not alone. Canadians lose millions annually to unauthorized transactions, billing errors, and fraudulent charges. But here’s the good news: you can dispute them—and win.

In this detailed guide, we’ll walk you through how to contest a credit card charge in Canada in 2025. From initiating a chargeback to dealing with your bank and using legal protections, we’ll cover everything you need to know.

Quick Stat: In 2024, Canadian financial institutions processed over $25 million in successful chargeback claims.

What Is a Credit Card Chargeback?

A chargeback is the reversal of a credit card transaction. It allows you to dispute a charge and ask your issuer to reverse the payment. This is different from a refund, which comes directly from the merchant.

In Canada, chargebacks are governed by card network rules (Visa, Mastercard, Amex) and protected under federal financial consumer laws.

Valid Reasons to Dispute a Credit Card Charge

Here are some of the high-value reasons that can justify a chargeback:

- Unauthorized transactions (fraudulent use or stolen card)

- Billing errors (duplicate charges, incorrect amounts)

- Non-receipt of goods or services

- Defective or misrepresented products

- Subscription charges after cancellation

- Incorrect foreign transaction fees

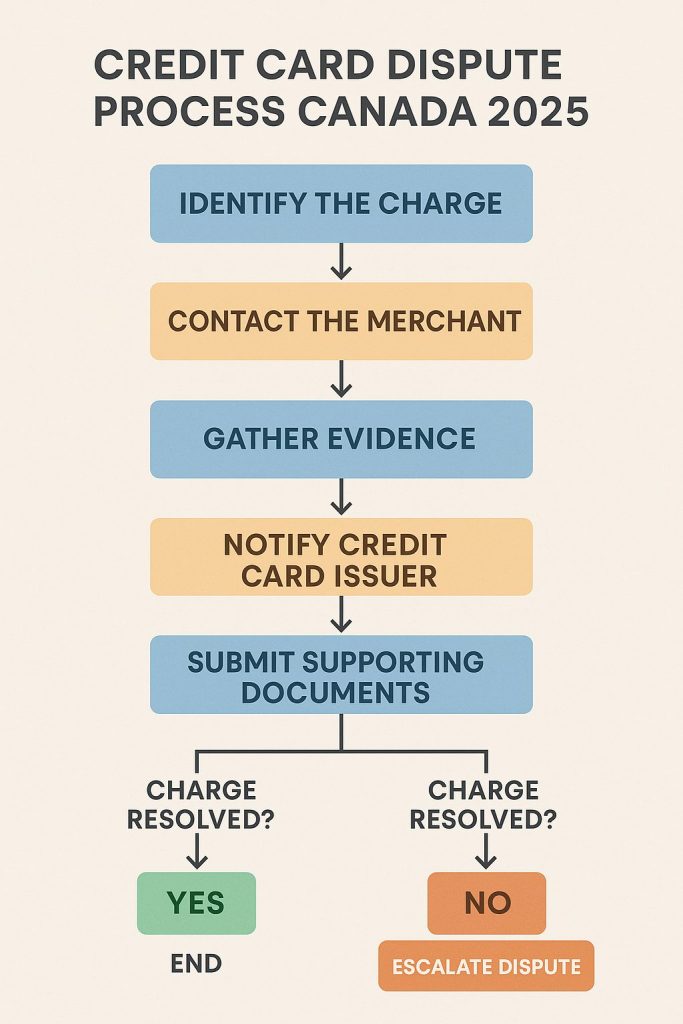

Step-by-Step: How to Contest a Credit Card Charge in Canada

? Step 1: Identify the Charge

Before you panic, verify the merchant name. Many appear differently on your statement (e.g., “1337 Tech Billing” instead of “Spotify”).

? Step 2: Contact the Merchant First

Reach out to the business directly. Most reputable companies will resolve billing errors or refund unauthorized charges quickly to avoid chargeback penalties.

? Step 3: Gather Evidence

Prepare documentation:

- Screenshot of your statement

- Email or chat logs with the merchant

- Receipts or order confirmation

- Photos of damaged or incorrect goods

? Step 4: Notify Your Credit Card Issuer

Contact your bank’s credit card division (e.g., RBC, TD, Scotiabank). This can usually be done via:

- Online banking portal

- Mobile app

- Phone

Request a formal dispute or chargeback. Note the reference number.

? Step 5: Submit Supporting Documents

Your issuer will often ask for:

- A signed dispute form

- All supporting evidence

Make sure everything is submitted before the deadline (more on that below).

⏳ Step 6: Monitor Progress

It can take 30–90 days to resolve, depending on the issuer and merchant’s response. In most cases, your issuer will issue a provisional credit during the investigation.

Insider Tips Most Websites Don’t Tell You

Here’s where we give you what other guides don’t:

- Include timestamps: Screenshots with visible timestamps are viewed as stronger evidence.

- Use the “non-receipt” angle: Even digital services (like online courses or software) can qualify if delivery wasn’t properly verified.

- Cite Canadian Law: Under Canada’s Code of Conduct for the Credit and Debit Card Industry, banks are required to provide dispute resolution services.

- Mention “Fair Billing Practices”: It shows you know your rights—many agents are trained to fast-track such requests.

How Long Do You Have to File a Dispute?

Each card network has slightly different windows, but here’s a safe guide:

| Card Network | Chargeback Deadline |

|---|---|

| Visa | 120 days |

| Mastercard | 60–120 days |

| Amex | 120 days |

| Discover | 60 days |

Pro Tip: Always file your dispute within 30–45 days to stay ahead of processing delays.

What If the Credit Card Company Denies Your Claim?

If your dispute is rejected, don’t give up. You have options:

- Request escalation to a supervisor or senior dispute officer.

- File a complaint with Ombudsman for Banking Services and Investments (OBSI).

- Contact the Financial Consumer Agency of Canada (FCAC) for regulatory support.

Some persistent consumers also have success by:

- Filing small claims court action

- Writing a public complaint on social media tagging the bank

Dispute Process Simplified

Final Thoughts: Know Your Financial Power

Contesting a credit card charge in Canada doesn’t need to be intimidating. By knowing your rights and following the correct steps, you can recover your money and protect yourself from future billing issues.

Always be proactive. Scan your statements monthly, report unauthorized charges quickly, and remember—your financial institutions work for you, not the other way around.

Scotiabank Scene+ Visa: A Smart No-Fee Rewards Card for Everyday Canadians <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> A practical, no-annual-fee rewards card that turns daily grocery trips and Cineplex nights into points you can spend for statement credits, Home Hardware discounts and more </p>

Scotiabank Scene+ Visa: A Smart No-Fee Rewards Card for Everyday Canadians <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> A practical, no-annual-fee rewards card that turns daily grocery trips and Cineplex nights into points you can spend for statement credits, Home Hardware discounts and more </p>