VANCITY

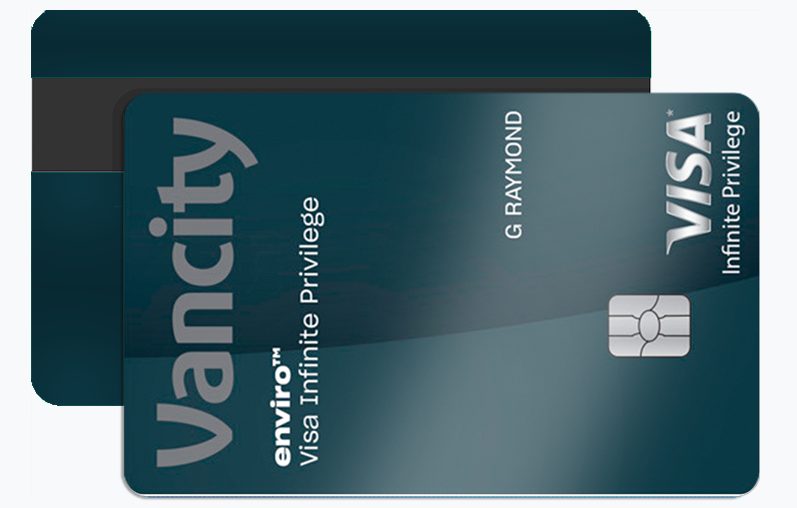

REWARDS PROGRAM PURCHASE PROTECTIONThe Vancity Credit Card is more than just a payment method—it’s a financial tool aligned with sustainability, social responsibility, and personal financial growth. Unlike many big-bank offerings, this card is tailored to Canadians who want rewards, transparency, and ethical banking. It stands out by putting community impact and long-term member value first. In this article, you’ll uncover exclusive benefits, key considerations, and how to apply with confidence today, knowing that your financial decisions can align with broader positive change.

Top 3 Vancity Credit Card Benefits You Didn’t Know

1. Member Dividend Program: Earn More Than Just Points

While most credit cards offer cash back or travel rewards, Vancity members receive annual dividends based on their usage and the co-operative’s profits. This unique profit-sharing model adds tangible value, especially for responsible cardholders who prefer local financial ecosystems over multinational banks. It’s a way to see your spending come full circle—supporting a local institution that reinvests in the community and gives back to you.

2. Climate-Positive Impact

Vancity is the first Canadian credit card issuer to offset 100% of emissions from card usage. That means every time you swipe, the card contributes to verified carbon offset programs. From renewable energy to reforestation projects, these efforts reduce your environmental footprint. For eco-conscious consumers, this positions the card as a leader in green finance — a rare and highly sought-after value proposition that resonates with today’s climate-aware citizens.

3. Credit-Building Tools with Human Support

Unlike automated banks, Vancity offers personalized credit-building consultations for newcomers, students, and those rebuilding credit. Paired with no-fee secured credit options, this makes the Vancity card one of the best for credit growth with real human guidance, not bots. The focus is on empowerment and education—offering you not just a credit product, but a pathway to long-term financial well-being with the help of experts who care.

Disadvantages You Should Consider

1. Limited Nationwide Acceptance for In-Branch Services

While Vancity is a member of the Acculink ATM network, its in-person banking services are only available in British Columbia. This could be a limitation for those who prioritize physical banking access outside the province. If you’re often on the move or living in another province, you might find the lack of branch presence inconvenient, although digital tools are available to bridge the gap.

2. Rewards Flexibility Isn’t Universal

Some reward structures, especially on entry-level cards, are not as flexible or high-yield as those from premium cards by major banks. For users focused purely on maximizing travel points or cash back, it’s important to compare tiers before applying. Choosing the right Vancity card ensures you match your reward preferences with the card’s actual benefits.

Want to Know More? Here’s How to Apply for Your Vancity Credit Card Today

[If you’re ready for a card that aligns with your values, financial goals, and lifestyle, the Vancity Credit Card is worth serious consideration. Click below to compare card types, discover exclusive member perks, and learn how to apply online in under 5 minutes. You’ll not only gain a powerful financial tool— you’ll become part of a movement toward ethical, community-driven banking.

How to Contest a Credit Card Charge in Canada: Step-by-Step <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Know Your Rights, Protect Your Wallet </p>

How to Contest a Credit Card Charge in Canada: Step-by-Step <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Know Your Rights, Protect Your Wallet </p>  How to Apply for a Vancity Credit Card: Step-by-Step Guide + Insider Tips <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore hidden perks, eligibility criteria, and how to get your card approved faster </p>

How to Apply for a Vancity Credit Card: Step-by-Step Guide + Insider Tips <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore hidden perks, eligibility criteria, and how to get your card approved faster </p>  RBC Avion Credit Card: Elite Travel Rewards for Canadian Cardholders <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Unlock premium travel perks, earn faster rewards, and enjoy unparalleled flexibility with one of Canada's top-tier credit cards </p>

RBC Avion Credit Card: Elite Travel Rewards for Canadian Cardholders <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Unlock premium travel perks, earn faster rewards, and enjoy unparalleled flexibility with one of Canada's top-tier credit cards </p>