Lloyds Bank, a renowned financial institution with a rich history dating back to 1765, offers a range of financial products and services to meet the diverse needs of its customers. Among its array of offerings, Lloyds Bank credit cards stand out as versatile financial tools designed to empower individuals with convenience, security, and flexibility in managing their finances.

What is Lloyds Bank?

Lloyds Bank is a major British retail and commercial bank, with a rich history that dates back to 1765. It is one of the largest and oldest banking institutions in the United Kingdom.

Lloyds Bank provides a wide range of financial services, including retail and commercial banking, mortgages, insurance, and wealth management. Over the years, Lloyds Bank has played a significant role in the UK’s financial landscape and has grown through mergers and acquisitions.

Diverse card options

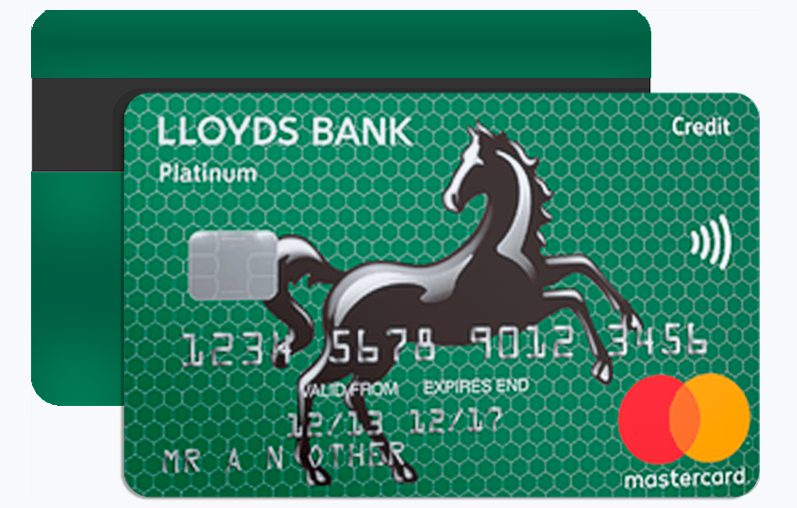

Lloyds Bank provides a variety of credit card options to cater to different lifestyles and preferences. Whether you’re looking for rewards, cashback, or low-interest rates, Lloyds Bank has a card to suit your needs.

Contactless technology

Lloyds Bank credit cards are equipped with contactless technology, making transactions quick and hassle-free. Simply tap your card at the point of sale for speedy and secure payments, offering a convenient alternative to traditional chip and PIN methods.

Security measures

This bank prioritizes the security of its customers’ financial information. With advanced security features such as fraud protection and secure online access, cardholders can have peace of mind knowing their transactions are safeguarded against unauthorized use.

Online account management

Lloyds Bank’s user-friendly online banking platform allows credit card holders to manage their accounts efficiently. From checking balances to reviewing transactions and setting up alerts, customers have access to comprehensive tools to stay in control of their finances.

Travel benefits

For those who frequently travel, Lloyds Bank credit cards often come with travel-related perks such as travel insurance, airport lounge access, and favorable currency exchange rates, enhancing the overall travel experience.

So, are credit cards good?

Lloyds Bank credit cards offer a blend of practical features, security, and rewards, making them an attractive choice for individuals seeking a reliable financial companion. Whether you’re looking to streamline your finances, earn rewards, or enjoy the convenience of contactless payments, Lloyds Bank has a credit card option tailored to your needs, contributing to a seamless and empowered financial journey.

How can I apply for a Lloyds Bank credit card?

Applying for a credit card can be a significant step towards managing your finances effectively. Lloyds Bank, a trusted financial institution, provides a straightforward application process for those seeking a credit card tailored to their needs. Here’s a step-by-step guide on how to apply for a Lloyds Bank credit card.

1 – Visit the Lloyds Bank website

Head to the official Lloyds Bank website to access the credit card application portal. Navigate to the credit card section and select the specific card you wish to apply for and initiate the application.

Click on the “Apply Now” or a similar button to start the application process. You’ll be prompted to enter personal details, such as your name, address, date of birth, and contact information.

2 – Financial information

Provide details about your employment status, income, and monthly expenses. Lloyds Bank uses this information to assess your creditworthiness and determine your credit limit.

3 – Security and terms agreement

Carefully read through the terms and conditions of the credit card agreement. Ensure you understand the interest rates, fees, and other important details. Accept the terms and proceed to submit your application.

4 – Wait for approval

Once your application is submitted, Lloyds Bank will review your information. The approval process may take some time, and you may be contacted for additional verification if necessary.

Upon approval, Lloyds Bank will send your credit card by mail. Once received, activate the card as per the provided instructions. You can then start using it for your financial transactions.

Zopa Credit Card: Financial Management Upgrade <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Learn How the Zopa Credit Card Can Improve Your Financial Management and Provide Exclusive Benefits in Your Daily Life. </p>

Zopa Credit Card: Financial Management Upgrade <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Learn How the Zopa Credit Card Can Improve Your Financial Management and Provide Exclusive Benefits in Your Daily Life. </p>  Zopa Credit Card: Key Benefits & Features <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits and Features of the Zopa Credit Card to Improve Your Financial Management and Maximize Your Purchases. </p>

Zopa Credit Card: Key Benefits & Features <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Explore the Benefits and Features of the Zopa Credit Card to Improve Your Financial Management and Maximize Your Purchases. </p>  Zilch Credit Card: Main Features, Tips, and How to Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how the Zilch Credit Card can transform your financial life with interest-free payments and exclusive benefits. </p>

Zilch Credit Card: Main Features, Tips, and How to Apply <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Discover how the Zilch Credit Card can transform your financial life with interest-free payments and exclusive benefits. </p>