When shopping for an auto loan, you might immediately think of banks or dealership financing. However, credit unions like GEICO Credit Union offer competitive and member-focused auto loans that often save borrowers money and hassle. If you’re considering financing your next vehicle, understanding how GEICO’s auto loan program works can help you make a confident, informed choice.

This comprehensive guide walks you through how GEICO Credit Union auto loans operate, what qualifications you’ll need, how to determine if this option suits your financial situation, and a detailed, step-by-step walkthrough for applying. Along the way, you’ll find unique insights that many lenders don’t openly share, helping you avoid pitfalls and get the best deal possible.

How GEICO Credit Union Auto Loans Work

GEICO Credit Union auto loans combine the best features of traditional credit unions with modern lending technology. They offer:

- Competitive Interest Rates: Thanks to their nonprofit structure, GEICO Credit Union often offers lower APRs compared to banks or dealer financing, especially for borrowers with solid credit profiles.

- Flexible Loan Terms: Loan durations range from 24 to 84 months, giving you the freedom to balance monthly payments and total interest paid.

- Membership-Based Lending: To apply, you must be a member, which typically requires an affiliation with GEICO or partner organizations. This exclusivity helps the credit union maintain lower operating costs and pass savings to members.

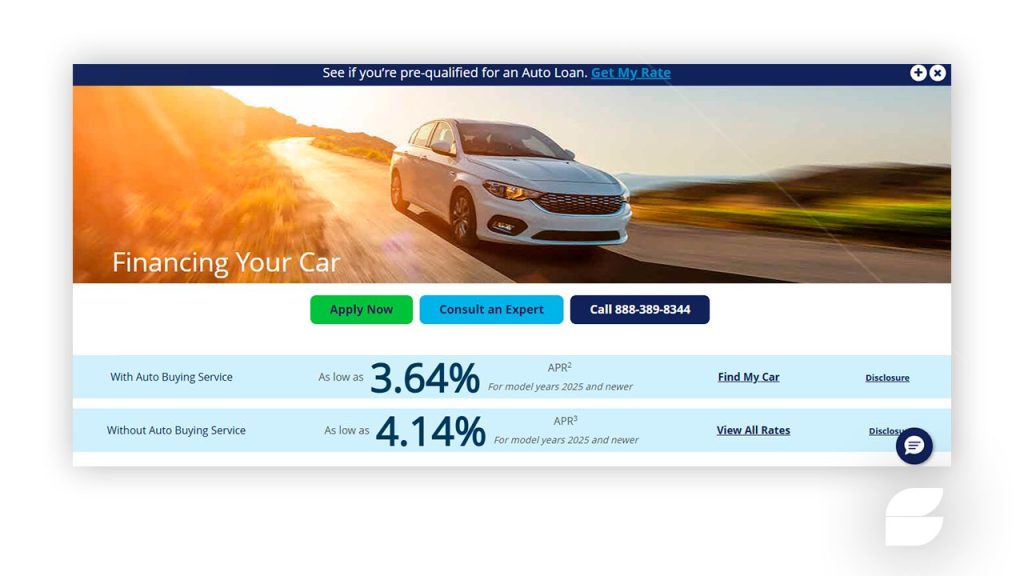

- Easy Online Pre-Qualification: You can check your eligibility and potential loan terms without impacting your credit score through their pre-approval tool.

- No Penalties for Early Payoff: Pay off your loan faster without extra fees, which isn’t always standard at other lenders.

Unlike some lenders who focus solely on credit scores, GEICO Credit Union evaluates your overall financial health, including income stability, debt levels, and payment history.

What Are the Key Requirements to Qualify?

While credit unions are generally more flexible, GEICO Credit Union does maintain certain standards to ensure responsible lending. Here’s what you need:

- Membership Eligibility: You must qualify for membership, which usually involves having GEICO insurance or membership through affiliated groups. Opening an account with a small deposit is typically required.

- Minimum Credit Score: There’s no public minimum, but most approved borrowers have scores above 620. Applicants with scores between 580-620 may still qualify, but likely at higher rates.

- Stable Income Proof: Provide recent pay stubs, tax returns, or bank statements showing consistent income to demonstrate your ability to repay.

- Debt-to-Income Ratio (DTI): Aim for a DTI below 40-45%. This ratio compares your monthly debt obligations to your income and signals your repayment capacity.

- Valid U.S. Residency: You need a verifiable U.S. address and valid government-issued ID.

- Down Payment: While GEICO Credit Union supports zero-down loans, putting at least 5-10% down often improves your chances and lowers your APR.

Keep in mind, their lending philosophy is holistic — so even if one area is weaker, strengths elsewhere might tip the scales in your favor.

How to Know if GEICO Credit Union Auto Loan Is Right for Your Profile

Before applying, ask yourself these questions to gauge fit:

- Are you a GEICO customer or affiliated with a partner organization? This is essential for membership and loan eligibility.

- Do you want low-interest rates and flexible terms? GEICO Credit Union typically beats dealership financing and many banks on pricing.

- Are you comfortable with a credit union membership model? Unlike banks, credit unions are member-owned and operate with a community-first mindset.

- Do you prefer online pre-qualification without affecting your credit? Their streamlined pre-approval tool is a huge plus.

- Are you financially stable but looking to improve credit? GEICO Credit Union’s comprehensive underwriting may help those with fair credit who meet income and debt criteria.

If you want a transparent process with potential for better savings, GEICO Credit Union is worth exploring.

Step-by-Step Guide to Applying for a GEICO Credit Union Auto Loan

Step 1: Confirm Your Eligibility and Join the Credit Union

Visit the GEICO Credit Union website to check if you qualify for membership. If yes, open your member account, usually with a small deposit ($5-$25).

Step 2: Use the Pre-Qualification Tool

Submit basic financial info to get estimated loan rates and terms with no hard credit pull. This step helps you shop with confidence.

Step 3: Shop for Your Vehicle Within Your Pre-Qualified Budget

Focus on cars you can afford based on your pre-approval — this avoids surprises or declined final applications.

Step 4: Complete the Full Loan Application

Provide detailed personal, employment, and financial data. This triggers a hard credit inquiry and official underwriting.

Step 5: Submit Required Documents

Upload pay stubs, proof of residence, government ID, and any co-borrower info if applicable.

Step 6: Review Your Loan Offer

GEICO Credit Union will send you official loan documents with interest rate, term, monthly payment, and fees.

Step 7: Accept, Sign Electronically, and Finalize

Sign your loan contract digitally or in person, then arrange vehicle purchase or refinance.

Step 8: Manage Your Loan Responsibly

Set up autopay to enjoy rate discounts and avoid late fees, which will help boost your credit score over time.

Conclusion: A Member-First Auto Loan That Can Save You Money

GEICO Credit Union auto loans provide a competitive, member-oriented alternative to traditional car financing. Their blend of affordable rates, flexible terms, and easy pre-qualification helps many borrowers get the car they want — without paying dealer premiums or dealing with rigid bank processes.

If you qualify for membership and seek a transparent, straightforward way to finance your vehicle, GEICO Credit Union deserves serious consideration. Plus, their commitment to early payoff options and autopay discounts adds value rarely found elsewhere.

Top Auto Loans in the US: Why Westlake Financial is a Smart Choice <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Looking for a car loan that works with your credit score—and not against it? Here's what you need to know before signing the dotted line </p>

Top Auto Loans in the US: Why Westlake Financial is a Smart Choice <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Looking for a car loan that works with your credit score—and not against it? Here's what you need to know before signing the dotted line </p>  How Westlake Financial Auto Loans Work: Step-by-Step Guide to Qualify and Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the real inside scoop on Westlake Financial car loans—how they work, who they’re for, and what you need to get approved today </p>

How Westlake Financial Auto Loans Work: Step-by-Step Guide to Qualify and Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover the real inside scoop on Westlake Financial car loans—how they work, who they’re for, and what you need to get approved today </p>